As a self employed individual, you have to pay both the employer and employee portion of your Social Security and Medicare taxes, also known as”self employment taxes” Should you earn $400 or more at self employment income, then you’ll pay between 15.3%-16.2% in self employment tax up to 92.35% of your income.

It’s possible to use Program SE to calculate and report your quarterly personal employment taxes.

But If you do your own taxes and are worried about your self employment income, attempt QuickBooks Self-Employed. With QuickBooks, you can separate business and personal income and expenses, automatically calculate quarterly estimated earnings and pay taxes online. Get started with up to 50% off QuickBooks.

Visit QuickBooks

Self Employment Tax Rate Table

| Self Employment Taxes | Tax Rates |

|---|---|

| Social Security Tax | 12.4% up to a maximum wage of $127,200 |

| Medicare Tax | 2.9% – 3.8% with no commission cap |

*Note: self employment taxes are paid on 92.35percent of self employment income

Who Has to Pay Self Employment Tax

In the event that you had net earnings of $400 or more in self employment income then you must pay self employment tax. Self employment tax is due four times a year on the 15th of April, June, September and January (of the following year). Watch our due dates table for additional details.

The following entities typically earn self employment income and are subject to self employment tax:

- Sole proprietors

- Partners in a partnership

- Members of an LLC

- Independent contractors such as Lyft/Uber drivers who obtained a 1099-MISC form

If you are an S-corp you will have to pay self employment taxes. But If you possess a Corporation, you may or may not have to pay self employment tax. Have a look at our how to determine whether the owner of a C-corp or even S-corp has to pay self employment taxes section to discover more.

If you need to get your self-employment taxes registered, try TurboTax, our recommended tax software for small businesses. TurboTax will compute your self employment taxes for you as well as complete Schedule SE and some other supplemental forms.Start your yield for free and pay only once you file.

See TurboTax

How to Figure Self Employment Taxes

When you are a W2 employee, you’re subject to 6.2percent of social security taxes (up to $127,200 for your 2017 tax season ) and 1.45% of Medicare taxes. This is a joint total of 7.65%. But, self employed individuals have to pay double social security and Medicare taxes because they are required to pay both the employee and the employer portion of those FICA taxes.

Thus, your”self employment taxes” include 12.4% in Social Security taxes (around $127,200 for your own 2017 tax year) and 2.9% in Medicare taxation (with no income limit). This is a joint total of 15.3%. However, Depending on your earnings and tax filing status, you might be subject to another Medicare tax of 0.9 percent; consult with our self employment tax rate for more info.

To ascertain how much self control taxes you actually owe, you will need to first know your company’s total net profit or net loss for the tax season. As a Company Owner, there are a Couple of ways to get this figure:

- If you are a Sole Proprietor or single-member LLC, then finish your Schedule C . The web Profit (Loss) figure from Line 31 is your self employment income (loss). Have a look at our Program C guide for help with completing this form.

- If you are a Partnership or multi-member LLC that files Form 1065, then consult with your Program K-1 for the Internet Profit (Loss) figure. This is your self employment income (loss). For help completing this form, have a look at our guide on Form 1065.

- If you’re an Independent contractor, consult with your 1099-MISC form for your Net Profit(Loss) figure. This is the self employment income (loss). Check out our article on Form 1099 reporting for more information.

If you use a bookkeeping program like QuickBooks, simply run your gain and loss report for the tax year (i.e. January 1-December 31). The main point Net Profit (Loss) is your self employment income (loss). Once you have your self employment earnings, use the following table to find out your 1099 tax rate.

It’s important that you understand that only 92.35% of your self employment income is subject to self employment taxes (not including the wage cap of $127,200 on Social Security taxes for your 2017 tax season ). That is because the IRS permits you to deduct half of your self employment tax when calculating your net earnings.

Self Employment Tax Rates for 2017 & 2018 Tax Years

| Internet Self Employment Income | Social Security Tax Rate |

Medicare Tax Rate |

Combined Self Employment Tax Rate |

|---|---|---|---|

| Under $400 | N/A | N/A | No self employment tax due |

| $400-$200K: Single filers $400-$250K: $400-$125K: |

12.4percent – up to a maximum wage of $127,200 (2017) and $128,700 (2018) | 2.9% | Combined 1099 tax fee of 15.3percent

Pay 1099 taxes 92.35% of your income |

| Above $200K: Single filers Above $250K: Above $125K: |

12.4percent up to a maximum wage of $127,200 (2017) and $128,700 (2018) | 3.8% | Mixed 1099 tax fee of 16.2percent

Pay 1099 taxes on 92.35% of your income |

NOTE: should you file a joint return with your partner, make sure you combine your partner’s income along with your own to ascertain your self employment income and tax rate.

Let’s look at a couple of examples of how you would calculate the Quantity of self employment taxes owed:

Example 1: Let’s say that you have a restaurant and the net earnings for 2017 were 100,000. To find out your taxable self employment income, multiply this amount by 92.35%, which equals $92,350. After that, use the 15.3% taxation rate to this level. This shows that you owe $14,130 in self employment taxes.

