403(b) plans are alternative retirement plans only available to non-profits like charities, churches, public schools, health programs, and government agencies. Like retirement plans used by for-profit companies, 403(b)s incentivize employee saving through deferrals and employer contributions. Combined contribution limits are $55,000 and can be spent only in annuities and mutual funds.

The best way to 403(b) Plan Works

403(b) programs are tax-deferred annuity plans which are typically the only retirement plan option for non-profits. 403(b) programs were made to be very conservative, and not-for-profit employees can simply invest in annuities, conservative mutual funds, and target date funds. At a 403(b), you can not buy shares, bonds, ETFs, or other assets like real estate.

In training, 403(b) plans are just like a middle ground between a 401(k) and a pension, and therefore are meant to provide recurring retirement earnings in place of the lump sum economies of a 401(k). Like 401(k)s, they allow for employee salary deferrals and employer contributions (either matching or non-elective contributions) around the same $55,000 annual limit. However, actual limits are decided using individual worker formulas available via the IRS or your plan provider. We talk about this in greater detail below.

If you operate a for-profit company or are self explanatory, then a 403(b) plan isn’t an alternative for you. Alternatively, you can read our article on the best retirement plans for small businesses. Alternatively, you can check out the Small Business Alternatives into a 403(b) Plan below.

Sometimes, however, a person might have access to both a for-profit 401(k) plan as well as a non-profit 403(b) plan. This might occur if you’re employed by a nonprofit and also run a side business for a solopreneur. If this is true, it is important to consult 403(b) plan rules to ascertain if and how you can contribute to your 403(b) in conjunction with a different for-profit retirement program, including one established for your own business.

“For many Americans, defined contribution programs that enable employees to save in the office have replaced defined benefit programs as the core retirement savings vehicle. There are two primary types of workplace retirement plans: 401(k) programs that any private sector employer may sponsor, and 403(b) plans, that are readily available to just certain tax-exempt or public education organizations. The 401(k) plan was mostly meant to provide supplemental retirement savings, but 403(b) plans were designed from the outset to provide retirement income, with mutual fund investments additionally permitted beginning in 1974.” -Patty Wu, Senior Managing Director, TIAA

Who a 403(b) Plan Is Ideal For

More likely than not, if a 403(b) is right for you, then it is going to be the only option open for you. That is only because 403(b) plans were ordered specifically to serve not-for-profits. For-profit companies are not even eligible for tax-deferred annuity plans, and almost no choices are acceptable for non-profits.

403(b)s are just used in narrow Conditions, including:

- 501(c)(3) tax-exempt organizations: Charitable organizations and regional divisions

- Public school systems: Anyone involved in the day-to-day operations of a college

- Hospital programs: Employees of non invasive healthcare systems

- Churches and other religious organizations: Ministers and other employees in some religious organizations

If you operate a for-profit company looking for a retirement program, have a look at our article on the 6 best retirement plans for small companies. Otherwise, keep reading to get a list of the top 403(b) providers, including general expenses, contribution limits, and deadlines.

Best 403(b) Plan Providers

Since 403(b)s are tax-deferred mortgage plans, providers tend to be big mutual fund and insurance companies. This is in contrast to for-profit plans that may be administered by institutions of all shapes and sizes, such as alternative online suppliers.

The top 403(b) plan suppliers include:

Vanguard

Vanguard, the largest mutual fund company in the world, also provides retirement plan services for small businesses and nonprofits. Among other plan types, Vanguard helps companies who qualify to implement and administer 403(b) programs that meet their precise needs.

Vanguard is a great option for any employer who qualifies for a 403(b) and wants to set up one that includes a solid selection of cost-effective, professionally managed mutual funds and a few target date capital. Because tax-deferred annuity plans are confined to annuities and mutual funds, Vanguard is an superb provider for all these traditional retirement programs.

TIAA

TIAA is an insurance and annuity company that was founded more than a century ago with the sponsorship of Andrew Carnegie to supply educators, researchers, medical and government employees with income during retirement. With more than $1 trillion in assets under management, TIAA continues to assist teachers and other workers with tax-exempt organizations. 403(b) plans, that can be largely modeled on the annuities originally sold by TIAA, are one of the firm’s core offerings.

It’s been reported by Cerulli Associates that TIAA retains up to 40% of all 403(b) plan assets nationally. TIAA caters specifically to educational and healthcare tax-exempt organizations, so TIAA is a great potential supplier if you run one of these forms of organizations. However, we position them behind Vanguard specifically since they’re confined to education, health care, and government organizations.

