A small company debt consolidation loan can reduce your interest rates and reduce the size of monthly obligations. They may even allow you to borrow additional working capital. Knowing when it is the right time to combine business debt is dependent upon the terms of your current debt, your business’s current finances, and your personal credit.

SBA loans will probably offer you the best rates and longest repayment terms of business consolidation loan options. SmartBiz may have the ability to help you join to $350k in business debt with SBA financing. Their loans have low prices with ten year periods and monthly payments. It is possible to prequalify online in minutes.

Stop by SmartBiz

When to Have a Small Business Debt Consolidation Loan

You’ll typically know if it’s the ideal time to consolidate your debt by events which improve your personal or business credit profile. Consolidating at the ideal time can get you lower rates of interest, better repayment schedules, and more terms. Consolidating at the incorrect time can waste your own time, damage your charge, or get you a bad loan which can hurt your ability to borrow from the long run.

We asked Mihir Kroke of Able Lending when the Ideal time to apply for debt consolidation was, which was his reply:

“There are two timelines to keep in mind when consolidating business loans. Timeline #1 applies if you had good credit and took a short term loan because you had the quick-turnaround time of a short term loan supplier. In that case you’ll be able to apply for a consolidation loan straight away.

Timeline #2 applies if you took out short term debt because your finances or credit wouldn’t allow you to qualify for anything greater. In that case you’d want to wait around for three weeks of positive earnings trends before applying for a consolidation loan to be able to increase your likelihood of approval.”

In other words, unless you’re consolidating loans you took out for expediency’s sake, you should consolidate your enterprise debt when you’re a better candidate to get a loan than you used to be. There are several techniques to achieve this.

