Rental financing is a short-term loan or line of credit used by a company to buy inventory. The loan or line of credit is usually secured by existing stock without having to pledge personal security. Inventory financing is commonly utilized to prepare busy seasons, fill large buy requests, or as startup funds for product-based companies.

Should you need access to funding quickly, you may also want to check out our article on short-term loan suppliers. Short-term loan providers have easy online application processes and you can get the financing as fast as the exact same day that you apply. Check out our review of prices, terms, and credentials.

Greatest Short-Term Lenders

Inventory Financing Options at a Glance

| Supplier | Who It Is Right For |

|---|---|

| Business Line of Credit with Kabbage | Businesses with constant cash flow or inventory needs. |

| Online Inventory Financing with Behalf | Business that require fast inventory financing around $500K. |

| Bank Inventory Financing | Firms with an established banking relationship and a high personal credit score. |

| Asset Based Lenders | Businesses that may wait up to 1 month for financing, and have stock that holds its value. |

| Vendor Financing | Firms who buy large quantities of inventory from precisely the exact same vendor. |

How Inventory Financing Works

Traditional inventory financing is typically once you take out a loan backed by new inventory assets which are purchased using the loan. Often, inventory financing lenders will pay your providers directly and you will then repay the lender. However, if you’re a small business owner, it’s more common to use a general short-term working capital merchandise.

