An SBA Express Loan is guaranteed by the Small Business Administration for up to $350k. They carry fewer documentation requirements compared to a conventional 7a loan and will fund quicker. These loans carry a maximum rate of interest of 4.5percent — 6.5% over Prime and typically have a 10 year repayment period.

Similar to Express loans, SmartBiz provides quick, conventional SBA 7(a) funding up to $350k. They could work with companies which have been operating for 2+ years and have a credit rating above 680. The whole application may be completed online in only a couple of minutes and they could have you financed in as little as 2 weeks.

Visit SmartBiz

Types of SBA Express Loans

There are two types of SBA Express loans, one for companies who export goods and another for all other business. Lenders can approve a loan or credit line up to $350k with the main SBA Express program, whereas the SBA Export Express loan program can help companies get approved who primarily export goods for up to $500k.

The two types of SBA Express loans are:

1. SBA Express Loans

The SBA Express features an accelerated turnaround time for SBA inspection but a smaller maximum loan amount. The SBA will respond to your application within 36 hours but the maximum you may borrow is $350k. This funding program is flexible and may be used for operating capital loans, a line of credit, or commercial real estate loans.

Who It Is Right For

The SBA Express may be a good option for those who need working capital loans under $350k. The simplified application process and fast turnaround time make this an attractive alternative to the standard 7a loan.

Maximum Loan Amount

$350,000

Conditions

- 5 — 10 Years for working funds

- 7 years for a credit line

- 25 years for commercial property loans.

SBA Approval Time to Lender

When a lender submits a loan application to the SBA for approval, they’ll typically respond within 36 hours.

Actual Funding Time

30 — 90 times

Interest Rates

Lenders and borrowers negotiate the interest rate. Rates may be fixed or variable and are tied to base prices, including the prime rate, LIBOR, or the optional peg rate. These rates may not exceed SBA maximums, which are up to 6.5% over the base rate for loans of $50k or less, and up to 4.5% on the base rate for loans over $50k+.

Collateral

Collateral may be required by your lender. Lenders are not required to take collateral for loans up to $25k, but they might use their existing security policy for loans of 25k — $350k.

If you’re searching for around $350K in SBA financing, we recommend applying with SmartBiz. If you have been in business for 2+ years, possess a credit score above 680, and are profitable, you can be eligible. Get pre-qualified in under 5 minutes and financed within 30 days.

Stop by SmartBiz

2. Export Express Loans

The SBA Export Express Program is a streamlined method to get SBA-backed financing for loans and lines of credit up to $500k. Lenders use their own credit decision process and loan verification, and the SBA gives an expedited eligibility review within 24 hours. The funds have to be used to improve the business’s capacity to export goods and services.

Who It’s Right For

The Export Express is a good option for businesses that need $500k or less in loans to start or expand their export company. The simplified application process and the rapid approval turnaround time create this loan more attractive than the SBA Express for export companies.

Maximum Loan Amount

$500,000

Maturity

- Working capital loans: 5 — 10 years

- Lines of credit: 7 years

- Property loans: 25 years

SBA Saves Time to Lender

When a lender submits a loan application to the SBA for approval, they will typically respond within 24 hours.

Actual Funding Time

30 — 90 days

Interest Rate

Lenders and borrowers can negotiate the interest rate. Rates can be fixed or variable and are tied into a base rate, which can be either the prime rate, LIBOR, or the optional peg rate. These prices may not exceed SBA maximums which are up to 6.5% over the base rate for loans of $50k or not, as well as 4.5percent over for loans more than $50k.

Collateral

Collateral is based on the policies and processes established by the lender for the non-SBA-guaranteed loans.

SBA Express Loan Minimum Qualification Requirements

The eligibility requirements for the SBA Express loan are like the 7a loan application, but in the long run, your lender will determine what you must satisfy to get approved. Generally, to qualify for the SBA Express loan you’ll want:

- Credit rating over 680 (assess your credit score for free)

- Debt-service-coverage-ratio (DSCR) of 1.1 or higher

- Positive revenue trends

- Business is rewarding

Where to Get an SBA Express Loan

SBA Express loans may be seen at conventional banks. Due to the high number of potential lenders on the market, it can be difficult to know which to go with. If you’re not sure where to begin you can read our article about the best 100 SBA lenders. A number of these lenders offer an Express loan that you are able to apply for.