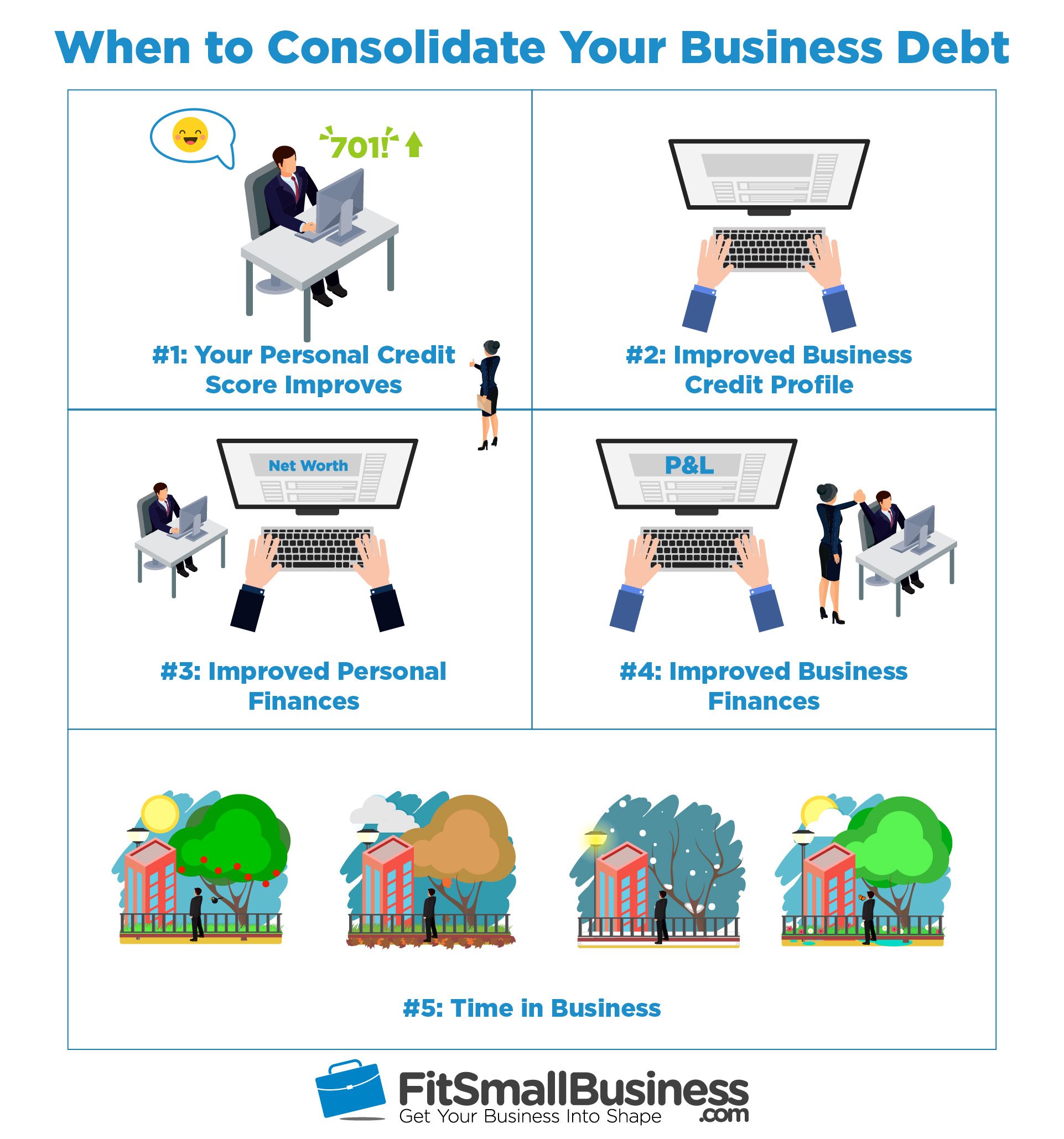

Here Are Five signs it is a Fantastic time to consolidate your business debt:

1. Your Personal Credit Score Has Improved

If your own credit score has considerably enhanced since you continue borrowed money, then now might be a good time to consolidate your enterprise debt. An improved credit score is an important eligibility for lower interest rates and longer repayment terms.

Keep in mind that your credit rating improving by just a few points is unlikely to qualify you to get a better loan, as your growth needs to be significant. Additionally, no matter how much your credit rating improves, negative credit incidents such as bankruptcies, tax liens, or repossessions can create qualifying for a small company debt consolidation loan almost impossible.

Below we look at exactly what credit development milestones you need to make in order to possibly qualify for an SBA loan and also an alternate consolidation . These are probably your two best choices when looking to consolidate your debt.

SBA Loans with 10-Year Conditions

- 680+ (Check your credit score here for free)

- Consistent long-term history of earning timely debt payments

- Good for refinancing short-term loans, alternative loans, equipment financing, etc..

Term Loans with Up To 5-Year Terms

- 650+ (Check your credit rating here for free)

- Consistent recent history of earning timely debt payments (3-6 months)

- Good for refinancing MCAs, short term loans, credit card debt, etc..

If you’re searching to consolidate a small amount of debt (under $35K), then company credit cards can be a fantastic alternative. They are typically a lot easier to get, and quicker to apply for than term loans or SBA loans. Company credit cards are also probably your only option with 0 percent rates, even though they only last for the introductory period.

An SBA loan has harder qualification requirements to fulfill, but they’re typically the best option for debt bigger than $35K. SBA loans help you lower your debt obligations by offering lower interest rates and longer repayment terms than other term loans. SmartBiz offers these SBA loans up to $350K and repayment terms up to 10 decades.

Stop by SmartBiz

2. Your Own Business Credit Profile Has Enriched

Showing an improvement in your small business credit generally involves showing that you are a more responsible borrower. This means that you generally do not have more money than you can handle, and that you’re not using the entire worth of your credit lines. Improvements in both areas make you a good candidate to consolidate your enterprise debt.

A Fantastic business credit profile will generally possess:

- Multiple companies reporting

- Positive (timely) payment histories

- A high percentage of credit line you are not using

- No reporting mistakes

- No bankruptcies, repossessions, or tax liens

Knowing business credit reports, how they work, and how you can build your business credit can be difficult. But it’s an important skill to manage if you find yourself struggling with expensive debt, and assessing your score is the very first step.

