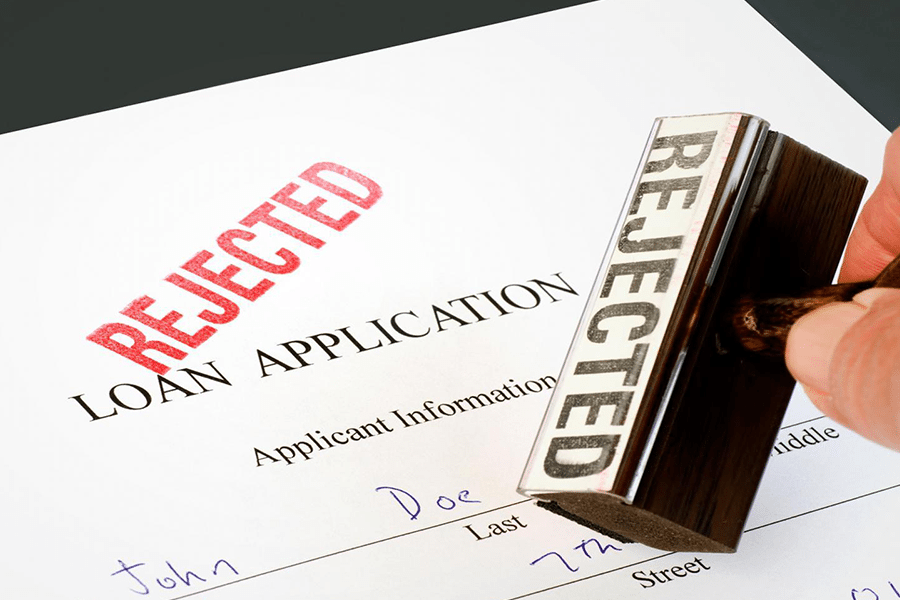

Applying for a small business loan may be a challenging procedure. You need to prove to the lender that you are accountable and capable of repaying the money you’ve got. One wrong move at a loan application can get you diminished. We spoke against the pros regarding key mistakes they see small businesses make that get their loan denied.

Here are the 25 mistakes you must avoid when applying for a small business loan:

1. Being Truthful When Presenting

Stuart Blake, Vice President of Sales and Customer Assistance, BlueVine

When it comes to a loan demonstration, it’s essential to have the ability to highlight the advantages of your business. However, resist the temptation of presenting a less than truthful image of your organization when applying for funding. Finally, the truth will get exposed and it could hurt your future attempts to secure financing.

2. Applying for a Loan Before You Are Ready

Wade Rasmussen, President, Amerifund, Inc..

A frequent issue that has a small business loan application is that many small business owners apply for financing until they are fully ready to do so. The practice of being approved for financing entails several variables beyond the guarantor’s FICO score. You want to choose the time to document as a business thing and prepare your tax filings and other files to help expedite the process of your loan application.

7. Being Disorganized

Sean Snider, Director, University of La Verne Small Business Development Center

Being disorganized is one of the most frequent mistakes when applying for a small business loan. Most lenders and banks would demand a list of files. If you are not organized, it would be tough for you to obtain these requirements in a timely fashion. Additionally, there’s a possibility that you will overlook something, which can cause a delay on your small business loan application process.

Bottom Line — Small Business Loan Application

When applying for a small business loan, then it is extremely important to come prepared. One little mistake may lead to a denial of your loan program. Make sure that you spend more time doing your own homework first before talking to your lender. Additionally, remember to avoid the 25 small company loan application errors listed above.