It’s no wonder that retailers big and small would like to supply a retail financing alternative to their clients. In-store financing gives shoppers instant buying power and is shown to drive greater sales volume and enhanced purchase values. But standard financing programs can be difficult for little and mid-size businesses to manage, and easier online methods like PayPal Credit won’t work for brick-and-mortar stores.

These are a couple of of the challenges which Greg Lisiewski set out to resolve when he founded Blispay in 2014. Available to some in-store or online seller that takes Visa, Blispay’s retail funding merchandise now boasts over 500 active merchants and just declared $12M in expansion funding. Certainly, Lisiewski seen a niche in desperate need of a solution and created an ideal fit.

Blispay founder and CEO, Greg Lisiewski

With Blispay touted as the next-gen response for sales-driving, secure SMB retail funding across all channels, we wanted to discover more. So who better to inquire about his motives for heritage Blispay, and where the $12M expansion financing will take them , compared to Lisiewski?

The following Q&A is based on my interview notes and not representative of the exact words.

Blispay lets small and midsize sellers provide retail funding to better compete with giants like Amazon, Home Depot, and Macy’s. How did you see this opportunity and know the Blispay answer was the response?

When I abandoned BillMeLater (now PayPal Credit), I knew that easy, no-risk retail funding helps online sellers of all sizes compete against the internet’s major players. Additionally, I understood that a massive part of the retail market was underserved, namely small to midsize brick-and-mortar retailers. Certainly, an internet payment solution such as BillMeLater was not right for them. But, most did not have the revenues or management structure needed to support traditional in-store financing solutions.

My aim was to create a simple, no-risk retail funding merchandise for these sellers, and in precisely the same time provide consumers access to funding anyplace they store. Our solution needed to work for in-store, online, and mobile sellers. Plus, it had to be wholly secure, low-cost, fast to set up, hands-off for employees, protected and, above all, attractive to shoppers. We developed a Visa-based deferred payment financing product to this exacting standards, and Blispay was first born.

Blispay’s Visa-based alternative lets any vendor that takes Visa offer financing to their clients. Shoppers apply in just minutes via their mobile phone or online, so our retailer is not responsible for managing any sensitive information. Once accepted, shoppers instantly get a Visa card number to use, and also our merchant completes the sale and gets paid just like any other Visa payment.

Because we offer special financing rates, shoppers tend to buy more once accepted. Most merchants actively boosting Blispay report increases in order values from 75 percent to as much as 200%. Additionally, shoppers may use their Blispay account everywhere Visa is approved, making it even more attractive to them.

* No obligations and No interest on all purchases over $199 if paid in full in 6 weeks. Read our in-depth article to learn more about supplying customer financing with Blispay.

Obviously Blispay is a huge improvement to the small business toolbox. Can you see consumer financing as the last significant sales barrier dividing SMB’s and large businesses? Or are additional big-business tools still out of reach for SMBs?

Technology narrows the gap between small and massive sellers each and every day, and retail funding is a fantastic example of that. Because of revenue minimums and technology restrictions, consumer credit was accessible only to larger companies, but even a day-old startup can offer their shoppers financing.

Other things have enhanced the small company arsenal, too. Fast funding via groups like Kabbage allows small companies to act quickly on chances like their larger counterparts. Information sourcing, insights, logistics, and calling also are somewhat more accessible to small sellers thanks to inexpensive online SaaS providers. But regardless of the best technologies, there’s 1 thing little store owners never appear to have enough of, and that’s time.

Larger companies have specialized personnel and whole departments to handle every detail, from surgeries to growth planning. Most small business owners need to run their store throughout the day and frequently are in a reactive, not proactive, manner. They simply have to concentrate on the actual business and make important decisions after hours. There is not a tool at the box to address the time dilemma yet, though adopting time-saving, revenue-driving technologies wherever possible is a fantastic first step.

Around 500 retailers now offer Blispay, and you intend to double that with your most recent round of financing. What sorts of new retailers are you hoping to bring in the Blispay household?