Fidelity

Fidelity is a full-service, diversified financial services company. The company provides a complete array of banking and brokerage solutions for small businesses and other things, such as 403(b) management services.

For entities looking to set up a 403(b) and also need banking or other services, Fidelity is an excellent full-service alternative. For instance, should you want to open a company bank account or need additional services for your financing or a side business, Fidelity may be a great help.

T. Rowe Price

T. Rowe Price is a large asset management firm that, along with supplying mutual funds and other investment goods, supplies administration and recordkeeping services to 403(b) plans. T. Rowe can also assist in choosing investment options for program participants.

If you want to be certain plan participants have access to a vast selection of investor education tools, T. Rowe Price is a fantastic alternative. That is because their schooling tools will help employees to improve financial literacy and make better investment choices.

403(b) Plan Costs

Because 403(b) programs are niche products supplied by just a few firms, fee information is not widely available. Broadly , though, costs are organised along the same lines as 401(k) plans but are often lower. Though mostly dependent on plan size, typical tax-deferred annuity plan prices are between 0.7% and 0.8% of plan assets.

Average 403(b) plan costs likely include:

- Administrative costs (0.5%-2%): 403(b)s require plan management that typically includes a commission depending on the number of plan participants or assets. As plan involvement or assets increase, this fee tends to rise.

- Recordkeeping fees (0.15%-0.5%): oftentimes, recordkeeping is included with program administration, but occasionally has its own fee that’s normally tied to employee headcount. As the number of participants in a strategy increases, this expense tends to rise.

- Custodian charges ($20-$50): These fees are typically paid directly by employees and are normally a flat yearly fee. The commission does not usually change with the total invested, but each additional strategy participant will pay their particular custodian fee.

- Mutual fund expense ratios (0.15%-1%): Because only mutual funds and annuities are permitted at a 403(b), there are no trading costs for bonds or stocks. However, investment choices charge their own expense ratios based on the amount of assets you invest. As you spend more in a fund, the amount you pay in fund expenses will rise.

- Investment advisory fee (0%-1.5%): Because investment options are so limited, not all of 403(b) plans have an investment advisor. In those programs that have an adviser, however, there is often an advisory fee paid from each player’s account based on the amount they’ve invested. As a worker invests more, the amount they pay in advisory prices increases.

403(b) Plan Contribution Limits 2018

Annual 403(b) contribution limits are specific to individual workers based on a number of factors, such as how long they’ve worked for the plan sponsor. To ascertain your private donation limits, you must calculate your Maximum Allowable Contributions (MAC) based on IRS guidelines. Generally, 403(b) contribution limits for 2018 are 55,000.

Specifically, the breakdown of maximum contributions consists of the following:

- Worker deferrals: 403(b) program participants could contribute up to $18,500 in pre-tax salary deferrals at 2018.

- Nonelective or Matching Employer Contributions: An employer can choose to match employee deferrals or make nonelective contributions of up to $18,500 to every employee’s account, which are pre-tax and created whether a worker chooses to donate or not.

- Added Employer Contributions: In addition to non-elective contributions, companies can choose to make discretionary contributions up to $18,000 from year-to-year. These contributions are post-tax and can be likened to the profit-sharing part of a 401(k).

In case you’ve got a 403(b) account along with a different retirement account from a for-profit employer or your own business, you can contribute to another plan, but any donations you make to personal retirement programs will be counted against the $18,500 in allowable deferrals for a 403(b) plan. Further, your total contribution limit is $55,000 for 2018.

Lastly, 403(b) contribution limits may vary with the 15-year principle, which applies to those workers who have 15 decades of service with the program sponsor. For those qualified workers, maximum allowable gifts may increase according to a formula based on years of service and previous deferrals. To ascertain that your Maximum Allowable Contributions, you can refer to IRS Publication 571 (Worksheet 1 on Page 18 is especially useful ).

403(b) Plan Tax Deductibility

Unlike retirement plans common to for-profit businesses, the tax deductibility of 403(b) contributions is a bit more complex. The initial $18,500 in employee salary deferrals are pre-tax, as are company matching (or nonelective) contributions (if appropriate ). On the other hand, the last $18,000 in allowable 403(b) contributions for 2018 are post-tax.

