SIMPLE IRAs are employer-sponsored retirement programs allowing participants to save up to $25,000 pre-tax in deferrals and fitting. Using a SIMPLE IRA, employers must match employee deferrals on a dollar-for-dollar foundation between 1% — 3%. To utilize a SIMPLE IRA, employers must implement their plan before October 1 of the year it will become effective.

How a SIMPLE IRA Works

A SIMPLE IRA is known as a”poor man’s 401(k)” because it supplies numerous 401(k) advantages at a lower price. However, a SIMPLE IRA has lower contribution limits than alternatives like SEP IRAs. However, while SIMPLE IRA contribution limits are lower compared to other options, they simply require that an employer suits involving 1% — 3% of employee deferrals and are a terrific option if you want to incentivize employee retirement savings.

Unlike 401(k) plans, SIMPLE IRAs price virtually nothing for companies to administer — generally less than $20 per employee each year. Also unlike 401(k) plans, they do not need annual filings or compliance testing to ensure the plan remains in balance. This exclusion from testing is something which SIMPLE IRAs have in common with Safe Harbor 401(k)s.

Contribution limits for SIMPLE IRAs are $25,000 if deferrals and employer matching are maximized, almost 5 times greater than the limit on Traditional IRAs (which can be $5,500). But, SIMPLE IRA contribution limits are lower compared to alternatives like 401(k) programs and SEP IRAs, both of which have contribution limits of $55,000.

SEP IRAs are appealing options for many solopreneurs or businesses with few employees and therefore are popular alternatives to SIMPLE IRAs. With SEPs, nevertheless, you are required to fund all worker contributions proportional to your contributions, but with a SIMPLE, the only requirement is that you match employee deferrals dollar-for-dollar between 1%-3%, making it a cheaper choice for businesses with more than 5-8 workers.

Contribution Limit Replies: The Way SIMPLE IRAs Stack up

| Type of Strategy | Total Contribution Limit | Contribution Limit with Catch-Up |

|---|---|---|

| Traditional IRA | $5,500 | $6,500 |

| SIMPLE IRA | $25,000 | $28,000 |

| SEP IRA or Solo 401(k) | $55,000 | $61,000 |

| 401(k) | $55,000 | $61,000 |

SIMPLE IRA contribution limitations include employee contributions and employer match. SEP IRAs and Solo 401(k) contributions must be by companies, instead of through employee deferrals. 401(k) contribution limits include employee contributions, employer match, and profit sharing.

“A SIMPLE IRA is more simple than a 401(k). They are generally less costly to administer and less time-consuming to function. A SIMPLE IRA has lower contribution limits than a SEP IRA and is simpler to install…Otherwise, a SIMPLE IRA program follows the same investment, supply, and rollover rules as traditional IRAs. Contributions made to traditional IRAs and SIMPLE IRAs during the year are tax-deductible, but you pay taxes on the money when you take it out in retirement” — Josh Zimmelman, President, Westwood Tax & Consulting

Who’s SIMPLE IRA is Right For

SIMPLE IRAs are best for business owners who have over 5-8 employees but want to avoid the expense of administering a 401(k) plan. SIMPLE IRAs can also benefit small business owners who wish to promote employee saving through salary deferrals instead of through the employer-only donations of a SEP IRA.

In many cases, a SIMPLE IRA matches well for small business owners that aren’t making substantial profits or aren’t capable of optimizing contributions under a SEP or 401(k). A SIMPLE is also more economical than a SEP, so owners may defer their own income without needing to create proportional gifts for each worker.

Situations where a SIMPLE IRA could be particularly beneficial include:

- Young businesses still in development stages — SIMPLE IRAs can be fantastic From the early years of a new business when owners still must reinvest earnings to continue growing the business. Most owners in this scenario can’t afford to take full advantage of the higher contribution limits of a SEP or 401(k).

