A succession plan is a set of instructions for every time a company owner or key employee leaves the business. Succession planning requires careful consideration of queries such as who will take over, how long it will take, and what processes have to be passed .

It may take a great deal of time and attempt to answer these questions, which is the reason why business owners typically begin planning five to six years before a transition. Many also write a contingency plan if an unanticipated death or accident renders the requirement for a transition sooner than expected.

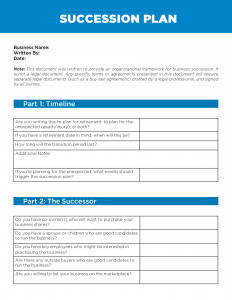

This guide includes a series planning template that helps business owners consider every one of these scenarios. It will direct you through steps like picking your successor and deciding whether to offer your business utilizing life insurance, an acquisition loan, or alternative procedures. Just remember: once you’ve composed a strategy, it needs to be backed up with a formal contract, like a buy-sell agreement. The series planning template is just a starting point.

AXA ranked as the number one global insurance brand for the ninth successive year and will be the sponsor of the article. All warranties are based solely on the issuing insurance company, either AXA Equitable Life Insurance Company or MONY Life Insurance Company of America. Click the link below to get a free quote on your life insurance policy.

See AXA Equitable to get a free quote

Download Succession Planning Template

Just click here to get our five-page series program template like a DOCX or PDF:

Just click here to get our five-page series program template like a DOCX or PDF:

- Download as DOCX (to fill out in Microsoft Word)

- Download as PDF (to fill out by hand)

The remainder of this manual will explain how to fill out this record. Here’s the way to complete the five steps of the succession planning template.

1. Timeline of Succession

There are two key kinds of succession plans. Based on one’s present life situation, You Might Be writing both:

- Exit Succession Strategy — A strategy to transfer ownership on a specific date, e.g., at retirement.

- Death or Accident Succession Plan — A strategy for one’s company in the event of their death or disability.

While an crash program ought to be considered at any age, an exit succession plan is just necessary if you are within several years of retirement. Within this situation, you should begin to think about when, especially, you’d like to move the business, and the length of time the overall process will take. By way of instance, some company owners prefer to remain involved in the company to some capacity, while some prefer a swift exit.

On the document, answer all of the questions in part one. If you’re writing this succession plan to exit your business on a known date, then fill out any extra detail about the length of time you anticipate the transition to continue.

Pro Suggestion: Start Planning Years Ahead

Mark Teitelbaum, AXA Advanced Markets

Where an owner is seeking to sell to an outside group, it might make sense to begin planning five to six years prior to a retirement or sale. That’ll give them the time to get their financials so, make adjustments to income and product lines and, essentially, groom the company to be attractive to an outside purchaser.

If they intend to transfer the business to family members or key employees, they should begin as soon as possible. This will involve training and training key employees in different facets of the company, to customers, bankers, etc.. For relatives, it is going to involve grooming folks and working to balance interests between individuals who’ll run the business and those who won’t.

2. Determining Your Successor

Arguably the most important part of your succession plan is figuring out who will take over. Depending upon Your situation, this might be a:

- Co-owner

- Family member

- Vital employee

- Outside buyer

Choosing can be tricky. Even when there’s an obvious option, it is important to consider what is truly in everyone’s best interest. For instance, keeping the company in the household can seem like the best way to safeguard your loved one’s livelihood. However, this has to be balanced with the fact that second generation businesses do have a greater failure rate (70%). Some business owners instead opt to sell their interest and give a money inheritance for their loved ones.

In the templatewe recommend filling out profiles for at least three prospective candidates. This will offer you a good preliminary comparison of everybody’s skills and experiences. Even if you’re already set on a candidate, then it’s good idea to have a backup plan if person leaves your business or simply doesn’t need to become an owner.

We also have a mathematical guide which covers the pros and cons of each type of succession. This can help you decide, for example, if an outside buyer is more secure compared to a key worker, or vice versa.

3. Formalize Your Typical Operating Procedures (SOPs)

Every successful business knows the value of composing and formalizing their day-to-day functions. However, standard operating procedures (SOPs) also need to be documented for prospective owners, supervisors and personnel to mention. Whether it is a daily checklist for launching the business, training process for new employees, or a complete performance management system, all of these may wreak havoc on a company once the information is lost.