Once donations are made, funds spent through a tax-deferred annuity plan grow tax-free, with pre requisite contributions and profits being taxed when withdrawn after age 591/2. Because 403(b) programs are used by non-profits, there are no tax consequences for plan costs paid by an employer, and because these plans are tax-deferred retirement programs, all expenses borne by workers are pre-tax.

403(b) Plan Rules

As niche investment products, 403(b) plans are available only to certain types of tax-exempt organizations. As soon as you enroll or establish in a tax-deferred mortgage program, there are rules that have to be followed. Failure to follow these principles can generate an extra tax burden for plan participants or endanger the tax-exempt standing of your company.

There are a number of principles specific to 403(b) plans, including:

1. Limited Investment Options

Under a 403(b), investments can only be made in annuities and mutual funds. Trading in individual stocks, bonds, or ETFs is prohibited, and there’s no such thing as a self respecting 403(b) accounts to invest in real estate or other alternative assets.

2. 403(b)s Can Be Used in Conjunction with Other Plans

If you are qualified for a retirement program through another company or your own company along with a 403(b), you can contribute to both strategies. However, any gifts in external plans are counted from the own $18,500 in allowable deferrals to your 403(b), which might damage your matching. Any employer fitting, contributions, and profit-sharing also count from the total $55,000 contribution limit.

3. Enroll all Eligible Employees

In administering a 403(b), it’s important that qualified employees be given the opportunity to sign up. The easiest way to do this is to give notice to employees as soon as they become qualified, and if they choose to participate, register them . Additional information on 403(b) plan eligibility can be found on the IRS website.

4. Immediate Vesting

Some retirement plan alternatives, such as 401(k)s, allow companies to utilize schedules for vesting company contributions. This creates a disincentive for employees to leave early. In 403(b)s, nevertheless, all contributions have to be vested immediately.

5. No Early Withdrawals

Like IRAs and other qualified retirement programs, assets held in a tax-deferred annuity can’t be withdrawn until following a plan participant turns 591/2. Any early withdrawals are subject to IRS penalties unless hardship or other exemption provisions are met.

403(b) Plan Deadlines

To avoid penalties or unanticipated tax liability at a 403(b) plan, it is important that employees and employers comply with specific IRS deadlines regarding policy creation and employee contributions. Though 403(b) program deadlines are later than several other types of strategies, failing to adhere to those deadlines can impact the tax-deferred standing of your strategy.

Specific 403(b) program deadlines include:

1. Plan Formation Deadline

403(b) plans can be installed anytime throughout the year, provided that plan sponsors follow the principles and supply notice to qualified employees.

2. Employee Contribution Deadline

403(b) program participants need to make their donations by the end of the year. Contributions aren’t confined by the time of plan, however how much of this year you worked for your plan supplier.

How to Establish a 403(b) Plan in 4 Steps

To utilize a 403(b), begin by following the setup process outlined by the IRS. A provider will help you get through the steps, however it’s still a fantastic idea to comprehend the process.

The 4 steps for establishing a 403(b) plan include:

1. Draft and Adopt a Strategy App

All 403(b)s, except several church organizations, must have formalized plan programs. Similar to 401(k) plan records, a 403(b) plan program summarizes certain mandatory and discretionary provisions, such as eligibility, limitations, investment alternatives, and time and kind of plan distributions.

The IRS also requires plan programs to add provisions to prevent the concentration of program contributions or assets by highly compensated employees. With specific exceptions, all these provisions require annual nondiscrimination testing that’s also utilised in 401(k) plans. As with Safe Harbor 401(k)s, the IRS has established Safe Harbor 403(b) plans which are exempt from the testing since they make required employer contributions.

2. Establish Participant Accounts

Once a strategy program was embraced, plan sponsors are required to set up individual accounts for eligible employees. Through these accounts, participants can invest in annuities or mutual funds recorded in the plan program.

3. Find a Plan ID Number

Depending upon your type of organization and number of employees, you might need to get an Employer Identification Number (EIN) specifically for your 403(b) program. Many programs are excluded from this requirement, such as government agencies, some church 403(b)s, as well as some strategies that are exempt from Safe Harbor requirements.

4. Supply Plan Details and Meet Fiduciary Prerequisites

Once your 403(b ) ) is established, you need to administer it in accordance with your program program. You could also be asked to meet fiduciary responsibilities and provide specific notice to eligible employees if your plan is not exempt from ERISA.