- Small companies with few employees — Small business owners with few employees often look first to a SEP IRA, but SEPs require employers to fund all employee gifts. This makes SIMPLE IRAs much cheaper for businesses with more than 5-8 workers.

- Firms with few employees and high turnover — Many tiny businesses with high employee turnover find it hard to take whole advantage of a 401(k) plan. For companies using higher-than-average employee turnover, business owners and high-earners could be prohibited from maximizing contributions to a 401(k), while still paying the whole administrative costs.

- Business with employees and low profitability — Most small companies provide owners and employees with a decent living but don’t produce excessive profits for the large contributions potential using a SEP IRA or 401(k).

- Employers that wish to promote employee retirement savings — SIMPLE IRAs allow employees to save for retirement via salary deferrals than Traditional IRAs. Savings are further afield through compulsory matching from the employer.

- Firms that wish to contribute more than their workers without fitting — In choosing a SIMPLE IRA vs SEP IRA, employers can give rise to their own savings via a SIMPLE, without needing to create proportional contributions to each employee, much like a SEP..

“SIMPLE IRAs feature higher employee contribution limits than traditional or Roth IRA but lesser than SEPs or 401(k)s. While workers can withdraw contributions and earnings at any moment, the traditional tax penalty of 10 percent applies to those below the age of 59 1/2 and may be as high as 25 percent when the worker withdraws within two years of participating. Additionally, employees cannot accept loans out of their SIMPLE IRAs or SEPs in case of a financial emergency, unlike the penalty-free loans of a 401(k).” — Gerri Walsh, Senior Vice President for Investor Education, FINRA

Top SIMPLE IRA Providers

Most banks and mutual fund companies are structured to help small business owners employ and administer SIMPLE IRAs at relatively low prices. Normally, SIMPLE IRAs cost practically nothing to set up or maintain — less than $20 per player each year. However, each provider has a different menu of offerings, investments, and add-on services to gain business owners.

A number of the top SIMPLE IRA providers comprise:

Scottrade

Scottrade is generally called an online/discount brokerage service which also has a variety of branch offices across the company. However, Scottrade’s recent growth into diversified financial services has left them well-poised to supply SIMPLE IRA and other retirement plan services to companies across the nation.

While day-trading is not suggested for retirement account, Scottrade provides a great platform for investors that want to exchange listed securities within their SIMPLE IRA.

Charles Schwab

As one of the established financial services companies in the USA, Schwab provides an array of solutions and services to fulfill most needs. Along with brokerage and investment advisory services, Schwab also provides full banking, employer benefits and other options as required.

Small business owners who may need additional services separate from retirement planning may benefit from having an institution like Schwab, which can serve as a one-stop-shop.

Vanguard

Since the largest asset manager in the usa with assets, Vanguard has established itself as the company to beat in many categories such as retirement plan services. While generally retirement plan investments are limited to Vanguard’s funds, the company offers competitive fee arrangements that are tough to beat.

If you want to prepare a simple, straightforward, cheap SIMPLE IRA with a few diversified investment alternatives, you should definitely look at Vanguard.

Fidelity

Fidelity is just another well-established financial services company — the largest in the United States, in fact. In addition to its discount brokerage and investment advisory services, Fidelity also provides an array of retirement plan alternatives including SIMPLE IRAs.

Where business owners can really benefit from Fidelity over another provider is through the individual, in-person service available via their offices around the country.

TD Ameritrade

TD Ameritrade is also known chiefly as an internet trading platform but can also be a provider of employee benefits such as SIMPLE IRAs. It enables investors to trade in most listed securities and offers competitive incentive programs for companies to start sponsored retirement programs.

If you currently have a relationship with TD Ameritrade, adding a SIMPLE IRA may be a simple way to begin a retirement plan for your small business.

SIMPLE IRA Costs

Among the biggest advantages of a SIMPLE IRA relative to likely choices is that the incredibly low price. In SEP IRAs, employers are required to finance all employee contributions and 401(k) plans have high administrative expenses. SIMPLE IRAs, however, price between $10-$20 per employee and need only small employee matching programs of 1-3%.

