The phrase cash flow issues generally refers to cash not being available for use when your company needs it. Cash flow issues can vary from not having the ability to make payroll on time not to having the necessary cash to make the most of a growth opportunity. You may typically fix your cash flow by means of a mixture of financing and non-financing options.

This report is sponsored by OnDeck. OnDeck delivers short-term working capital loans and lines of credit up to $500K. Their application process is completely online and only takes a few minutes. They can typically have you funded in as fast as 1 business day.

Visit OnDeck

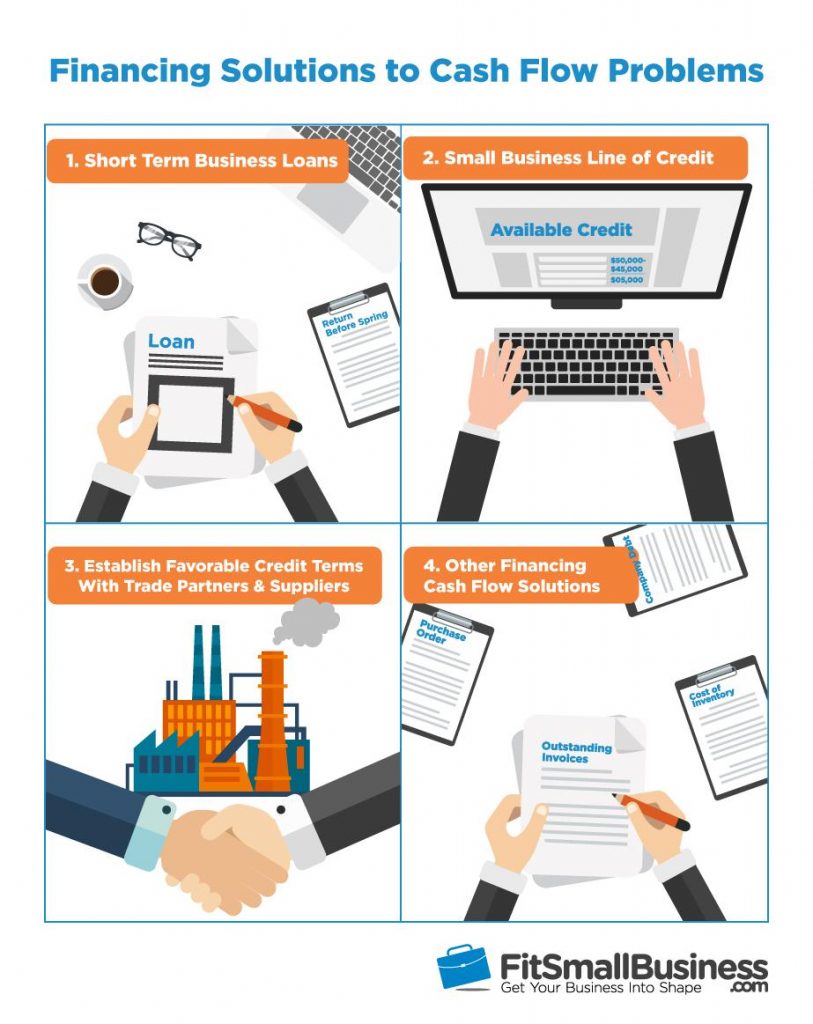

Financing Solutions to Cash Flow Problems

If you have an immediate cash flow problem, then the quickest fix may be a short-term financing alternative. It’s the fastest way to acquire money on your bank account if you don’t plan on receiving any massive revenue payments over the next moment.

There are 9 chief strategies to resolve company cash flow problems, starting with 4 funding solutions for immediate needs.

1. Short-Term Business Loans

Short-term loans are rather easy to become approved for and can be funded in as few as 1 business day. These loans typically have a higher interest rate (APR), however, the total price of capital may be less expensive than defaults options using a lower APR.. If you’re seeking to acquire a short-term loan quickly, OnDeck Capital company loans could be a fantastic fit.