90% of trade still happens in-store, therefore we made a conscious choice to focus our growth on brick-and-mortar retailers when we rolled out Blispay. We’ll continue that strategy as we enlarge, but we aren’t in any way restricted to a single sales channel. Blispay is a true omnichannel solution that aligns well with each the sales channels our merchants use, in-store, online, and mobile.

Size-wise, we do not confine merchants based on revenue levels or average order values. However, merchants that have a high proportion of earnings over $200 often possess higher conversions because our $199 particular financing threshold contrasts nicely with their own buyers. The vast majority of our merchants fall between $1M and $2M in annual sales, and a few reach $100M in sales, but even a new store or online seller can offer Blispay from day one. It’s that user-friendly.

Presently, ecommerce shoppers employ for Blispay via their mobile phone or on Blispay’s website. Will new funding visit integrations that let shoppers employ inside a store’s checkout?

Conversions are a sacred thing in online sales, and average checkout logic states buyers ought never to be disrupted within the checkout stream. That said, immediate credit funding is on a very short list of things proven to not interrupt an active shopper’s buying pattern. This is due to the fact that the interruption actually expands a purchaser’s capacity to make the purchase. Studies show that shoppers welcome a financing opportunity that defers payments with no interest, even at the late stages of the checkout flow. Plus they often increase their purchase to meet a unique financing minimum buy.