The particular costs for a SIMPLE IRA include:

- Custodian Fee — Custodians generally charge $10 — $20 each year per employee to hold an IRA, which can be deducted from individual employee accounts.

- Employer Matching Contributions — SIMPLE IRAs require companies to match employee salary deferrals between 1%-3%.

- Payroll Provider (if applicable) — Employers that choose can elect to use a payroll provider like Gusto that can further streamline matching contributions and other items. However, this isn’t necessary to get a SIMPLE IRA and is purely discretionary.

SIMPLE IRA Contribution Limits 2018

SIMPLE IRA Contribution Limits for 2018 total $25,000. Contributions are divided into two categories, with employee salary deferrals limited to $12,500 and yet another $12,500 potentially coming from matching employer contributions. In the end, the total amount will be dependent on the employer’s matching formula. Remember that company owners are required to fit involving 1% — 3% of employee deferrals.

These contribution limits are much higher than some alternatives (Traditional IRAs) and lower than many others (SEPs and 401(k) plans). SIMPLE IRAs represent a fantastic middle ground in terms of contribution limitations while keeping annual administrative costs as low as possible.

“SIMPLE’s are greater if an employer (under 100 employees) wants to put away between $5,500-$25,000 for retirement but also wants to help their workers and does not want to have a lot of administrative issues doing it. The best part is there is no administrative testing of this plan that’s expensive but more important to small business owners, time-consuming.” — T. Eric Reich, CIMA, CFP, CLU, ChFC, President, Reich Asset Management

SIMPLE IRA Tax Deductibility

At a SIMPLE IRA, employee deferrals are excluded from their respective taxable incomes. At precisely the same time, matching company contributions are tax-deductible to the employer. Though distinct mechanically, this is essentially the same as SEP IRAs, 401(k) plans, and Traditional IRAs under current U.S. tax law.

“In addition to business gifts being tax-deductible, there is a tax credit of up to $500 available for companies that start a SIMPLE IRA plan for their business. The credit can cover costs to establish, administer the plan, and instruct employees, and can be claimed for 3 years.” — Matt Hylland, President, Hylland Capital Management

SIMPLE IRA Rules

To be able to qualify for a SIMPLE IRA, companies need to abide by certain rules determined by the IRS. Unlike many other retirement plans, SIMPLE IRAs aren’t”qualified” plans, and yearly nondiscrimination compliance testing isn’t required.

SIMPLE IRA rules include:

1. Follow Appropriate Installation Process

Any employee who earns over $5,000 during the calendar year gets eligible for a SIMPLE IRA. People who decide to participate can enroll, start low-income, and receive matching gifts. But, employers can pick on less strict eligibility requirements, if they are outlined in plan documents.

2. Implement a Compliant Matching Program

To utilize a SIMPLE IRA, a company should establish a deferral fitting program that meets IRS requirements. Employers need to fit between 1%-3% of employee salary deferrals. However, fitting can’t fall below 3% for over two decades of the previous 5. Alternatively, employers can choose to contribute 2 percent of an employee’s wages, irrespective of whether they decide to contribute themselves.

3. Enroll Eligible Employees

In order to qualify a SIMPLE IRA with the IRS, employers must immediately offer employees the chance to register once they become qualified. Newly-eligible employees must receive proper disclosures concerning the plan, together with information about the advantages of tax-deferred retirement savings, employer matching, etc..

4. Immediately Vest All Contributions

SIMPLE IRAs, like many retirement plans, require immediate vesting of all contributions for workers. It is not unusual for some employers to utilize vesting programs to deter workers from leaving early, but these vesting schedules aren’t available to be used in SIMPLE IRAs.