SOPs vary from business to industry, but often include the following items:

| Org Chart | A flowchart of your worker structure, including roles, departments and who reports to whom. Have a look at the best org chart program. |

| Operations Manual | A rundown of daily acts — e.g., checklist for how to open & close a retail store, a flowchart of how jobs get finished. |

| IT Guide | An overview of any computer, technician or software systems used by your business. |

| Employee Handbook | A manual that covers business policies, procedures, culture, benefits, security and much more. Have a look at our employee handbook template. |

| Training Programs | A pair of processes for coaching and onboarding new workers in various roles. Learn more about talent management systems. |

| Skill Retention Strategies | Plans for continuing training — e.g., quarterly meetings to examine new strategies, changes to employee handbook. |

| Performance Management | An explanation of how employee performance is measured and reviewed. Consider performance management software. |

| Meeting Agendas | An overview of some other regularly-held meetings, such as sales meetings. |

Within our succession plan template, we’ve provided a checklist for all these items — feel free to add or remove any, if needed. When you have a completed an up-to-date document, staple it to your succession plan and check it off the list.

4. Value Your Small Business

Figuring out the value of your business should occur early — and frequently. It is an unfortunate truth that lots of small business owners tend to overvalue their venture, and these misjudgements can snowball into fiscal errors when planning for retirement.

To assist you value your company, we’ve developed a simple calculator that offers a rough estimate and a more comprehensive manual with advanced business valuation methods in addition to tips for selecting an appraiser.

At this phase, you’ll also have to consider the cheapest offer you’ll really accept. If the business will be set on the market upon your retirement or triggering event, it could have a long time before somebody is willing to pay whole price. Your succession plan can provide stipulations about how long to wait before dropping the price.

Pro Tip: Establish a Valuation Method in the Contract

Doug Lawson, AXA Advanced Markets

Where your business interest is going to be marketed pursuant to a contractual buy-sell agreement, it’s important that the value of the company or a price-setting formula be established and integrated into the agreement at the time it is drawn. This builds certainty and decreases the chance that the parties will need to resort to litigation to type it out. Frequent methods for setting a purchase and sale price include 1) Book Value, 2) Agreed-upon price, 3) Appraised Value, and 4) Formula Value.

5. Fund Your Succession Plan

Last but not least, this section answers the question: how are you going to get compensated for your company?

Few buyers out there have enough liquid cash to cover your business upfront. That is why every succession plan requires a specific strategy for the way the purchaser will make the purchase, whether it is a loan, installment payments, or other choice. The very last thing you need is to accomplish your retirement , or triggering event, and also find that your preferred successor has no way to afford your company.

That is why your funding plan will often desire a buy-sell arrangement. This is a legal document in which your buyer agrees to a specific plan of actions (like taking a loan out or life insurance coverage ) in order to pay for the purchase. Once you’ve settled on a particular method of financing, ensure to meet a legal professional to draft your buy-sell agency.

Here are the most Frequent ways succession plans are funded:

Life Insurance

Most commonly used when a family member or even co-owner is taking over the business, a life insurance policy can aid your successor purchase the business from you or your heirs. Unlike how it sounds, life insurance is not only utilized in case of one’s premature departure. Permanent life insurance builds cash value that may be taken out at any moment, so it may also be utilised in case of retirement, disability, or any other triggering event.

Life insurance arrangements are common in household successions, particularly when you may have several kids, but just one is taking over the enterprise. Together with your favorite successor as the beneficiary, a life insurance policy payout can enable them to purchasemails from your other kids, thus leaving everyone with some reimbursement and financial security.

AXA rated as the number one worldwide insurance brand for the ninth consecutive year and is the host of this article. All warranties are based solely on the issuing insurer, either AXA Equitable Life Insurance Company or MONY Life Insurance Company of America. Click the link below to get a free quote on your life insurance plan.

See AXA Equitable to get a free quote

Acquisition Loan

An acquisition loan is money borrowed by the purchaser in order to purchase the business. That is common when a key employee or external party is taking more and they want some funding to pay for the purchase. Buyers can normally get 70 — 80% of the cost financed from a bank or the SBA — which is great news for sellers that need a complete, upfront payment for their loved ones.