3. You Personal Finances Have Improved

As a small business owner, your personal financial health is just as important as your business’s financial health. That is because you will likely be asked to personally guarantee any business consolidation loan. The lender should feel assured that if your business were not able to make the payments, you would personally have the ability to get involved and make those payments.

Here are some ways your personal finances might show improvement:

- Increase in earnings

- New sources of earnings

- Present reduction of outstanding debt

- Improved equity in a piece of real estate (that you’re willing to pledge as collateral)

- Fewer dependents or decreased necessary household expenses

Any significant improvement for your financing will raise your chances of qualifying for a consolidation loan with greater rates, longer repayment terms, and also a much more convenient repayment program. You should also check your private credit from time to time to remain on top of your credit score is, so that you can hit the minimum prerequisites for debt consolidation loans.

4. Your Business Finances Have Enriched

It’s ideal to approach a creditor about a business consolidation loan as soon as your company finances (revenues & profitability) possess a positive tendency. Your ability to qualify for better funding terms can improve quickly in the event that you have a successful month, quarter, or year.

When you reach a significant business objective, it’s often a good time to start thinking about consolidating. Anything you can do to paint an up swing on your business’s earnings or overall fiscal strength is a large positive in getting approved for a loan.

Here are some scenarios that can enhance your ability to get funded for a consolidation loan:

- Finished a hectic year

- Filed latest taxes (showing improved sustainability )

- Increased earnings significantly

- Lowered expenses significantly

- earnings have grown steadily for the past 3-6 months

Whenever your company’s revenue or profitability has improved for 3+ consecutive months, it can be a fantastic time to consider consolidating your business debt. Should you fall into one of those scenarios above then here are some general guidelines to keep in mind before you apply, which can be again broken up by SBA loans or other consolidation term loans:

SBA Loans with 10-Year Conditions

- Attain $120,000+ annual earnings

- 3+ months of upward trends

Term Loans with Up To 5-Year Terms

- Attain $25,000+ Yearly earnings

- 3+ months of up trends

5. Your Company Has Reached a New Milestone

The longer your company has been working, the more funding options are available to you.

Many lenders set a minimal time in business to qualify for their loan products. The most common minimum requirements lenders place are:

- 3 months

- 6 weeks

- 1 year old

- 2 years

As your business ages, the number of opportunities to acquire needed debt relief typically increase. For example, an SBA loan typically requires two years time in business while term loans often require only one year. Typically, lenders won’t consider time that your business was lazy (not working or generating any earnings ) as counting time in company.

Whenever your business hits a new milestone, you’ve probably just opened up a totally new type of business funding. If you’ve been juggling credit cards, short term loans, or MCAs, you are much more likely be eligible for a small company consolidation loan once you hit the next milestone. You are able to use our consolidation calculator to determine how much you can save.

If you’ve recently hit one of the milestones listed above, you might qualify for a consolidation loan with SmartBiz. They give SBA loans with rates between 6-9 percent, and repayment terms up to 10 decades. Getting pre qualified internet takes just a couple minutes and funding can occur in as fast as 30 days.

Visit SmartBiz

Six Advantages of Company Debt Consolidation Loans

While refinancing can help reduce your total loan costs, it is only one benefit. Refinancing company debt can normally help your business do 6 items:

1. Reduce APR

Reducing interest rates is a very common goal for smaller companies that have taken out a short term business loan or even a retailer cash advance. While there’s surely a place for short-term funding, the cost makes it more demanding for a long time period. A small company debt consolidation loan comes with lower APR than nearly every short term financing alternative available.

2. Lower Monthly Payments

Business loan consolidation generally leads to reduced monthly payments. A lower monthly payment can ease current strains on your business’s cash flow. This means that you’ll have more money available for normal operating expenses and unexpected opportunities. It may also let you avoid additional borrowing in the future.