With OnDeck, you can generally qualify if your own personal credit score is above 500, you’ve been in business for at least 12 weeks, and have at least 100K in annual business revenue. This short term loan is a great fit for companies that need money immediately and are ready to pay it back in 3 — 36 months.

You can submit an application to get an OnDeck loan on the internet. The approach is easy, and you can get approved with 10 minutes. OnDeck will connect with your business’ bank accounts or accounting software to make the process easy. You generally do not have to supply any additional documentation outside of your private and company info.

OnDeck Short Term Business Loan at a Glance

|

|

|

|---|---|

| Loan Amount | $5,000 – $500,000 |

| Time to Receive Funds | As quick as 1 business day |

| Time in Company | 12 Months |

| Minimum Annual Revenue | $100,000+ |

| Minimum Credit score | 500+ (Check your score for free here) |

| Collateral | No Essential |

| Private Guarantee | Required |

| Average APR | 30% – 50% |

| Repayment Period | 3 – 36 Months |

| Get Started | Visit www.Ondeck.com |

2. Small Business Line of Credit

A small business line of credit functions similarly to your credit card. You pay interest on your current outstanding balance, not to the total credit line extended to you. When you pay down your balance, the amount of available credit rises and becomes available to borrow in the foreseeable future.

A business line of credit may be a better choice compared to a short-term loan if you do not need access to a great deal of cash right away but might require that cushion in the near future.

OnDeck offers a flexible business line of credit up to $100K. The line must be paid in full within 6 months of your last draw. This means the monthly obligations are just like a 6-month loan, but you can borrow less at any one time since it’s a revolving credit line. You need to have a 600+ credit score, be in business for at least 12 months, and have 100K+ in annual earnings to qualify.

Much like OnDeck’s short-term small business loan, you can apply online and get approval in a matter of minutes. You generally do not need to provide any additional documentation beyond basic personal and business info.

OnDeck Business Line of Credit at a Glance

|

|

|

|---|---|

| Maximum Loan Amount | Around $100,000 |

| Time to Get Money | As quickly as 1 business day |

| Time in Company | 12 Months |

| Annual Business Revenue | $100,000+ |

| Credit Score | 600+ (Assess your score to get free here) |

| Collateral | Not Required |

| Personal Guarantee | Required |

| APR | 13.99% – 39.9percent |

| Repayment Period | Up to 6 weeks |

| Get Started | See www.Ondeck.com |

3. Establish Favorable Credit Terms with Trade Partners & Providers

Another option that may help your cash flow would be to negotiate new or better payment terms with your trade partners. Extending the time you have to pay a spouse from due on reception due in 30 — 90 times will allow you to hold on to more money for a longer period.

You could look at getting new, or extended, payment stipulations. Providers you have a good payment history could be open to providing you with payment provisions. If you have trade partners now with 30-day provisions and also have been consistent about paying them on time, consider negotiating a 60 or 90-day payment program.

Extending your terms frees up cash now that will otherwise be going to pay your commerce partners. This is similar to a credit line from the suppliers because you are receiving services or goods right away and paying for them later. This agreement will free up your capital, but might also be reported on a business credit report like Dun & Bradstreet.

4. Other Funding Cash Flow Solutions

Some trade spouse payments will require you to pay with money. Using your credit cards available credit line to create other payments can continue to keep a maximum amount of cash in your business for when it’s required. Together with your available credit may stretch your cash and keep you paying all of your bills on time.

Other cash flow options are also available in case you have specific wants, or fulfill very specific qualifications. We don’t cover them with an in-depth evaluation here, but we have written about them earlier, and you need to check them out in the event that you believe they might match your financial requirements.

Invoice Factoring

Invoice factoring advances you money on your outstanding invoices owed by B2B or B2G customers. Basically you pay a little charge for early access to revenue you’re going to get from your own customers anyhow, but you don’t have to wait the 30-90 days you generally do.

If you are seeking to fund less than $50K in bills contemplate accounts receivable financing (AR financing). This is similar to factoring in the financing is based on unpaid invoices, but it works more like a credit line and is generally more flexible.