“SIMPLE IRA’s have a loony tax penalty if you decide to withdraw your capital within the first couple of decades of launching and under the age of 59.5. For most retirement programs, under these terms your withdraw could be assessed a 10% early withdrawal penalty. To Get A SIMPLE IRA, the penalty is a whopping 25%. Bottom line, if you are likely to utilize a SIMPLE IRA, do not take withdraws until you retireand in the event that you can’t wait that long, definitely wait at least 2 years.” — Ryan Miyamoto, CFP, Managing Director, Derive Wealth

SIMPLE IRA Deadlines

SIMPLE IRAs offer better flexibility than some choices, but not with respect to deadlines. New SIMPLE IRAs must be formed between January 1st and October 1st of the year they take effect, and prior-year contributions are prohibited. Failure to meet these deadlines can lead to unforeseen tax accountability or perhaps penalties for employers.

The SIMPLE IRA deadlines to understand include:

1. SIMPLE IRA Formation

A company can establish a SIMPLE IRA anytime between January 1 and October 1. If you’re setting a new SIMPLE IRA for a company formed after October 1st, a SIMPLE IRA has to be established as early as is practicable to your new company.

2. Employer Deposit Deadlines

SIMPLE IRA contributions are a blend of employee salary deferrals and matching employer contributions. For a SIMPLE IRA to comply with IRS regulations, matching employer contributions must be within 30 days of an employee salary deferral.

How to Set up a SIMPLE IRA in 4 Steps

In comparison to 401(k)s, SIMPLE IRAs are amazingly cheap and for companies to establish and administer. These measures will typically be completed by your administrator, however, are still very important to know. Unlike 401(k)s and other retirement plans, SIMPLE IRAs make payroll and plan management easy for employers to handle themselves.

To correctly establish a SIMPLE IRA, business owners need to follow certain steps which include:

1. Pick & Contact SIMPLE IRA Provider

When you are opening your account, the first step is to choose and contact the best provider for you. This is because it is important to find the necessary forms and materials to establish your plan, choose investment options, and get ready to enroll employees. Additionally, they will help you through the remaining part of the process.

2. Execute a Strategy Agreement

A plan arrangement for a SIMPLE IRA is similar to a plan document for a 401(k) plan. The plan agreement outlines plan rules and limitations, worker eligibility, the employer matching formula, etc.. This record will typically be ready as part of the new account process with a supplier.

3. Provide Annual Notice to Eligible Employees

IRS regulations require that workers eligible to get a SIMPLE IRA be offered with yearly notice that includes certain important details regarding the plan. A lot of this information is going to be based on the plan arrangement from Step 2, such as disclosures about employer matching contributions, contribution limitations, etc..

4. Installation and Maintain Employee Accounts

The last step of a SIMPLE IRA involves establishing individual accounts for each qualified employee and making matching employer contribution based on the formula set out in the plan agreement. New account applications have to be completed for each participating employee, and employer contributions must be created for each employee who elects to participate within 30 days of an employee salary deferral.

To get a more comprehensive breakdown of these steps, be sure to have a look at our ultimate guide on how best to Set Up a SIMPLE IRA.