All else equal, small business consolidation loans result in lower monthly payments as they have a lower APR and a longer repayment term. If your target is to reduce the amount you’re paying your debt each month, then an SBA loan is likely going to be your best alternative.

3. Allows for Additional Borrowing

When small companies get consolidation financing, they might qualify for additional borrowing. That is due to the decrease APR and longer repayment terms, which raises the business’s DSCR (Debt Service Coverage Ratio).

It is not unusual for small companies to require some additional working capital when consolidating debt. The extra working capital should help them cope with the unexpected, or assist them afford needed equipment. This will prevent your company from falling back into becoming another expensive short-term loan later on.

4. Simplifies Cash Flow Management

A business consolidation loan can help you better manage cash flow in three manners:

- Instead of juggling multiple creditors, you may now be able just a single account

- You’ll now have only one monthly payment.

- The lower rate and longer repayment term will lead to a smaller monthly debt repayment.

Each one of these benefits should give you more cash in the bank to pay for regular expenses. This will not only improve your financial situation, but it is going to also streamline your cash flow control procedure.

5. Free Up Revolving Credit Lines

Revolving business lines of credit, especially credit cards, are a remarkably useful cash flow management instrument. They give a business a high amount of flexibility in their spending since it’s possible to float invoices, basically interest , as long as you pay the card in full each month. But if you have assembled a balance on the line, you eliminate flexibility and are on the hook for expensive debt payments.

Consolidating small business credit card debt using a business consolidation loan not only makes the monthly payment cheaper, but it frees up your credit line again. You’ll have a less expensive loan and a revolving line of credit that’s prepared to be put back to work, or to have on reserve to prepare for the unexpected.

6. Make Payments More Predictable

Many short term loans that are consolidated have variable interest rates. This means that the payment changes over time, and you can’t accurately budget the exact same amount on each payment date. This can be very frustrating if your obligations wind up becoming more than what you expected.

A consolidated business loan with a fixed interest rate helps you more accurately budget what your loan costs will be throughout the entire term of the loan. You will not have the sudden payments or frustrations a variable interest rate loan can bring.

SBA loans offer all six of those advantages, and they do it using the lowest prices and maximum repayment terms available. SmartBiz can get you financed you for an SBA loan up to $350K, and get you funded in as quick as 30 days. This is a lot faster than other SBA loan suppliers, that frequently require 45 — 120+ days to fund. You can prequalify online in a couple of minutes.

Stop by SmartBiz

Small Business Debt Consolidation Loans

Not every type of loan is a fantastic fit when considering refinancing your small business debt. Many short term business loans, as an instance, get refinanced or merged themselves. These loans are often more expensive the longer you keep them, and are almost always meant to be repaid or refinanced within 12 months.

Usually, term loans and SBA loans are the major two choices for borrowers seeking to consolidate their small business debt. The table below shows an overall overview of qualifications and terms for both medium term business loans and SBA loans.

SBA Loans vs Term Loans for Debt Consolidation

| SBA Loan | Term Loan | |

|---|---|---|

| Credit Score | 680+ (check yours for free) |

600+ (check yours for free) |

| Business Revenue | $100,000+ | $25,000+ |

| Time in Company | 2+ Years | 1 Year |

| Time to Receive Money | 30 – 60 Days | 1 Week – 30 Days |

| Time To Get Approval | As fast as 1 week | 1 – 7 Days |

| Repayment Terms | 10 Years | 3 Months – 3 years |

| Loan Amounts | $30,000 – $350,000 | $5,000 – $500,000 |

| APR | 6% – 9.5percent | 8% – 40 percent |

| Origination prices | 4% + Guarantee Fee of 3- 3.5% on loans over $150,000 |

2.5% – 5% |

| Pre Qualify | See SmartBiz | Visit Funding Circle |

Qualification: SBA Loan vs Term Loan

SBA Loan

In general, qualifying for an SBA loan to refinance your enterprise debt will demand a private credit score of 680+, been in business for 2years, and revenue of at least $100,000.