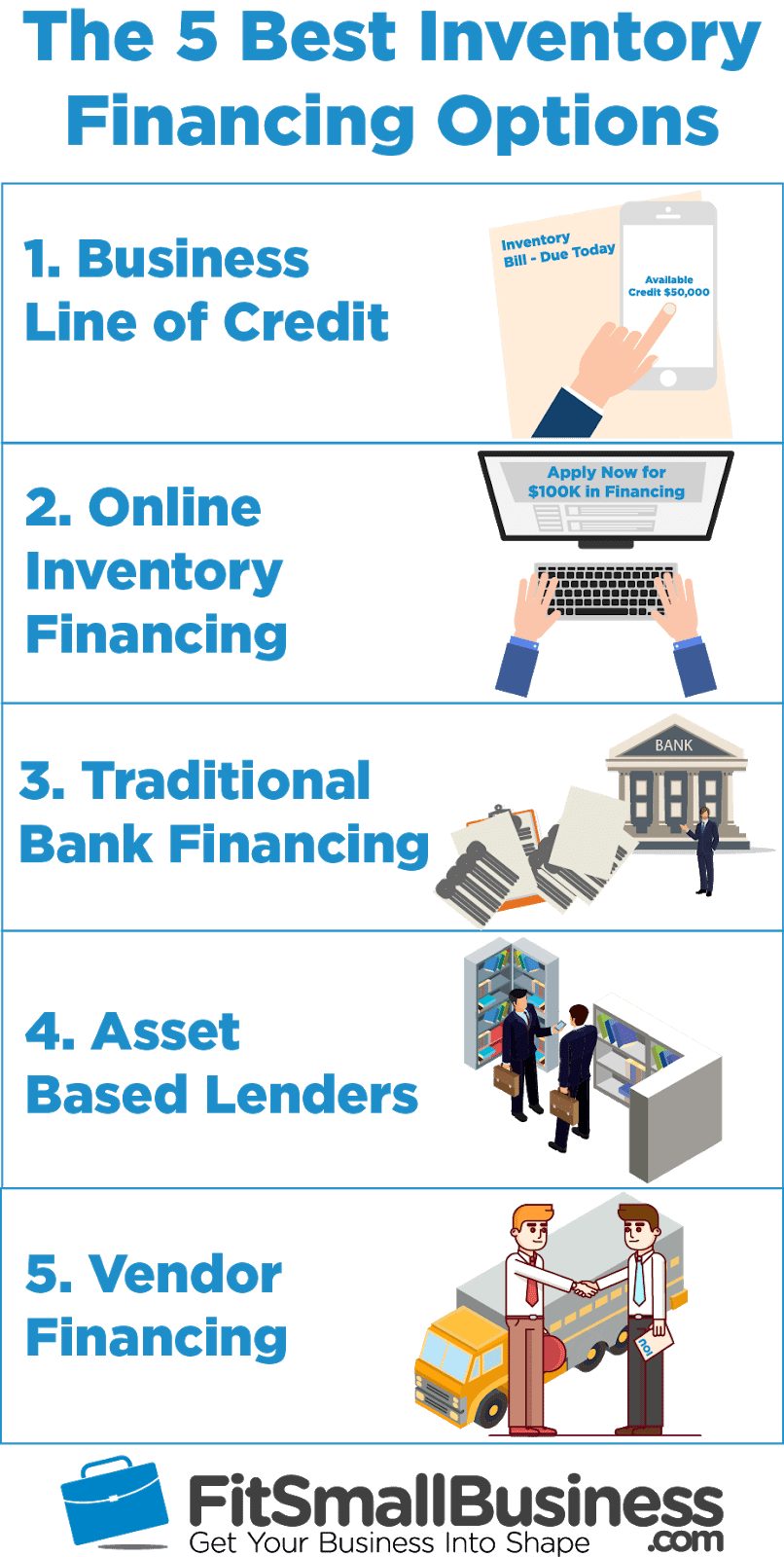

The 5 greatest inventory financing options for small business owners are:

1. Business Line of Credit

A business line of credit is the fastest stock financing solution. Having a LOC, you get financing that you may use again and again without needing to reapply. Plus, in case you have unforeseen expenses that pop up, you may use your company line of credit for more than just inventory purchases. It’s a fantastic tool to have no matter your requirements.

Who Is it Right To

A business line of credit is usually right for businesses with constant inventory or cash flow requirements. Since you don’t need to reapply every time you need cash, it is the perfect answer to be used for the very same purchases every month.

Costs

The expenses of a business line of credit fluctuate widely, depending on where you get it from. The general APR can vary from 13.99% — 55%. This doesn’t include extra fees you may see, such as draw fees, origination fees, or service fees.

Terms

With a business line of credit you can get approved for a lineup to $150K, and your repayment terms will generally be 6-12 weeks for each draw. You’re only required to pay interest on the portion of the credit line you are currently using. Therefore, if you are approved for a $100K line, but just borrower $10K, then you’ll only pay interest on the $10K before the sum is reimbursed.

Qualifications

The eligibility requirements will vary by lender, but typically you’ll need to meet these minimum standards:

- Credit rating: 550+ (check your credit score for free )

- Period in Business: 1+ Year

- Annual Business Revenues: $100K+

- Other Requirements: You may also have to be profitable and have no significant recent credit offenses like a bankruptcy, tax lien, or repossession.

Recommended Business Line of Credit Provider: Kabbage

Our recommended small business line of credit supplier is Kabbage. They provide up to $250K of financing with an APR that ranges between 30-50%. Your repayment terms are either 6 or 12 months, and you make payments yearly until it’s paid in full. You may qualify if you have $50K+ in annual company revenue, have a credit score of 500, and have been in operation for 1 year or longer. It takes 10 minutes to apply.

Visit Kabbage

2. Online Inventory Financing

You will find an assortment of online lenders that provide financing particularly for inventory. Getting a business line of credit might be easier and quicker, but if you know you’ll use the money solely for stock, it can be cheaper to choose one of these more technical providers. These lenders typically pay your suppliers directly and then accumulate repayment.

Who Is it Right For

These online choices are good for businesses that don’t have a great deal of inventory, receivables, or track record of success and are consequently unable to qualify for a business line of credit. However, they are a good alternative for businesses that need a smaller (up to $50K) short-term solution and know that they don’t want the financing for whatever else.

Costs

These online inventory financing lenders will typically charge you up to 3% of your loan for each 30 days you’re in repayment. The normal APR drops between 30-35percent but may be cheaper if you pay it back within the first month.

Terms

You are able to borrow between $300 and $50K using an internet stock loan, and your repayment terms will be between 1 months. These loans work similarly to some short-term business loan, but are slightly cheaper since you can only use the funds for stock. You can get completely funded in as fast as 1 day.

Qualifications

Online stock financing lenders aren’t always clear about their qualification requirements. Every one of them will normally check your individual credit and connect to a bank account to ascertain your eligibility. If approved, some may want to check information regarding your inventory to learn how long of a shelf life it generally has, with some requiring as much as 1 year.

Recommended Online Inventory Financing Provider: Behalf

Our recommended online inventory financing supplier is Behalf, who pays your vendors directly so you can make large purchases of stock. It is possible to borrow up to $50K in under 4 minutes, and you have up to 6 weeks to cover it. All you have to employ is really a social security number and US bank accounts. The APR on a Behalf loan is generally around 30 percent.

Stop by Behalf

3. Bank Financing

If you’re searching for inventory financing, you might even go the path of more conventional financing and receive a bank loan or line of credit. This is the most economical choice but the cheapest one if you are borrowing money. Banks prefer to lend to businesses with a solid cash flow and good credit. The worth of stock is a secondary consideration.