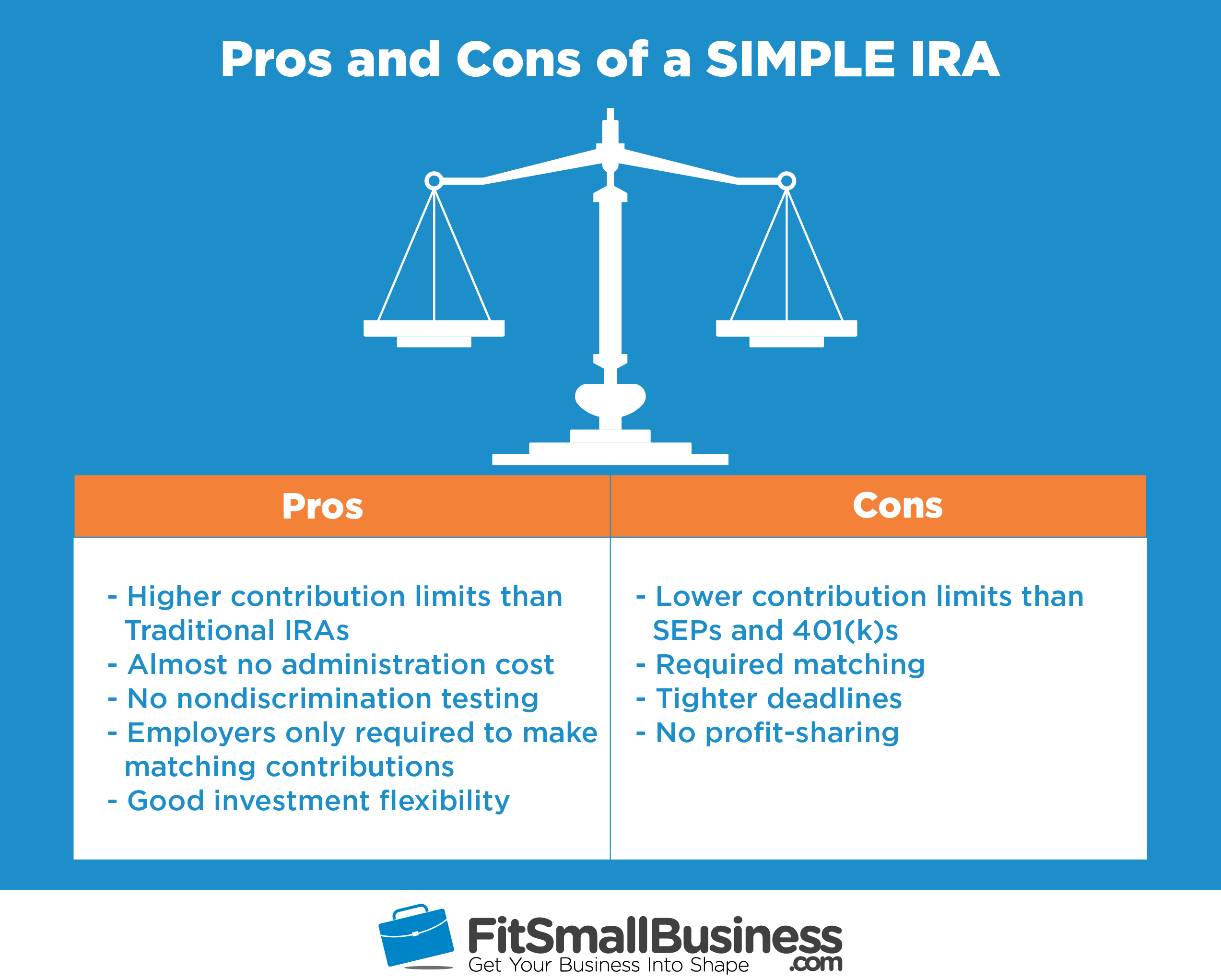

Pros and Cons of a SIMPLE IRA

In determining whether to utilize a SIMPLE IRA, you need to believe carefully about the advantages and disadvantages offered by these kinds of accounts. In some cases, the advantages will outweigh the drawbacks, while the majority of those who believe a SIMPLE IRA will finally find a better choice.

Pros of a SIMPLE IRA

There are many Benefits to SIMPLE IRAs, including:

- Higher contribution limits compared to Traditional IRAs — SIMPLE IRAs permit for $25,000 in annual donations in comparison to $5,500 for Traditional IRAs.

- Virtually no administration cost — 401(k) plans involve administration, recordkeeping, and auditing costs which make them far more costly than SIMPLE IRAs.

- No nondiscrimination testing — Unlike 401(k)s and some other qualified retirement plans, SIMPLE IRAs aren’t required to under annual testing.

- Employers just needed to make matching gifts — Employers who use SEP IRAs are required to make employee contributions proportional to their own, but under a SIMPLE, employees must decide to participate.