Term Loan

You can generally qualify for a medium term business loan to refinance your business debt when you’ve got a personal credit score of 600+, been in business for at least 1 year, and your gross yearly revenue is $25,000 or more.

Time to Funding: SBA Loan vs Term Loan

SBA Loan

It’s possible to qualify over 1 week, along with the underwriting process can finish in 1 — 2 weeks. However, generally financing takes 45 — 60 days.

Term Loan

You can be pre-qualified in 5 minutes, fully approved within 1 to 3 times, and get your funds as fast as 1 week.

Prices: SBA Loan vs Term Loan

SBA Loan

An SBA loan has to occur after the utmost guidelines fixed by the SBA, which can change. Generally the rates of interest will fall between 6% and 8.5%, with fees raising the total APR up to full 1% on top of this interest rate.

Origination fees can be as much as 4 percent of the entire loan amount, and a fee the SBA charges to guarantee the loan loans above $150,000. That guarantee fee can be as much as 3% — 3.5%. You can observe current SBA rates here.

Term Loan

The APR for all these loans generally vary from 10% to 40%. This includes an origination fee which ranges from 2.5% to 5%.

SBA Loan vs Term Loan Summary

SBA loans can be a terrific option, but they have comparatively strict qualifications. Additionally, but obtaining an SBA consolidation loan by a traditional lender can take two — 3 weeks. However, SBA loans will be likely your cheapest consolidation option, making them the best option for many. And firms like SmartBiz have streamlined the SBA loan process so that many business owners are financed in under 30 day.

A more option term loan might be a better option for you in the event that you need the loan immediately or if don’t want to deal with the frustrations and headaches of an SBA loan process. You are going to wind up paying larger rates of interest, causing your monthly payments to be larger than they would be if you waited patiently to get an SBA loan.

SmartBiz SBA loans have rates between 6-9% and terms of up to 10 decades. They’re a terrific fit for businesses that are prepared to fix their short-term debt issues. You’ll typically qualify if you have 2+ years in business, are rewarding, and have a private credit score of 680+. Get prequalified online in just a couple of minutes.

Visit SmartBiz

How to Consolidate Business Loans

Consolidating your company loans generally starts with knowing what type of debt you are consolidating, and what the conditions of the debt are. Based on the volume you need and what your current terms are the consolidation options may vary.

For under $35K of money, company charge cards may be your very best option. You can apply online and typically get access to capital in precisely the same day you’re approved. If you’re searching for a small business credit card that provides you a high degree of flexibility plus great rates and rewards, take a peek at Chase. Pick between excellent money back offers and travel rewards. You may see specific rates, terms and detail here. Apply online in minutes at Chase.

SBA loans will probably be your very best option when consolidating larger amounts of debt, if you’re in a position to qualify. These loans can carry a good deal of paperwork and take a good deal of your time during the application process. You can find out more about the application procedure by reading our article describing how to obtain an SBA loan.

Here are the 5 steps to consolidate business loans:

1. Ascertain What Debt You Want to Consolidate

You may be in a position to consolidate some, but not all your debt. Or some of your current loans might involve good terms that you want to maintain while some don’t. You need to know how much debt you are consolidating, and which loans you are going to throw into a new loan before you start applying.

2. Know the Conditions of Your Existing Debt

Some of your current loans may have obstacles that prevent you from consolidating them, like abnormally high prepayment penalties. In accordance with Michael McCord, CPA and Managing Partner of McCordial & Company:

“A few of these lesser known mistakes that I see people make is not factoring in prepayment penalties or intangibles during consolidation. The initial inclination is generally to consolidate the maximum interest rates . However, often times I have seen folks not adequately consider the cost of prepayment penalties or additional refinancing prices into the mathematics.

Further, intangibles like operational covenants or whether loans are full recourse (private recourse), limited recourse, or no recourse at all can be a massive deal. Consolidating into a slightly cheaper interest rate could be an error if it means potentially violating covenants or guaranteeing more debt”

Being aware of these elements of your current financial loan covenants is important. They might have been unimportant when you first borrowed, but they can make a significant difference when you are consolidating.

