In this article we’re going to spell out the SBA guarantee fee in detail and discuss how much you will typically be charged. These guarantee fees are important to understand before you find SBA financing in order to fully know about all expenses associated with a possible loan. When getting an SBA loan are different fees you are going to be charged in addition to the guarantee fees. We are going to speak about such fees as well, how much they’re, and when you’ll be responsible for paying them.

If you’re prepared to begin the SBA loan application process then we recommend using SmartBiz as your own loan provider. They provide working capital loans up to $350,000 and commercial property loans as much as $5,000,000. Their SBA loan experts can help you navigate the challenging SBA financing process in as few as 30 days. You may fill out an online application and receive pre-approved in about 5 minutes.

See SmartBiz

What Is an SBA Guarantee Fee?

In most cases, the Small Business Administration (SBA) is not a creditor. Rather, they ensure specific kinds of loans that private lenders make to small companies. This assurance is what maintain SBA rates so low and the repayment provisions provided that. After the SBA guarantees a loan, then they typically assess a commission, called an SBA guarantee fee, so that is passed to you by your creditor.

The SBA guarantee fee is predicated on two things:

- The dollar amount of the bonded part of the SBA loan — The SBA does not guarantee 100% of your loan. Rather they guarantee 75% — 85 percent of your loan and the guarantee fee a percentage of that dollar amount.

- The repayment term of the SBA loan — Repayment conditions can vary and be as large as 10 years for working capital loans 25 years for commercial real estate loans. Any loan with a term of 1 year or less will have a 0.25% guarantee fee, while all other terms begin at 3% and vary based on the total amount of the guaranteed portion of the loan.

The SBA guarantee fee may range from 0% — 3.75percent and could be included in the general loan proceeds. These guarantee penalties are only required on SBA 7a loans, but all SBA loans have fees of any sort which are paid to the creditor or the SBA. We discuss the different types of fees you will experience below.

In the table below we look at everything you will typically be charged in exchange for your SBA guaranteeing your loan. These charges are based on the quantity of your loan being ensured and reflect an SBA 7a loan.

SBA 7a Loan Guarantee Fees by Loan Amount

| SBA Loan Under $150,000 | SBA Loan from $150,000 – $750,000 |

SBA Loan Above $750,000 | |

|---|---|---|---|

| SBA Guarantee Fee | None | 0.03 | 0.035 |

| Additional Fee on Amounts Above $1,000,000 | N/A | N/A | 0.0025 |

| Length of Loan Guaranteed by the SBA | 0.85 | 0.75 | 75 percent up to $3,750,000 |

How SBA Loan Guarantee Fees Work

When an approved lender puts a loan in the front of the SBA for acceptance, they require the creditor to pay a fee in exchange for the SBA to ensure the repayment of up to 85% of their loan. The lender then typically passes this fee on the borrower, rolling it in your loan where you pay it back over time as a portion of the whole loan. The creditor also must pay the SBA an annual service charge of 0.546% of the guaranteed portion of the loan to continue guaranteeing the loan. This ongoing fee isn’t typically passed on to you.

The warranty fee amount fluctuates based on how far the SBA is reassuring for your creditor. The fee isn’t based on the entire loan dimensions, but rather on the section of the loan that the SBA promises to repay in the case of a default. The SBA’s guaranteed portion of the loan ranges from 75% — 85%.

If the loan amount is less than $150,000, then the SBA has agreed to waive their guarantee fee. This is important because as of April, 2017, 56 percent of all SBA 7a loans are for $150,000 or less. This does not indicate that SBA guarantee fees are not important, however. Because while the majority of borrowers do not pay a fee, loans under $150K account for only 9 percent of the total cash loaned out through the SBA 7a application in 2017.

While the SBA guarantee fee is waived for loans under $150,000, the fee becomes 3% of the guaranteed portion of the loan when the SBA loan is between $150,000 -$750,000. For SBA loans over $750,000, the fee begins at 3.5% of the guaranteed portion of the loan and gains (and more complex ) once the loans size spans the $1,000,000 threshold.