Your existing inventory will act as security for bank financing, however, the bank may also place a blanket lien on your company assets, which lets them go after any company asset if you can not pay back the loan. A blanket lien may also affect your ability to acquire other funding. If your company isn’t profitable, the lender is less likely to approve you or will approve you for smaller sums of capital.

Who Is it Right For

Firms who don’t require immediate financing, and are looking for the most inexpensive option. Also great for business owners with a strong personal credit score and companies with a solid business credit score and business credit report.

Costs

At any time you receive financing from a bank you will likely encounter origination fees, packing charges, or additional upfront costs that are rolled into your loan or paid out of pocket. The APR typically falls between 4-10percent for conventional banks and closing costs can be 2% — 5%.

Terms

It’s possible to borrow a large amount of cash to fund your inventory from a bank, as far as $1 million or more. You are also likely to find the longest repayment terms using a lender, normally falling between 1 — 5 decades. A bank may provide you with a business line of credit to fund your inventory if you need money on a constant basis.

Qualifications

Like other kinds of financing, it can be difficult to qualify with a bank. While it will vary by lender, and depend on your present banking relationship together, you can generally qualify if you meet these minimum standards:

- Credit Score: 680+ (check your credit rating for free )

- Time in Company: 2+ Years

- Inventory Value: 1+ Year of shelf life and can only borrow up to 50% of inventory value

- DSCR: 1.25+

- DTI: Less than 36

- Other Qualifications: Business needs to be rewarding. You can’t have any negative credit events such as bankruptcy, tax liens, or repossessions.

Generally with a lender the more powerful your business’ cash flow will be the more probable it is that you will get approved because you’re showing lenders that you can repay the loan.

Recommended Bank Financing Provider

We currently do not have a recommended supplier, but you should check with your current bank . Existing relationships are the very best place to get started. By way of example, you can inquire with the bank where you have your business checking account or business savings accounts.

4. Asset Based Lenders

Whereas banks lend based on cash flow and credit score, asset-based lenders consider just two sets of resources, accounts receivable and inventory, in deciding whether to approve you for a loan.

“We serve businesses that can’t qualify for bank financing since their profits or credit score aren’t large enough,” says Marc Smith, Senior Vice President in Magnolia Financial, an asset-based lender that provides inventory financing for B2B businesses.

Asset-based lenders take a much more hands-on function in assessing your inventory by assessing your stock on-site prior to you becoming approved. Following that, they need monthly reports on stock levels. Ideally, according to Marc Smiththey need customers with well-managed inventory systems that understand exactly where their stock levels stand at any given moment in time.

Who’s it Right For

Firms who want a large amount of financing ($500K+) and take at least twice their financing needs in inventory value. Meaning, if you want $500K in funding afterward at any given time you have $1M+ in stock.

Costs

Asset-based loans have interest rates of approximately 10 — 18 percent. There might also be loan origination fees and expenses related to the lender doing an onsite stock evaluation.

Terms

It is possible to borrow up to 50 percent of the value of your stock and get funded within 1 month. The loan is secured from your stock and your business receivables.

Qualifications

There are no set credit rating or earnings requirements. Rather, the lender will inspect and evaluate the inventory and assess your inventory management system. You can get approved for up to 50% of the worth of your present inventory.

Recommended Asset Based Lender

We don’t have a recommended asset-based lender at this time. A few examples of lenders within this area are Crossroads Financial and Capital Source.

5. Vendor Financing

A good place to begin if you’re searching for inventory financing would be to ask your seller if they will allow you to cover credit. This is often the easiest way to buy inventory when you’re short on cash because your sellers will be very interested in making a purchase or getting an upgrade on the payment you owe them.

Vendors may offer 30-90 day payment terms. If this is the case, they could collect a percentage of payment up front (deposit) and defer the remainder into an agreed upon date. Or, they may collect installment payments over time. Still, in case you’ve got a good relationship you should be able to negotiate payments in full following 30-90 days.

Even though most vendors offering these financing services provide them free of charge, some may charge an interest rate. Before providing you with a payment program, the vendor will most likely check your business credit score and business financials. However, a vendor is more likely than a lender to overlook problems such as a low credit report or poor cash flow.

Who’s it Right For

Seller financing is for everyone. If you can get your vendor to agree to expand your payables then it’s a fantastic solution, regardless of what your requirements are or how large of a company you have. It is usually best for existing companies and business owners with prior vendor relationships.

Prices

Typically that is offered free of charge, but some vendors may ask you to pay an extra fee or a higher rate of interest in exchange for this particular option. There might also be late payments if you fail to pay on the agreed date.