3. Compare Your Current Debt For Your Potential Consolidation

Now that you have all the details, you may have a look at whether consolidating will actually help you save money, or if it has the potential to do so. Taking everything into consideration, after that you can weigh your options.

It may not make sense to move forward with the process at this point. If consolidation can cost you more money then you likely do not wish to experience the long application process of receiving an SBA loan. However, consolidating your business loans is generally the best option if you currently have debt that you are fighting to keep up .

4. Gather All Necessary Documentation

Now that you are all set to proceed with a business loan consolidation, you have to make sure you’re ready. SBA funding, even SBA express loans, can have a very long time to finance, and the procedure is simply slowed down if you are not prepared with the ideal documentation prior to applying. Collecting all the needed information up front enhances your odds at getting approved.

5. Apply to Consolidate Your Organization Loans

Finding the right lender and starting your application process is the last step in consolidating your business loans. This measure entails working with a creditor to secure you and your business approved by their loan underwriting team.

Finding a loan provider, like SmartBiz, will streamline this process since they give an online application that only requires a couple of minutes to see if you prequalify. And they manage the administrative work for you.

Qualifying for a Company Debt Consolidation Loan

As a summary, qualifying to consolidate your enterprise debt may be a lengthy procedure which involves a great deal of different terms you will be unacquainted with. The table below represents the key factors which the underwriting team typically looks at along with your consolidation loan application.

Crucial Factors for Qualifying for a Company Debt Consolidation Loan

| Definition | Frequent Minimum Requirements | |

|---|---|---|

| Credit Rating

(Assess yours for free ) |

Some indicating whether or not a borrower is a risk to give cash to, or do business with. | SBA Loan: 680+

Term Loan: 600+ |

| Time in Business | The length of time that your business has been registered and getting revenues. | SBA Loan: two Years

Term Loan: 1 Year |

| Annual Revenue | Total Quantity of money your business obtained for the Entire year. | SBA Loan: $120,00+

Term Loan: $25,000+ |

| Profitability | The Sum of Money the business generated after all expenses were paid.

Calculated by: Revenue – Expenses (including all salaries of taxpayers and other optional earnings) |

Profitable and trending up |

| Real Estate With Equity | The equity in real estate is the difference between the average market value of their property and what’s owed on any outstanding mortgages or loans. | 15%of Real Estate Value |

| Lending to Service Coverage Ratio (DSCR)

Or Debt Coverage Ratio (DCR) |

The ratio of money available for debt servicing to get interest, principal, and any lease payments.

Calculated by: Net Operating Revenue / Total Debt Payments |

Greater than 1.20 following the new loan terms are calculated in together with your financial performance. |

| Charge Use Ratio | The proportion of a consumer’s available credit which is being used.

Calculated by: Outstanding Credit Balances / Sum of Total Credit Limits |

Greater than 35 percent |

Debt Consolidation vs Debt Refinancing Loans

Debt consolidation and debt refinancing are conditions which are frequently used interchangeably. However, they actually refer to two slightly different forms of loans.

- Debt Consolidation is generally referring to lowering your interest rates and payment amounts for a single loan.

- Debt consolidation is the practice of consolidating multiple debt obligations into one loan.

An SBA loan provides you the option to either refinance or consolidate your debt. Either may lower your overall payment levels, and simplify your money flow process to set your business up to get a larger amount of success moving ahead.

Bottom Line

SBA loans are a great alternative for business consolidation, but they can be tough to qualify for, require a lot of paperwork, and require 2-3 weeks to obtain. Online lenders have stepped in to offer term loans in a portion of time and with substantially easier application processes.

SBA loans offer you the best loan consolidation option because of their low interest rates between 6-9%, and their long repayment terms of up to ten decades. SmartBiz features SBA loans of up to $350K. You can normally qualify if your business has 2years old, is rewarding, and you personally have a 680+ credit rating. You can prequalify in minutes online.

Stop by SmartBiz