For SBA loans over $1,000,000, the entire fee for the initial $1,000,000 is 3.5% of the guaranteed portions of this loan. Any dollar amount within $1 million will be charged a 3.75% commission on the guaranteed portion of the loan. The two fee amounts are added together to get to the entire guarantee fee you will pay.

The table below represents a good example of exactly what assurance fees you would pay based on the amount the SBA is reassuring.

SBA Guarantee Fee Instance

| Loan Amount | Total Quantity Loan payable from the SBA | Total Guarantee Fee | Guarantee Fee Breakdown |

|---|---|---|---|

| $110,000 | $93,500 (85%) | $0 | Fee is payable if loan is under $150,000 |

| $160,000 | $120,000 (75 percent ) | $3,600 | 3% of $120,000 |

| $800,000 | $600,000 (75 percent ) | $18,000 | 3 percent of $600,000 |

| $2,000,000 | $1,500,000 (75%) | $53,750 | 3.5% of the first $1,000,000 and 3.75percent of the Remainder of the guaranteed percentage ($500,000) |

If you’re looking for an SBA loan provider that could help you browse through the whole loan process, including all fees you’ll be charged, then we urge SmartBiz. They can get you approved up to $5,000,000 and entirely funded within 30 days. Their application can be completed online in a few minutes.

Visit SmartBiz

SBA 504 Loan Charges

The SBA 504 loan does not have a specific guarantee fee such as the 7a loan does but they do have regular loan origination fees which are roughly equal to this 7a loan guarantee payment sum. These standard fees are about 3-3.5percent of your loan. This fee, such as the assurance fee of the 7a loan, can be financed as part of your complete loan.

SBA 504 loans are ordinarily utilized to fund commercial property. When obtaining an SBA 504 loan you’re combining two loans, a loan by a lender, like a bank, and a second loan from a nonprofit community development corporation (CDC). This combination enables the SBA achieve their policy goals, and it helps you get funding with lower interest rates and longer terms than you may be able to locate elsewhere.

The bank almost always charges an origination fee of about 1% to fund such loans. The SBA charges 0.5% over the bank loan, and approximately 2.65% on the CDC loan. The SBA guarantees 100% of the CDC loan in exchange for these origination fees. The CDC will charge a $2,000 — $3,000 flat fee for financing the loan. The table below shows an illustration of what these origination fees will seem like to get a project financed through the SBA/CDC 504 loan program.

| Total Loan Amount | $5,000,000 |

| Your Down Payment | $500,000 (10 percent ) |

| Bank Loan Amount | $2,000,000 (40%) |

| CDC Loan Amount | $2,500,000 (50 percent ) |

| Total Origination Fees | $98,750 |

| Fees Explanation | Bank’s 1% commission on their loan = $20,000 SBA 0.5% on bank loan = 10,000 SBA 2.65percent on CDC loan = $66,250 CDC Flat Fee = $2,500 |

All these fees can be financed into your overall loan amount.

Other Average SBA Loan Charges

The SBA 7a loan as well as the SBA 504 loan have fees that are associated with different kinds of loans. If you aren’t aware of them ahead of applying you might be amazed to see just how much they can potentially increase the entire cost of your loan. Preparing for these loans will allow you to understand the size of loan you can afford before you get into the application process.

The SBA has limits to what charges can be charged and SBA form 159 must be filled out prior to closing a loan to disclose whether any brokers were paid to provide services during the loan application. Below is a listing of fees that are permitted by the SBA that are commonly charged when obtaining an SBA loan:

SBA Origination Fee: 0.5percent — 3.5%

SBA 504 loans require origination fees which work such as the 7a guarantee fees. When borrowing a loan from the SBA 7a loan program, a lender may also charge you an origination fee to process the loan. Origination fees range from 0.5% — 3.5percent depending upon your lender and the size of their loan.