Terms

Your vendor can prolong your payables by providing you additional time to pay what you owe them. They can also charge you interest to repay your stock over a longer period of time. These costs could be anywhere from 1 — 10 percent or more, depending on how comfortable your seller is with offering funding.

Qualifications

The sole qualification is your provider agrees to offer the financing to you.

Recommended Vendor Financing Provider

Your current suppliers.

Who Inventory Financing is Ideal For

Inventory financing is right for companies looking to pay for inventory before they receive payment from their clients. For example, it helps solve inventory deficit problems where you don’t have enough of the stock your customers want, or it can help you increase stock levels of new products in an effort to drive earnings.

The following types of businesses may benefit from inventory funding:

1. Brick and Mortar Retailers

Many retailers utilize inventory financing because most of their money is tied up in inventory. Having the right number of merchandise on their shelves is frequently the livelihood of their enterprise. Inventory funding gets you the stock levels you desire while freeing up your cash flow for other expenses.

2. E-Commerce Retailers

Selling goods online through an e-commerce site doesn’t necessarily mean your cash flow or stock management is any easier. You’ll still likely have a necessity to maintain your inventory levels at an acceptable rate so as to meet a constant flow of customer orders.

3. Wholesalers

Wholesalers require a continuous supply of inventory to meet incoming orders and replenish stock which leaves the shelves. Since wholesalers normally have bigger order volumes compared to retailers, it’s important to keep more disposable inventory that could get arranged at any given time. Financing can help you replenish that inventory, even in the event that you have not yet been paid for previous purchases nonetheless.

Benefits of Inventory Loans

Inventory financing has many benefits for businesses with stock requirements. The ideal company will find it to be very handy and helpful in running a constantly tight cash flow. Retailers are renowned for having narrow margins, which produces a problem for you once you attempt to fully stock your cupboards. Inventory financing can assist with that money flow problem.

The 4 main benefits of inventory financing include:

1. Helps Get You for Your Busy Season

If you are a seasonal business, you can prepare yourself for the busy season using financing to get inventory the months leading up to the beginning of your best season. You won’t normally have the money to finance the inventory needed for your hectic period until after it’s in full swing. That makes inventory funding a great solution for you.

2. Improves Your Money Flow

Many retailers struggle with cash flow problems because of their thin margins combined with the time of the obligations. These retailers do not receive revenue without stock to market, and often you don’t have the cash flow to buy the stock you want to maximize your sales. The right financing helps overcome this dilemma by freeing up your cash flow to be used for other expenses.

3. Increases Sales Volume

Inventory financing helps you improve your total sales since it can help you maximize the amount of stock you have for sale. Whenever you don’t have to pay cash for your stock, you are a lot more likely to buy extra items that sell well for you. It also helps you buy extra items which you wouldn’t have had available to your clients otherwise.

4. Easier to Get Than Other Financing

The true stock you buy is often used for collateral when you are financing it. This means that stock financing is much easier to obtain than a conventional business loan would be. And you usually don’t have to put up personal security to secure that additional working capital .

Drawbacks of Inventory Financing

As these are all great benefits of inventory funding, the one major drawback is the expense of due diligence. Many traditional lenders will expect a field audit to look at your stock, and see the best way to care for your inventory. They may also wish to look at your accounting and inventory systems to be certain they are functioning correctly, and receive an inventory appraisal.

These due diligence things can be really pricey, and you will be asked to cover these costs up front before you know if you’ve been accepted for financing. If you go with a loan provider which demands these qualification measures, we recommend only applying for larger amounts of stock financing, in the hundreds of thousands of dollars.

However, with smaller financing demands you can qualify with other loan providers. They are more expensive, carrying higher prices, but they also require not as due diligence and can fund very quickly. Our recommended provider is Kabbage, who will offer a business line of credit of up to $150K. You can complete an online application and pre-qualify within 10 minutes, and be fully funded within 1-3 days.

Stop by Kabbage

Bottom Line

Inventory financing can help you meet customer demand by financing the purchase of inventory which can fill your cabinets and increase your sales. You’ve got numerous options to get inventory funding, from vendor lending to banks and asset-based lenders or internet lines of charge. The ideal choice for you depends upon how much financing you require, and how fast you require.

Our recommended inventory financing option is a business line of credit. If you have been in operation for 1 year, have a credit score above 550, and over $50K in annual business revenue, you may pre-qualify up to $250k in financing with Kabbage. The program can be completed on line within a few minutes and you can be financed as fast as 1 day.

Stop by Kabbage