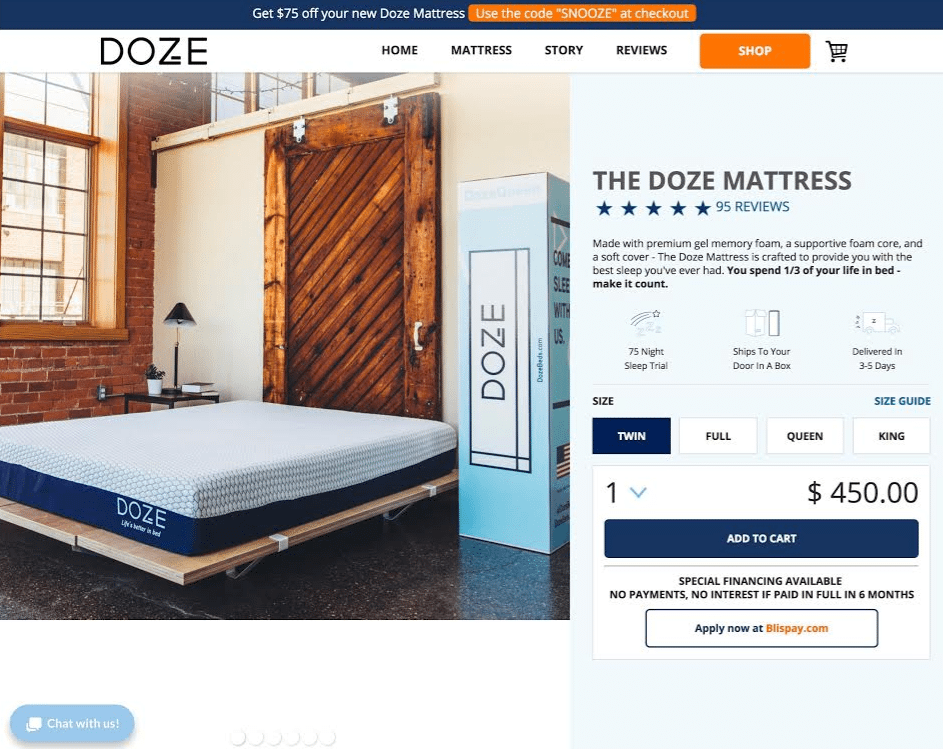

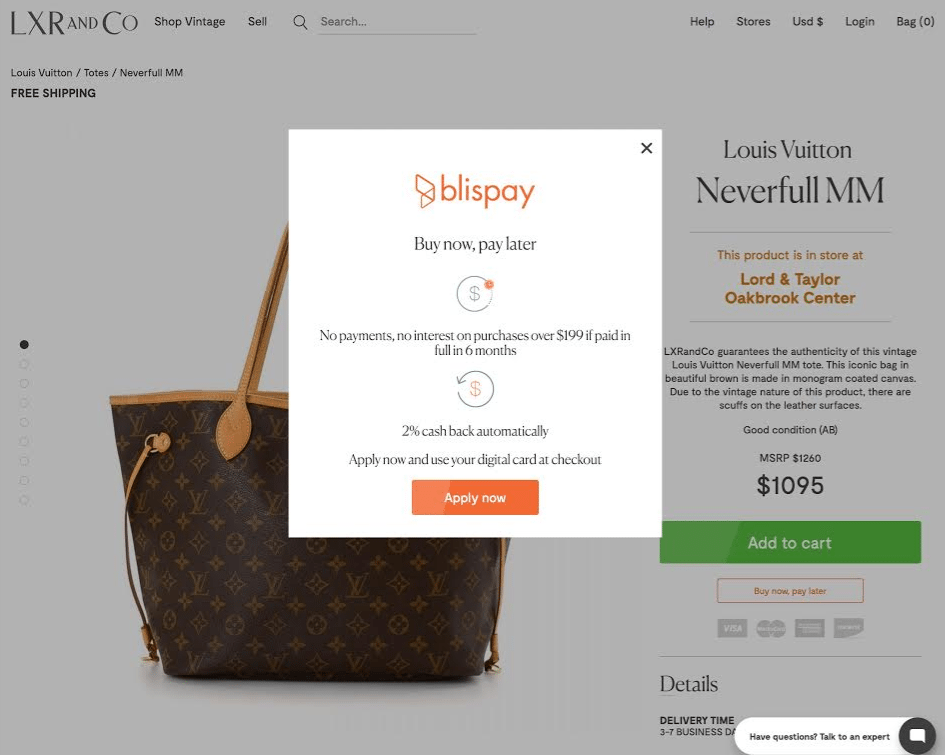

As shown below, our online retailers discover that site-wide consciousness drives engagement and is the best method to present Blispay financing to their shoppers.

Source: Dozebeds.com

Source: Lxrco.com

Online retailers who feature our special financing offers in their home, class, product, and checkout pages, and in advertising emails and social posts, see higher Blispay conversions compared to people who offer it only at checkout. They also see higher order values because customers begin browsing with our $199 unique financing deal in mind. Considering that the Blispay application takes just 2-3 minutes from entrance to acceptance, it is barely a hiccup from the shopping procedure.

While we don’t currently integrate with ecommerce platforms, adding data-sharing integration points within the checkout stream is something we’re looking to as part of our growth and continued improvement.

Blispay is exceptional in retail funding since customers can use it to finance purchases everywhere Visa is accepted. Are you going to earmark new funding for consumer-facing advertising?

Not at this time. While Blispay is a transparent and empowering merchandise with a solid value proposition for consumers with flexible funding nearly anywhere they store and 2% money back, we do not plan to market to customers directly in the not too distant future.

Our growth will continue our attempts to create both offering and getting retail funding easy for consumers and retailers. Our financing will be utilised to deliver our flexible, honest, transparent, and easy Visa-based retail financing alternative to more merchants of all sizes, across all stations, nationwide.

About Greg Lisiewski

Greg Lisiewski founded Blispay in 2014 and now directs the company as CEO. Before Blispay, Greg served as the head of Global Credit Products in PayPal, and before that was VP of Consumer Product and Marketing in Bill Me Later. He got his bachelor’s degree in Management Information Systems from Loyola University Maryland. He also holds an MBA in management from New York University — Leonard N. Stern School of Business.

Greg Lisiewski founded Blispay in 2014 and now directs the company as CEO. Before Blispay, Greg served as the head of Global Credit Products in PayPal, and before that was VP of Consumer Product and Marketing in Bill Me Later. He got his bachelor’s degree in Management Information Systems from Loyola University Maryland. He also holds an MBA in management from New York University — Leonard N. Stern School of Business.