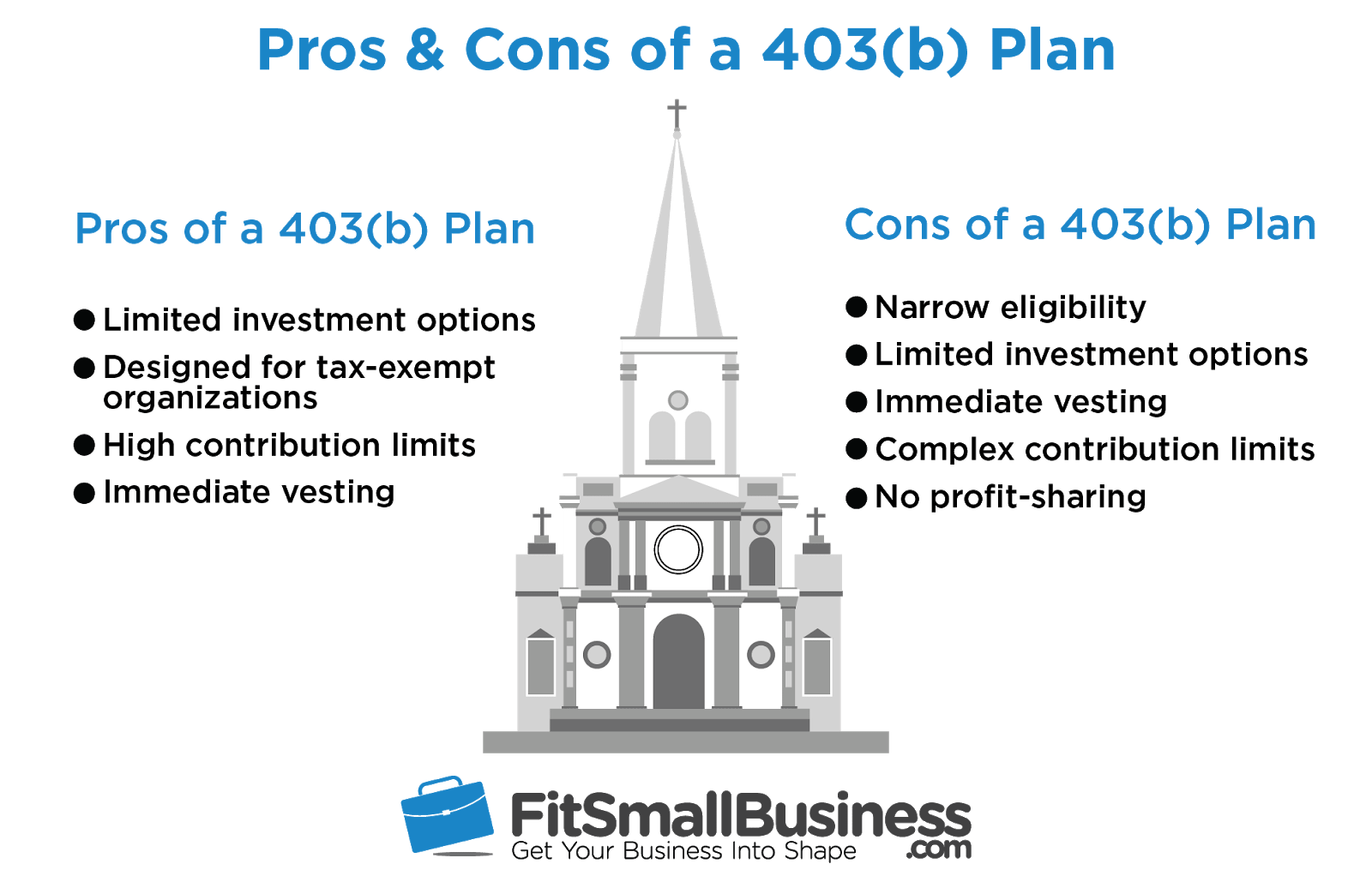

Pros and Cons of a 403(b) Plan

403(b) plans are specialized investment products which are extremely conservative and only available to certain tax-exempt organizations. Although 403(b) contribution limits are as large as 401(k)s and SEP IRAs, donations are only partially overburdened. There are additional drawbacks that employers should also think about when deciding whether to use a tax-deferred mortgage plan.

Some pros and cons of 403(b) plans include:

Pros of a 403(b)

There are many Benefits to 403(b)s, such as:

- Restricted investment choices: Because participants can only invest in annuities or mutual funds, it is difficult for them to get into investments which are overly risky or difficult to comprehend.