- Great investment versatility — SIMPLE IRAs have the same investment flexibility and mobility that’s found with different types of IRAs.

Cons of a SIMPLE IRA

Even though SIMPLEs have their advantages, they also have disadvantages which include:

- Lower participation limits compared to SEPs and 401(k)s — whilst participation limits for SIMPLE IRAs are greater than Traditional IRAs, they are still much lower compared to 55,000 limits for SEPs and 401(k)s.

- necessary fitting — Unlike 401(k) programs that give employers flexibility with fitting, SIMPLE IRAs are subject to rigorous matching guidelines determined by the IRS.

- Tighter deadlines — SIMPLE IRAs must be formed prior to October 1st of the year they become effective — much earlier than several other options. Also, unlike many kinds of retirement programs, prior-year contributions are illegal.

- No profit-sharing — While 401(k)s and SEP IRAs permit for profit-sharing with employees, SIMPLE IRAs only permit for employee deferrals and matching employer contributions.

Alternatives to a SIMPLE IRA

In mid-2017, there were over 630,000 SIMPLE IRA plans with more than 2.7 million participants. Even though SIMPLE IRAs can be a favorite option, that does not mean there are not choices that might be more suitable. To choose what’s best, consider contribution limitations, plan administration costs, and general flexibility of company contributions and investment selection.

Alternatives to SIMPLE IRAs include:

1. SIMPLE IRA vs. SEP IRA

SEP IRA contribution limits are twice as large as SIMPLE IRAs. However, there are not any salary deferrals and there’s absolutely no matching. Instead, business owners with employees are needed to fund contributions for every individual employee proportional to the contributions they make to their own account. SEPs are fantastic for smaller companies with few or no employees, while SIMPLEs are better if you have 5-8+ employees or need to avoid the administrative costs of a 401(k).

“A SEP IRA is a Simplified Employee Pension. In this type of plan, you will find only employer contributions, and the contributions have to be exactly the exact same for all employees. SEPs have generous contribution limits — up to $54,000 or 25% of total compensation (around $270,000). However, since the donation needs to be the exact same for all employees, unless it’s just you or you and your spouse, you are not likely to be able to take full advantage. Therefore, SEPs are a great option for solo practitioners or a few that works together, but not for a larger group.” — Lucy Shair, Financial Advisor, Action Point Financial

2. SIMPLE IRA vs. 401(k)

SIMPLE IRAs offer a tremendous benefit over 401(k)s by eliminating administrative costs and raising investment flexibility. On the other hand, the contribution limits for SIMPLE IRAs are also less than half of those of a 401(k), but that’s often fine for small or growing businesses who can’t maximize contributions to a 401(k) plan.

3. SIMPLE IRA vs. Traditional IRA

Traditional IRAs are good alternatives for some employers but have contribution limits of only $5,500 — much less than another kind of account. Traditional IRA contribution limits are one-fifth those of a SIMPLE IRA and only 10% of a SEP IRA or 401(k). However, Traditional IRAs are the ideal alternative for a number of people who can not contribute a good deal. They supply the great investment flexibility and have no administrative cost or company matching.

“In comparison to qualified plans, a SIMPLE IRA is comparatively easy and inexpensive to set up and administer, and there are no filing requirements for the employer. This strategy is appropriate as a start-up vehicle until your business can manage a qualified employer plan. Any company with less than 100 workers can adopt this program. If you decide to go with this option you aren’t permitted to have any other retirement program at the same time.” — Dmitriy Fomichenko, President, Sense Financial

Bottom Line

SIMPLE IRAs are nuanced plans that offer tremendous benefits for many small business owners. Employers need to consider alternatives, which might be more appropriate. Using a SIMPLE IRA, employers can contribute up to $25,000 pre-tax annually while continuing to grow their enterprise. To be eligible, they will need to implement a fitting program and follow IRS rules.