Acquisition loans have been secured against future profits of the business enterprise. While this makes them a more normally reliable alternative, it also means a little bit of work for the seller. Prior to the buy, you will need to provide a whole lot of details about your business for the lender due diligence. Even then, but the loan is not guaranteed. Pre-approval can provide some safety, but it would have to be experienced regularly (every 6-12 months) up until the move date or triggering event.

Seller Financing

Seller financing is when the buyer pays you back gradually over time. This is only one of the simplest and most flexible structures, since the company owner and purchaser can set whatever conditions they like. Most agreements involve a down payment of 10% or higher, followed by monthly or quarterly payments with interest before the purchase is paid for in full. Again, however, the specific terms may vary widely.

The key downside to vendor financing is the time it takes to get paid back. Especially if you’re relying on the purchase to finance your retirement, a 20-year term may be less than perfect. However, given the flexibility of seller financing, it may be possible to find an agreement that works for everybody.

The Bottom Line

Oftentimes, the toughest part of succession planning is asking the difficult questions: What unexpected events do I want to prepare for? Who is able to take over my organization? How will I compensate myself, partner, or kids?

Once you’ve answered these with the assistance of the succession planning template, the rest of the effort is rather straightforward. With the support of financial and legal experts, you are going to draft the appropriate legal documents to formalize your own plan. These experts should help you find the best possible fiscal and tax-saving agreements, while it’s life insurance, an acquisition loan or vendor financing.

AXA S.A. has been rated the No. 1 insurance brand in the world by Interbrand for 2 consecutive years as of September 25, 2017.

Applications for life insurance are subject to underwriting. No insurance coverage exists unless a policy is issued along with the required premium to put it in drive is paid.

Please be informed that this document is not intended as legal or tax advice. Thus, any tax advice given in this document is not intended or written to be used, and can’t be used, by any taxpayer for the purpose of avoiding penalties that could be imposed on the taxpayer. The tax information was written to support the promotion or marketing of this trade (s) or thing (s) addressed and you should seek advice based on your particular circumstances from an independent tax adviser.

Under present federal tax rules, you generally may take national income tax-free withdrawals up to your foundation (total premiums paid) in the coverage or loans from a life insurance plan which is not a Modified Endowment Contract (MEC). Certain exceptions may apply for partial withdrawals during the policy’s first 15 decades. If the policy is a MEC, all of distributions (withdrawals or loans) are taxed as regular income to the extent of gain in the coverage, and may also be subject to an extra 10% early distribution penalty prior to age 591/2, unless certain exceptions are applicable. Loans and partial withdrawals will decrease the death benefit and cash value of your life insurance coverage and may be subject to coverage limitations and income tax. Additionally, loans and partial withdrawals can cause certain policy benefits or riders to become unavailable and may increase the chance your policy may lapse. If the policy lapses, is surrendered or becomes a MEC, the loan balance at this time would usually be seen as dispersed and taxable under the general rules for supply of policy cash values.

AXA S.A. is a French holding company for a group of Global insurance and financial services firms, such as AXA Equitable Financial Services, LLC. (AEFS).

AXA Equitable and its affiliates do not endorse any of the company attorneys listed in this report.

Life Insurance is issued in New York and Puerto Rico by AXA Equitable Life Insurance Company (AXA Equitable), New York, NY or by MONY Life Insurance Company of America (MLOA), an Arizona Stock Corporation with its main administrative office at Jersey City, NJ and can be distributed by AXA Network, LLC and AXA Distributors, LLC, 1290 Avenue of the Americas, New York, NY 10104. When marketed by New York State-based (i.e., domiciled) Financial Professionals, Life Insurance is issued by AXA Equitable Life Insurance Company (New York, NY).

“AXA” is the brand name of AEFS and its family of organizations, such as AXA Equitable Life Insurance Company (AXA Equitable) (NY, NY), MONY Life Insurance Company of America (AZ stock company, admin. Office: Jersey City, NJ) (MONY America), and AXA Distributors, LLC. All group insurance products are issued either by AXA Equitable or even MLOA, which have sole responsibility for their insurance and claims-paying obligations. Some products aren’t available in all countries.

GE-135300 (4/18)(Exp. 4/20)