For those tiny companies seeking to borrow around $350K quickly, we recommend working with SmartBiz on a conventional SBA 7a loan. SmartBiz’s internet application procedure can prequalify you online in just a few minutes, and you can be financed in as quick as 30 days. This is quicker than several SBA lenders lending via the Express program.

Visit SmartBiz

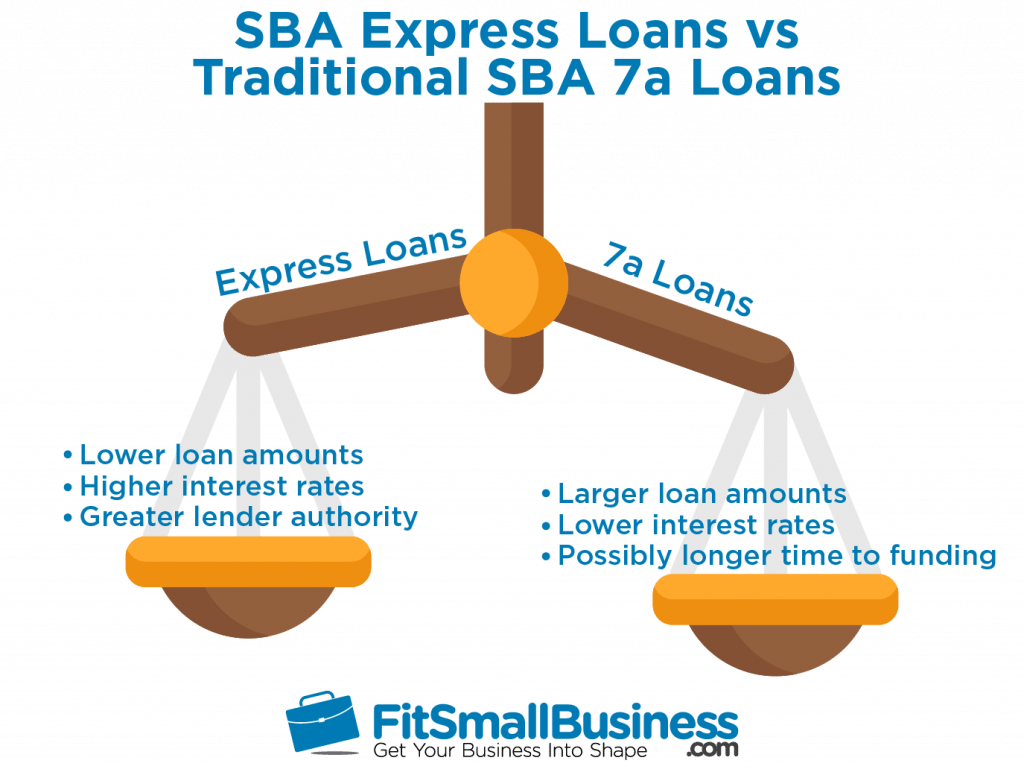

Differences Between SBA Express Loans and SBA 7a Loans

While there are many different kinds of SBA loans, most people first think of SBA 7a loans since it’s the most commonly used SBA loan program. SBA Express loans are built on the exact same program framework as the 7a program but they’re made for lower funding amounts up to $350k.

SBA Express loans have a smaller limit and a greater maximum interest rate compared to 7a loans, but they require less paperwork and could possibly fund faster. While comparable, SBA 7a Express Loans differ from traditional 7a loans in distinct ways.

SBA Express Loans vs SBA 7a Loans

| SBA Express Loan | Conventional SBA 7a Loan | |

|---|---|---|

| Maximum Loan Amount | $350k | $5 million |

| Maximum Interest Rates | Prime + 4.5 – 6.5percent | Prime + 2.75percent |

| Lender’s SBA Guarantee | 50 percent | 75 – 90 percent |

| SBA Inspection Timing | Applications reviewed over 36 hours | 2-3 weeks for non-PLP creditors Not required prior to closing for PLP lenders |

| Funding Time | 45 – 90 Days with most lenders | 45 – 90 days with most lenders Less than 30 times with SmartBiz |

| Lenders | Have a look at a list here | See SmartBiz |

The Four differences between an SBA Express Loan and a traditional 7(a) loan comprises:

1. Reduced Maximum Loan Amounts

An SBA 7a loan has a maximum loan size of $5MM and also an SBA Express Loan only brings up to $350k.

2. Higher Maximum Interest Rates

SBA 7a Loans take a maximum rate of interest of Prime + 2.75%, however an SBA Express loan has a maximum rate of interest of Prime + 4.5 — 6.5%.