- Constructed for tax-exempt organizations: 401(k)s and many others are designed for for-profit companies, however 403(b)s are particular strategies structured specifically to meet the needs of particular tax-exempt groups.

- High contribution limits: 403(b) contribution limits are based on individual formulations for every player, but generally match the maximum contribution limitations for for-profit possibilities, including 401(k)s and SEPs.

- Immediate vesting: Because all contributions have to be vested immediately, plan sponsors don’t need to rely on complicated vesting schedules.

Cons of a 403(b)

In addition to their advantages, 403(b) also have disadvantages that include:

- Narrow eligibility: 403(b)s are only available to certain tax-exempt organizations.

- Restricted investment options: Participants in 403(b)s can simply invest in certain annuities and mutual funds.

- Immediate vesting: While immediate vesting means employers do not need to use vesting schedules, in addition, it means they can disincentivize employees departing early.

- Complex contribution limitations: Contrary to other retirement programs that have comparatively straightforward contribution limits, 403(b) contribution limits derive from individual formulations for every player.

- No profit-sharing: Where 401(k)s and SEP IRAs permit for profit-sharing with workers, organizations with tax-deferred annuities do not have profits to share. Rather, the IRS has allowances for comparable discretionary employer contributions that are not necessarily tied to the performance of the organization

Small Business Alternatives into a 403(b) Plan

For most entities that qualify for 403(b)s, these programs are their only option. However, there are different types of plans which may be accessible, occasionally after restructuring. In other cases, 403(b) plan participants might want to utilize an alternative in combination with their tax-deferred annuity account.

Alternatives to 403(b) plans include:

1. 403(b) Plan vs Conventional 401(k)

403(b)s are extremely similar to 401(k)s for tax-exempt organizations. These programs have similar contribution limitations and construction, and have formalized procedures with strategy documents that govern their operation. Both will also be subject to nondiscrimination testing unless they meet Safe Harbor requirements.

However, 401(k)s are utilized by for-profit companies. If you are setting up a retirement program for a small business, a 403(b) is not for you, and you may want to check out a 401(k).

2. 403(b) Plan vs SIMPLE IRA

A SIMPLE IRA is frequently called a poor person’s 401(k) since it offers lots of the same advantages with lower administration costs and much more investment flexibility. However, the contribution limits for SIMPLE IRAs are less than half of those of a 401(k). Often, that’s OK for small business owners that can’t contribute more than $25,000 yearly anyhow. To learn more, check out our guide to SIMPLE IRAs.

3. 403(b) Plan vs Safe Harbor 401(k)

Safe Harbor 401(k) plans are like Traditional 401(k)s in both structure and function. The vital distinction is that, under a Safe Harbor 401(k), employers employ generous matching or nonelective contribution applications that exempt them from annual compliance testing.

This exemption makes it much easier for participants in a 401(k) Safe Harbor to maximize their contribution limits every year. To learn more on this form of strategy, check out our post on Safe Harbor 401(k) rules and donations.

4. 403(b) Plan vs Solo 401(k)

A Solo 401(k) is a great option for self-employed owners of for-profit companies which do not have any full-time workers. That is because Solo 401(k)s are not available to companies that have employees other than the business owner, and the plan can only have one participant (and their spouse).

Solo 401(k)s are especially beneficial for company owners who might hire employees in the future, as their Solo 401(k) can convert automatically to a Traditional 401(k) plan. For more information, check out our article on Solo 401(k) guidelines, limitations, and deadlines.

5. 403(b) Plan vs SEP IRA

Like Solo 401(k)s, SEP IRAs are excellent for independent contractors and self-employed small business proprietors who have few or no employees. That is because SEP IRAs demand that all contributions be 100% employer-funded and that donations be made for each eligible employee proportional to employer contributions to their account. SEP IRA contribution limits are just like those at a Solo 401(k), except in a SEP IRA, contributions are capped at 25 percent of low-income earnings.

This makes SEP IRAs a much better option for small business owners who make more than $75,000 per year. To learn more, check out our final guide on SEP IRA costs, limitations, rules, and deadlines.

Bottom Line

403(b)s are retirement plans for specific tax-exempt organizations such as charities and public schools. Though structured such as 401(k)s, 403(b)s are niche products which have fewer suppliers and more changeable strategy pricing. If you are setting up a small company retirement plan, a tax-deferred annuity probably won’t get the job done for you, but it’s a fantastic alternative for non-profits.