Inventory Financing

Inventory funding is used to finance inventory purchases. It is a fantastic match to ramp up for a busy season or to buy inventory to fulfill an order before you are compensated for your past work.

Purchase Order Financing

PO financing is an advance that pays your suppliers directly for products which will help you finish a written purchase order. PO financing can fund 100% of the costs to supply your purchase orders, which includes delivery.

Refinance & Consolidate

Cash flow issues are often the consequence of expensive debt payments. You can refinance a lousy small business loan, or you’ll be able to combine all your debts into one monthly payment that can help you save money. Consolidating can save you money and time currently spent on managing a complex cash flow control process.

So to summarize, here’s a look at the four funding solutions:

Non-Financing Cash Flow Solutions

If you don’t qualify for financing or do not need to take on additional debt in this moment, then using non-financing solutions to cash flow problems could possibly be a good alternative for you. These methods can either help your company free up cash that is now tied up in expenses or help you receive cash from your customers faster.

“Borrowing could be a solution for certain cash flow difficulties, however there are instances when borrowing can actually make money flow issues worse. Before borrowing, it is a good idea to examine how your company is doing and if a fresh debt payment will really help your cash flow scenario long term.”

— Ty Kiisel, Editor at OnDeck

All five of those solutions enhances your overall cash flow direction and sets you up to resolve cash flow problems before they occur later on.

5. Re-Negotiate Supplier Contracts

If you are constantly struggling with keeping your head above water, then you want a permanent change that will boost your disposable cash. This is especially true when you find that incorporating earnings doesn’t appear to increase your bottom line. Among those issues might be how much you’re paying your suppliers.

“One of the first things to consider is the gross profit margin. If the margin is too low, then it might be time to re- negotiate price of products sold with vendors.”

— Paola Garcia, Business Advisor in Excelsior Growth Fund

Your gross profit transferring a stage could indicate a substantial growth in disposable income. This isn’t a solution that you’ll have the ability to benefit from instantly, but you may begin to feel the impact of it within 30 days.

6. Improve Your Invoicing Processes

If you are not presently using your accounting system to bill your customers, then you should think about doing so. Additionally, if you are not Assessing your invoicing system, you must start. Automating your invoicing can:

- Reduce costly invoicing errors and delays

- Get bills to your clients faster

- Provides you data on who’s paying on time and who’s paying overdue

- Makes it easier to collect overdue invoices

It is possible to send your invoices online via your accounting software to accelerate the payment procedure. Most small companies use Quickbooks to track their bookkeeping, which can be used to send invoices directly.

If setting up automated invoicing seems complex, do not worry! We’ve got a free step-by-step course on the best way best to set this up through Quickbooks. If you don’t currently use invoicing software, Square includes a free option for you and our article describes how to put this up.

7. Incentivize Your Clients to Pay Faster

Every small business owner with cash flow problems should ask themselves what they can do to make it easier for their clients to pay quicker. Providing a strategy or a reason for your customers to pay you quicker can improve your immediate cash flow requirements. There are many methods to do this, and you’ll be able to get creative according to your company’s circumstances.

Setup Auto Billing

Assessing your clients up to an auto-billing cycle where the money is drafted directly from their bank account or billed to a credit card on the exact same day each month can help you know precisely when the money is going to hit your bank account. This knowledge can help you better plan how to spend that cash.

“For our repeat clients, we invoice them once a month and also the invoice terms are’due upon reception’ which motivates individuals to pay quicker. In addition, we provide to take direct deposits from our customers so that way the money goes directly into our bank accounts. This saves us from waiting for a check in the mail and having to go to the bank and depositing them all the time. We get paid 3 — 10 days quicker this way.”

— Ben Walker, the CEO of Transcription Outsourcing

Accept Online Payments

Paying a bill online with a credit card is super convenient for the customers. If your customers had the chance to pay online, then they might be more prepared to pay the invoice immediately upon getting it.