Example 2: Let’s say you have a booming plumbing company, and the net earnings for 2017 were 150,000. Multiplying this by 92.35% tells you the taxable self employment income, which will be $138,525. Just $127,200, however, is subject to Social Security taxation, so that the Social Security tax is $127,200*12.4% = $15,773.

The Medicare portion of this tax applies to the total $138,525, so that the Medicare taxes are equal to 138,525*3.8percent = $5,264. When you add up the Social Security and Medicare taxes, you will realize that you owe a grand total of $21,037 in self employment taxes.

To create calculating self-employment taxes easy, check out QuickBooks Self-Employed. QuickBooks will automatically evaluate your quarterly earnings for you and export your Schedule C to TurboTax so you’re able to cover your taxes on line. Get started now with up to 50% off.

Visit QuickBooks

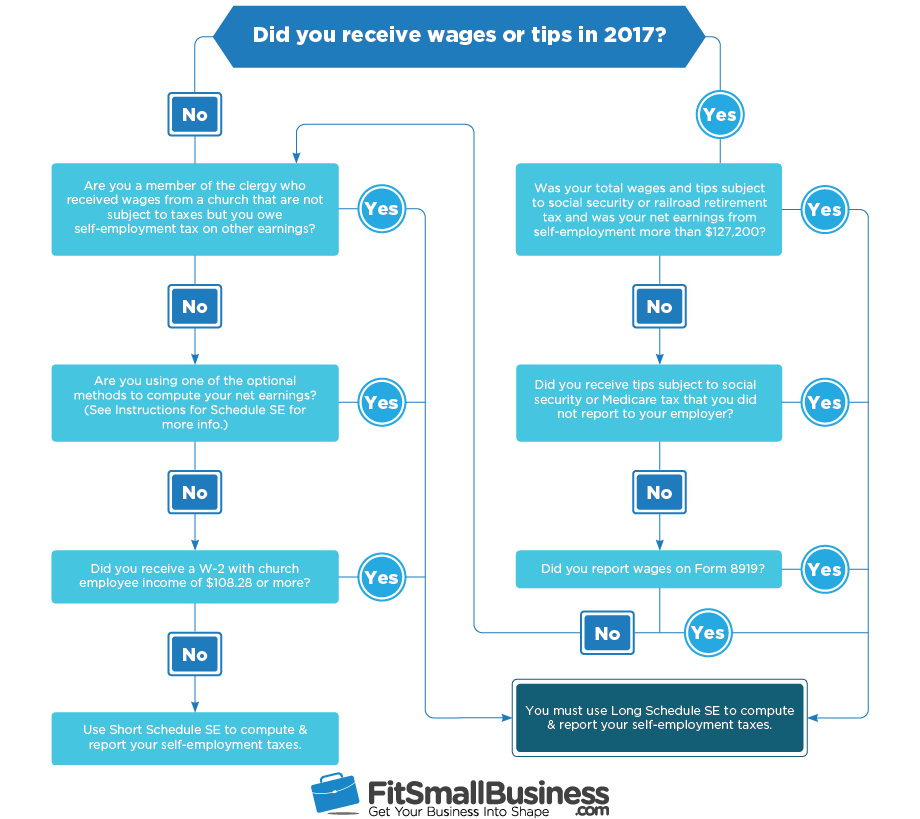

How to Record Self Employment Tax

Business owners must use Schedule SE to calculate and report self employment taxes. There are two different types of Schedule SE’s; a brief version and a long version. Use the diagram below to Ascertain which self employment type you need to complete:

In the event that you were subject to the 16.2% self employment rate then you must also file Form 8959 to record the additional Medicare tax paid. This form along with Schedule SE has to be submitted with Form 1040.

When to Pay Self Employment Taxes

In the event that you were taken by surprise having a large tax bill this year, you might want to look at making quarterly payments during the year. You can use IRS Form 1040 ES to estimate your quarterly payments. If you use TurboTax software, it is going to compute your quarterly tax obligations and complete all the necessary forms for you.

Keep in mind that if you underpay your taxes by over $1,000, the IRS may charge a penalty when you file your tax return. The amount of the penalty depends on a range of factors such as whether or not you were late with greater than one payment as well as the number of times the payment was made after it was expected. There are two ways of calculating the penalty, and the IRS Bar 505 provides step by step directions about the best way best to calculate the penalty for the two methods.

In the table below are the estimated due dates for each pay period. Provided that your payment is postmarked from the payment due date, it will be considered on time from the IRS.

Due Dates for Maximum Self Employment Tax Payments

| Pay Interval | Payment Due Date |

|---|---|

| Jan 1 – Mar 31 | 15-Apr |

| Apr 1 – May 31 | 15-Jun |

| Jun 1 – Aug 31 | 15-Sep |

| Sept 1 – Dec 31 | January 15 of the next year |

The IRS offers a number of approaches to make tax payments. I recommend using the Electronic Federal Tax Payment System (EFTPS). This is a free tool offered by the Department of Treasury, also you can use it to schedule payments beforehand in order to don’t forget.