3. Lower SBA Guarantees For Your Lender

The Small Business Administration guarantees around 85 percent of SBA 7a loans but only 50 percent of SBA Express loans. The difference likely won’t matter to the majority of creditors due to the low loan amounts connected with the SBA Express program.

4. Better Funding Rate

SBA Express loans can have quicker financing times than 7a loans in certain scenarios because the SBA provides more independence to the lender when it comes to the loan approval process. Essentially, the SBA is agreeing to trust the lender’s underwriting and just perform a high level review of this loan before approving it, instead of a comprehensive inspection.

The main reason borrowers choose an Express loan over a 7a loan despite the larger interest rates is that lenders promise faster funding times. Most business owners are ready to pay a premium for speed, particularly when they need money to cultivate their business.

4 Things That Affect SBA Express Loan Funding Time

Slow SBA financing times are a frequent complaint since the loan guarantee application began. Having a title such as”SBA Express Loan,” it certainly sounds like it would be a way to get quicker funding, but that can be misleading. Since the SBA loan still must go through the approval procedure of a conventional lender, the Express loan may be slower than you might imagine.

The time it takes to get SBA financing is primarily dependant on 4 items:

1. Bank Processing Throughout Underwriting

The biggest factor which impacts the funding speed to get an SBA Express Loan is typically lender efficacy. The creditor, not the SBA, controls the vast bulk of the application and underwriting processes and ultimately decides when to move forward with a loan approval. It follows that many of the issues around funding period on SBA loans are caused by inefficient lending partners.

Many creditors have antiquated, inefficient SBA application processes. They generally ask that you go into an office, talk with a range of bank employees and expect that you get passed into a loan officer that is familiar with SBA loans. After all that, the loan will likely just hand you some application paperwork. Remember, you probably have to do this all in your lender’s traditional”banking hours” program of 9-5 Monday — Friday.

After the application has been prequalified, they will request a huge quantity of information from you, which you may need to physically bring to them for review. Normally, they’ll just review things once every thing on their record was received. This is an extremely inefficient process that slows down many SBA loan applications, regardless of whether they’re SBA Express loans or SBA 7a loans.

Only after the lender has a complete loan package from you and has approved your loan internally will they seek SBA approval. Express loans get acceptance notice in 36 hours, or within 24 hours for Export Express loans. When it comes down to this, the antiquated application procedure at traditional lenders is what slows down SBA funding times the most, maybe not the SBA’s approval period.

That’s the reason why a spouse like SmartBiz can be so important to get funded quickly. Their 5-minute online pre-qualification tells you if you are a good fit. As an experienced SBA lender, they will only request the files they should complete your underwriting which means no chasing down unnecessary documents ahead of your application really gets reviewed.

Stop by SmartBiz

2. Borrower Preparedness

Many borrowers slow down their own loan process because they’re not ready for each step of the way. While there’s a lot a lender can do to speed up the SBA financing process, they have limitations if a debtor isn’t on top of all things. Even the most efficient SBA lenders may only work as quickly as their creditors let them.

Knowing what documentation will be requested by your SBA lender, and preparing it beforehand, will not just boost the speed of financing but can also raise your approval chances.

Here’s a list of documentation you can expect to need through the SBA Express loan procedure:

- SBA Loan Application

- Strategies for Loan Proceeds

- Personal Financial Statement

- Record of Personal History

- P&L Statement

- Financial Projections

- List of Ownership and Affiliations

- All Business Licenses or Certificates

- Loan Application History

- Last 3 Decades of Signed Personal and Business Tax Returns

- Personal Resumes (owners with 20%+ stake in the company)

- History and Outline of the Business

- All Business Leases

It is possible to plan on filling out particular SBA forms in addition to all of the above documentation. We’ve assembled guides on each kind to make your application process simpler. The forms you will probably have to fill out are:

- SBA Form 413 — Used to assess the financial ability of you, your partner, and other owners of the business.

- SBA Form 1919 — This type is where all basic borrower information is provided.

- SBA Form 912 — A statement of personal history utilized to assess your character.

- SBA Form 159 — This is a disclosure statement used if you hired somebody to assist you fill out your SBA loan program.

In addition, if you intend on utilizing the SBA capital to Buy an Present business then you Want to prepare to Offer the following records for your business you want to acquire:

- Current balance sheet

- Present profit and loss statement

- The last 2 years of the company’s income tax returns

- A Bill of Sale, or the proposed terms of sale

- List of their overall asking price that comes with a schedule of stock, machinery, furniture, fixtures, and other equipment.