Rich Patterson, the proprietor of Patterson Brands, said this about how receiving payments online has aided the cash flow of the company:

“We integrated our cloud-based invoice/accounting system using a charge card transactor. Now we find clients paying bills immediately when we issue the bill — even before they’ve received their dispatch. Our payables are down from an average of 40 days to 10 days.”

Keep in mind that accepting credit card payments can include transaction fees. Whether you decide to pass those with your client or not, getting them to cover more quickly will help your cash flow.

Encourage Early Payment and Discourage overdue Payment

Most people are cost-conscious. Your clients could be delighted to pay more rapidly if it means they are going to get a better bargain or discount.

“You’ll be able to use discounts or lower deposits to encourage clients to pay early. You can even charge interest or penalties for late payments. Encouraging your customers to pay early adds additional cash to your company.”

— Russab Ali, Founder of SMC Digital Marketing

Using the right combination of sticks and carrots to make sure your business gets paid on time is an easy solution to cash flow issues that does not require funding.

Let Your Clients Pick Their Payment Day

Every business has different revenue cycles. It could be beneficial to some of your clients to pay you at the center of the month, though some would favor the start of the month. Allowing them to pick the day that is most suitable for them will incentivize them to pay you on time. This increases your ability to correctly predict what your cash flow will be.

8. Stretch Your Payables

Stretching out your payables usually means picking to pay certain bills beyond their due date. Even though this can assist with short-term working funds, it is not a long-term alternative and may damage relationships with trade partners and hurt your credit score. In the event you decide to extend out your payables, then there are numerous ways to do this while nevertheless preserving important seller relationships.

Reschedule Payments

If your company has too many payments due at a specific portion of the month, which will be draining your cash, then consider negotiating a unique due date during the month with a few of those trade partners. Many vendors will be delighted to change your payment if they are feeling confident in your ability to pay on time.

Change Payment Arrangement

Many payments are expected once a month, but a few service providers allow you to pay semi-annually or annually. An annual subscription might be cheaper as some providers will give discounts for paying this way.

Also by paying only once each year, you don’t have ongoing monthly payments to fit into your budget, which removes one more payable that you are not going to have to attempt to manage every month.

9. Reduce Expenses

Reducing expenses is a common approach to attempting to fix a cash flow issue. But it’s simple to go about this the wrong way by clipping big-dollar expenses that hurt your ability to generate revenue.

There are other expense-reducing steps that needs to be taken first to maximize the amount of cash flow that the business receives without damaging the business operations, and also to minimize the time that it takes to get the cash.

Cut the Fat

Eliminate non-essential expenses. In case you have pest or landscaping control for your workplace, then this would be the time to suspend those solutions. Anything that’s not essential to business operations should be trimmed before requirements like inventory, advertising, or labour. Quite often the vendors you cut will provide discounts to make back your company later, once you’re able to manage them again.

Jennifer Aube, owner of DoYouBake, knows a thing or two about eliminating the fat in her own small enterprise. Her advice is:

“Be savvy about where you’re spending your money and cut any expenses which are not vital. For instance, lower your labor costs by doing it yourself, or put up shop from home unless you need a place for merchandise production. Building a business requires making intelligent money flow choices each day.”

There are ways to decrease the fat from services you’ll continue to desire for operations. Services like phones and internet can offer cost-saving chances. If you are not tied into a contract then you may shop around to see whether there are cheaper options out there for the same service with different providers.

To summarize, here’s a brief look in the finest non-financing options:

Bottom Line

There are several methods to address your cash flow issues. Some cash flow solutions involve being more intelligent about invoicing and receiving your clients to pay quicker, but some involve finding ways to cut expenses. Each solution can aid your total cash flow management, and boost your ability to accurately predict how much money you’ll have available at any given time.

Some cash flow issues require an immediate influx of funds. In those instances, a short-term loan or a business line of credit with OnDeck can be the right fit. Their online application is fast and they’re able to provide same-day funding of around $500K. Apply now and get approved within 10 minutes.

Visit OnDeck