SBA Loan Packaging Fee: $2,000 — $4,000

To improve your acceptance chances, it’s necessary your loan records are packaged together in a comprehensive and easy to comprehend way. A loan provider will typically bill this during an SBA loan procedure since they put forth effort in packaging your program and getting it accepted by the SBA to be ensured. The scope for this fee is $2,000 — $4,000.

SBA Loan Broker Fee: 1% — 4 percent

Broker fees are paid directly to third parties that package your loan or introduce you to the lender who funds your loan. Broker fees aren’t allowed from the SBA, but are often charged as packaging or service fees. These fees are not regular and require that you hire a person to help you get your loan funded. Depending on how big your loan the fees can range from 1 percent — 4 percent of your total loan amount.

SBA Loan Service Fees:

A loan provider may charge continuing service fees to manage your loan. These will be billed monthly or quarterly and are normally for services like billing and keeping accurate records of payments made. These vary by lender but you can expect anywhere from 0.25percent — 0.75% of the remaining balance on the loan for every billing cycle.

SBA Loan Closing Prices:

Furthermore, the fees listed below are usually associated with the closure of your loan, and are typically bundled together as”closing costs”:

- Evaluation Charges: You may need to get an appraisal on a bit of property you’re either using as collateral or buying. These fees vary from $2,000 — $5,000 in most states. Particular use commercial properties may want a fee up to $10,000.

- Business Valuation Fee: If you’re utilizing your SBA funds for a business acquisition then you are going to want a valuation of that business. These can cost anywhere from $5,000 — $30,000 or even more based on the the business’s size and how complex it is.

- Phase I Environmental Report Fee: In case you’re purchasing commercial real estate, or utilizing a few as collateral for your loan, then your loan provider may require you to acquire an environmental report. These reports identify potential or existing environmental issues that may harm the property later on. The accounts cost approximately $2,000 — $3,000 based on your state.

- Title Fee: In case you’re buying real estate then you’ll have to be certain the property has a clean title, free of any additional claims to it. The name fees go to doing UCC lien searches, purchasing title insurance, and recording your name at closing. These charges can cost you $1,000 — $2,500.

- Attorney Review Fee: You must anticipate your loan supplier to use an attorney to review all of the loan documents prior to closing, and when they do then it is very likely that they’ll pass these costs on to you. You are able to charge $2,000 — $3,000 with this fee.

With the exception of any service charges, which is continuing, these are all one-time fees that are either billed at closing or financed as part of their loan. To be able to move forward during the loan process, you will typically must pay deposits at several parts of the loan process to reveal the lender you are well prepared to close the loan.

None of these fees which you’re billed are standard for all SBA loan suppliers. Each loan provider charges different fees according to a number of distinct attributes. Some of the attributes that go into deciding which of these fees you will pay are:

- Goal of Your Loan: Extra fees are generally connected with loans that involve purchasing property, or that utilize particular property as collateral. If you are purchasing a business then there’ll also be additional fees for things such as getting a business valuation.

- Third Party Involvement: There could be additional fees when you’ve got a third-party included in the loan process. Also, the size of penalties charged may differ based on what third party you or your lender uses to complete legal, environmental, or other tasks required before closing.

- Amount of Your Loan: If your loan amount is modest enough, your SBA guarantee fee may be waived. The dollar amount of your fees may count on the dimensions of your loan when a percentage is charged rather than a set sum.

- Creditworthiness: Your creditor will decide whether they charge you some fees, and if you must pay them. Deposits are an illustration of a normal price a creditor may reduce according to your profile. The better your profile, the greater your deposit may return.

- Collateral: If you’ve got a large quantity of security then it might eliminate or reduce certain fees. Collateralization aids the loan provider view you as less of a threat, and fees are typically increased the riskier the loan will be to the lending company.

If you’re willing to apply for an SBA loan, then we advocating using SmartBiz. They are the SBA loan supplier we used when we were looking for funding. They are the quickest SBA loan supplier we have reviewed, having the capability to get you funded within 30 days. They can approve you for up to $5,000,000 and you can pre-qualify in about 5 minutes.