Additional documentation may be needed when purchasing or renovating a commercial property.

In the event the application process sounds complicated, you are not alone. You may follow our step by step guide about the best way best to apply for an SBA loan to browse your way through the approach.

3. The SBA Does Not Make the Last Lending Decision

Typically, the SBA does not actually lend money to small businesses. Rather they make it less risky for lenders to make small business loans by guaranteeing a specific percentage of financing, as long as those loans conform to strict SBA standards. Therefore the”SBA acceptance” is the SBA’s guarantee to the lender they will guarantee the loan should you default.

The SBA’s loan guarantee programs are supposed to encourage banks and other creditors to make more loans on a consistent basis. The percentage of the loan that the SBA will guarantee ranges from 50 percent — 90%, depending on the plan and the size of their loan. Loans made under the SBA 7a program get a guarantee of 75% — 85%, while loans made under the SBA Express program just receive a 50% guarantee.

The downside to this is that the SBA can not speed up your loan process because that burden drops into a lender. In fact, even though the SBA promises a quick turnaround time for the SBA Express loan it generally doesn’t accelerate your whole loan period because your creditor may still take up to 90 days or more.

4. Bank Willingness to Originate Specific Loans

Inefficiency isn’t the only thing which can slow down the lending procedure with SBA Express loans. Occasionally a lender just doesn’t have the desire to do your particular loan, plus they are not very likely to inform you that when you apply.

If you submit an application they’ll typically go through the motions because they have to, despite the fact that they know they are unlikely to approve your loan. This can be a huge waste of time and energy for a small business owner who needs to get funded quickly.

There can be a Couple of reasons for this, including:

Too Much Exposure to Similar Loans

This is where the lender has lots of outstanding loans such as yours and they don’t want to accept extra ones. This happens when management determines they must acquire a better combination of loans to reduce their exposure to any one business, any 1 kind of borrower, any 1 size of loan, etc..

Bad Experience With Similar Loans

Perhaps the creditor has completed a number of loans such as yours in the past and has experienced a greater than standard rate of default. The bank will probably prevent similar loans altogether or significantly increase the requirements and qualifications needed for you to get accepted.

Inexperience With Your Type of Loan or Company

Maybe the creditor isn’t very knowledgeable about your business model or is not familiar with what will enter underwriting your loan. As opposed to risk putting in time on a loan that may not get accepted, they will choose to steer clear of the ones they are unfamiliar with.

1 thing you can do is put in software with several creditors, but that includes its own dangers. Namely, you might get hit with numerous hard credit pulls. Also, in the event you believed working with one inefficient lender would be challenging, consider working with numerous unsuccessful lenders in precisely the same time. What you actually need is to have somebody who knows which lenders are most likely to perform your specific loan help you find the right lender.

The SBA Express program doesn’t help hasten the lender’s internal processes. If your lender has inexperienced loan officers, antiquated technologies, or redundant layers of management, the loan may take months to get financed. That is another reason we recommend for companies that are searching for under $350K in SBA financing to operate with SmartBiz.

“SmartBiz’s technology has produced an ecosystem for borrowers and lenders. The platform allows us to meet the ideal borrower with the ideal bank. Various banks will say no or yes to distinct loans. We added more lenders to our market this year so we are able to say yes to small businesses more frequently. Our applications can help couple borrowers with the ideal lender the first time. That means more debtors getting approved for the amounts that they request, with payments they can afford.” — Evan Singer, CEO of SmartBiz.

If you have been in business for 2+ years and want up to $350k in financing, we recommend working with SmartBiz. You can apply online, get approved in minutes, and funded over 30 days.

Stop by SmartBiz

Preferred Lender Program vs SBA Express App

Slow SBA funding times have been a common complaint since the loan guarantee application started. The SBA developed two applications to assist limit funding delays by lessening the burden they place on lenders, the SBA Express Loan Program and the Preferred Lender Program (PLP).

PLP lenders have a lot of SBA lending experience and have a history of making good loans. That track record enables the SBA to trust the creditor to generate SBA loans with diminished supervision on all SBA 7a loans, irrespective of size or term. This usually means that PLP approved lenders can submit underwrite their own loans, without even waiting on the SBA approval process.

The SBA Express Program, on the other hand, increases the liberty of the lender by reducing their exposure to the loans made under this program. SBA Express Loans are smaller (capped at $350K) and the SBA guarantees a smaller proportion of their loan (50% rather than up to 90 percent ).