According to the EFTPS site, it may take up to 7 business days for your PIN, which is needed that you log into and make payments. Ensure you apply well in advance of any deadlines. Just click here for information about other payment options which are available.

Two Ways to Lower Your Self Employment Tax

Two ways you can reduce your self employment taxation without getting the interest of the IRS are to require more business deductions and transform your business structure to an S-corp or an LLC taxed as an S-corp. Let us take a look at each one in a bit more depth.

1. Business Deductions

If you take advantage of each the deductions available for you, then you can reduce your gross income, which will consequently reduce your income tax obligation and self employment tax obligation. Below is a listing of the most Frequent business deductions that you can take:

- Home office expenditures

- Travel and entertainment expenses

- Vehicle mileage deduction

- Startup costs for Brand-new businesses

Make sure you keep good records just in case you ever have to prove to the IRS these were legitimate business expenses. To learn more about tax savings you may be missing out on, browse our Company Tax Saving Tips article.

2. Business Construction

If you choose to change your business structure to an S-corp or an LLC taxed as an S-corp, this could reduce the total amount of self employment tax that you pay since corporations have allowable deductions, and you might pay yourself a salary so that you only pay half of your social security and Medicare tax and the corporation pays the other half.

But, there are several requirements that must be met to qualify as a S-corp. Make sure you talk to a tax professional to determine if changing your company structure makes sense to your company.

Self Employment Taxes for Businesses

There are two types of corporations, S-corporation (S-corp) and C-corporation (C-corp). Both types of corporations protect shareholders from being sued so that they are not in danger of losing their personal assets if a lawsuit is filed against the business.

For taxation purposes, an S-corp is not taxed, therefore all company expenses and income are passed to the shareholders and reported on Program K-1. Therefore, the owner of an S-corp would need to include any income reported on Schedule K-1 as Net Self Employment earnings on Schedule SE to calculate self employment tax. To learn more about what taxes an S-corp will be subject to check out our S-corp tax manual.

A C-corp is considered a separate legal entity for taxation purposes. If you are the owner of a C-corp, you can be taxed twice, once as a corporate thing and then again on almost any distributions paid to you in the kind of dividends. You are required to pay income tax on any distributions that you get from the small business. But this income is not subject to Self-Employment tax.

As the owner of a C-corp, then you’re subject to self employment tax if you receive reimbursement which isn’t decreased by social security and Medicare taxes. In cases like this, the corporation could issue a 1099-MISC sort for you, and you would need to report that income as self employment income on Schedule SE. In general, most owners of a C-corp receive a salary like regular employees so they do not pay self employment taxes.

State & Local Tax Obligations

In this guide, we’ve mostly focused in your tax responsibility at the Federal level. Federal law controls self employment taxes because social security and Medicare are mandated at the federal level. However, states and localities may have additional or different income tax legislation. To learn more about your tax obligation at the state level, assess your state tax agency website.

Frequently Asked Questions (FAQ) About Self Employment Tax

What Are Social Security and Medicare Tax Rates?

Social Security and Medicare taxes combined are called”self employment tax”. For wage earners, this taxation is shared 50/50 with an employer. However, for self employed you are responsible for contributing both parts.

For the 2017 tax season, the joint tax rate for social security and Medicare is 7.65percent (social security is 6.2% and Medicare is 1.45%) for a worker and double (15.3percent ) for self employed. However, the maximum taxable earnings for social security is $127,200 ($128,700 for 2018 tax year). This means that as soon as you get $127,200 in taxable earnings for the year you no longer need to pay social security taxes for the rest of the year.

What’s the Difference Between Self Employment Taxes vs. Income Taxes?

A self-employed individual pays income tax based on the company earnings and the personal income tax tables supplied by the IRS. Self employment taxes insure social security and Medicare contributions that aren’t withheld from a paycheck throughout the year (like they are to get a wage earner).

What Tax Deductions Can Self Employed People Require?

Self-employed men and women are in business for themselves that makes them eligible to take the very same deductions as most small business owners. We’ve discussed Some of these deductions, but here are a few more:

- Meals and Entertainment

- Up to $500K at Equipment/Furniture buys (Section 179 deduction)

- Tax return prep fee

Where Would I Locate Directions On How To Complete Schedule SE?

You can find step-by-step instructions for Schedule SE here.

Bottom Line — Self Employment Tax Rates

Unfortunately, so long as you’re in business for yourself, there’s absolutely no way around paying self employment tax. The fantastic thing is that you are able to lower those taxes by taking each of the tax deductions you’re allowed and selecting the right company structure such as we discussed.

Take some of the stress from filing your taxes by simply using QuickBooks Self-Employed. QuickBooks will track your income, costs, and automatically calculate your earnings for you. Subscribe to QuickBooks Self-Employed and get 50% off.

See QuickBooks