Visit SmartBiz

When Do You Pay SBA Loan Charges?

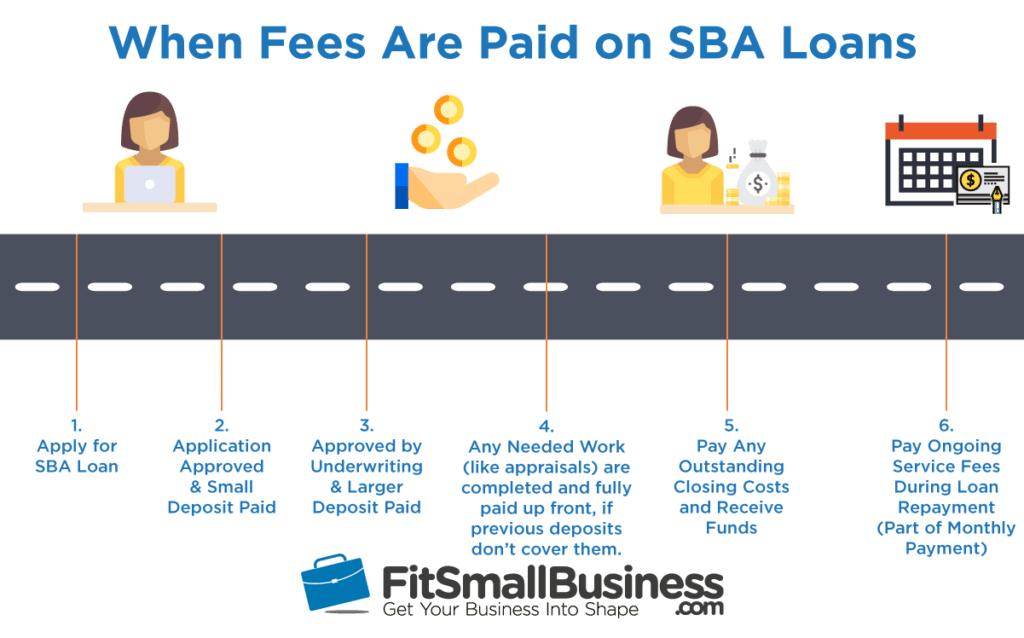

Even though SBA loan guarantee charges are financed as part of your final loan and reimbursed as part of your monthly payment, then it may be confusing as to if you normally need to pay the other fees discussed within this report.

SBA loan providers will normally ask that you pay deposits throughout the lending procedure that show your commitment to closing your loan. These deposits normally count as either part of your deposit on the loan, or as a prepayment on the charges which are charged at closing. You have to pay all the required deposits prior to closing out of your pocket.

The rest of the charges are paid when specific work is beginning, at closure, or they’re rolled into your total amount of the loan. The breakdown of that fees fall into each category is:

| Paid as Deposits | Paid at Closing | Rolled Into Your Own Loan |

|---|---|---|

|

|

|

Each of the fees in the”Paid as Deposits” category are typically paid through your 2nd big deposit if the funds are large enough to cover the work. The graphic below represents when every fee and deposit is usually paid throughout the SBA loan process under.

Bottom Line

SBA loan providers are charged SBA guarantee fees in exchange for guaranteeing up to 85% of your loan in the event of a default. These guarantee fees are usually passed on to you personally and funded into your total amount of the loan. Loan providers charge you a number of different charges based upon your loan profile along with your usage of the funds. It is important to know what you possibly might be charged in charges before you apply so you could accurately forecast your loan expenses.

As soon as you’ve got a fairly good idea of what your loan costs could be and you’re ready to proceed then we advocate using SmartBiz as your loan provider. SmartBiz can get you financed for up to $350,000 for working funds or up to $5,000,000 for commercial property. You can prequalify within a couple of minutes and be fully funded within 30 days.

Visit SmartBiz