Both of these programs are a fantastic effort to speed up the government’s procedure for approving prospective applicants and promising to guarantee the loans, even if you’re approved. PLP loans tend to be better for startups searching for funds while Express loans tend to be more for established companies.

The problem is that neither the PLP or SBA Express Programs help speed up the lender’s internal processes. If your lender has inexperienced loan officers, antiquated technologies, or even redundant layers of management, the loan will probably require forever whatever the SBA. Those are the reasons why conventional lenders take 3 weeks to get SBA loans done.

That’s what makes SmartBiz’s SBA 7a loan application so remarkable. They can typically get SBA 7a loans funded in under 30 days. If you’ve been in business 2+ years and need up to $350k in financing, we recommend working with SmartBiz. You can apply online and get approved in minutes.

Visit SmartBiz

Who An SBA Express Loan is Right For

An SBA Express Loan may be good match for strong borrowers seeking around $350k who aren’t able to meet the requirements for traditional 7a loans. Generally, you’ll want:

- Credit rating over 680 (assess your credit score here for free)

- Debt-service-coverage-ratio (DSCR) of 1.1 or higher

- Favorable earnings tendencies

- Profitable business

Proceeds from the loans can be used for working capital, to refinance company debt, to buy equipment or commercial property, to fund a company acquisition, and more. While the uses of profits are elastic, there are stringent limitations on the borrowing sum ($350k in many instances ) along with the loans include higher allowable interest levels (see present SBA loan rates here).

Full List of SBA Loan Programs

SBA Express loans are simply one of several SBA loan programs. A good deal of these apps are made for particular business situations or borrowers. Irrespective of the kind of loan application, they could be time consuming to get financed. Some have options similar to an SBA Express loan while others do not. You can find more info about each type of SBA loan in the table below.

Overview of SBA Loan Programs

| SBA Loan Type | Who It Is For |

|---|---|

| SBA Express | Businesses needing up to $350k quicker than you would receive them beneath a conventional 7a loan. |

| Export Express | Businesses wanting to enlarge their merchandise or services export company needing up to $500k. |

| 7a Loans | Businesses requiring working capital or commercial real estate loans around $5 million. |

| CAPLines | Businesses with seasonal revenue patterns and who are searching for a working capital line of credit. |

| Export Working Capital | Export Heavy companies needing short term capital. |

| International Trade | Businesses who are negatively impacted by imports or who want funds to expand their international trade enterprise. |

| Community Advantage | Firms in underserved communities looking for working funds. |

Useful Definitions for SBA Loans

When applying for SBA express loans, you might run into some terminology that is new to you. The table below has some terms and definitions you might find useful during the application procedure.

SBA Express Loan Terms and Definitions

| Term | Definition |

|---|---|

| Small Business (Under the SBA) | The SBA defines what a little company is through their size standards. These are based on each employee count or revenue size.

The general definition of a small business for production businesses is less than 500 workers. For non-manufacturing businesses it’s less than $7.5 million in yearly earnings. |

| Debt to Income Ratio (DTI) | DTI is utilized to ascertain a company’s capacity manage monthly debt payments. It’s calculated by dividing total monthly debt by gross monthly income, and expressed as a proportion. |

| Debt Service Coverage Ratio (DSCR) | The proportion of available cash to support debt through interest, principal, and rental obligations. |

| SBA Guarantee Percentage | The percentage of the loan balance the SBA guarantees, or honors, in the event of a default option. In case the SBA guaranty percentage is 50%, then on default the SBA will refund the lender up to 50 percent of the loan principal. |

| Lease Subordination | A lease subordination ensures that the SBA creditor is positioned ahead of any potential landlord disputes in case of a default option. A rental subordination must be signed with the landlord of any rentals the company has. |

Bottom Line: Fast SBA Loans

SBA Express loans are known for their faster SBA approval times, but they can carry higher rates of interest and shorter repayment terms than other classic 7a loans. While it helps speed up the SBA review process for creditors, it doesn’t typically get you financed any faster than a conventional SBA application if your creditor is ineffective.

Should you want funds quicker than the typical 45 — 90 days that SBA loans take then we recommend applying with SmartBiz. They could get you financed in under 30 days with more affordable rates of interest and longer repayment terms than an SBA Express loan. Get prequalified in less than 10 minutes by filling out their online program.

Stop by SmartBiz