Commercial real estate loan rates remain at near all time lows, which makes now a fantastic time for small business owners to buy or refinance commercial real estate. A variety of different lenders create commercial property loans. This report covers how commercial real estate loan rates operate and the interest rates which different kinds of lenders bill, which means that you may be a more educated borrower.

If you’ve been in business for 2years, plan on occupying at least 51 percent of the building, and possess a credit score above 680, you might be eligible for an SBA 7(a) loan using Northeast Bank. Northeast Bank is a nationwide SBA lender that offers rates as low as 5.5percent and loans up to $5MM.

Prequalify For a SBA Loan using Northeast Bank

Commercial Real Estate Loan Rates Summary — May, 2018

|

Type of Loan

|

Average rates

|

Average size of loan

|

Typical loan-to-value

|

Typical loan term

|

How simple to qualify?

|

|---|---|---|---|---|---|

|

SBA 7A Loan

|

7.0 into 9.50% (variable)

|

$350,000+

|

85-90percent

|

25 years

|

Moderate

|

|

SBA 504 Loan

|

4.88 into 5.15percent

(fixed rate on SBA percentage, fixed or changeable on bank percentage ) |

$1,000,000+ in most instances

|

85-90%

|

20 years

|

Hard

|

|

Traditional Bank Loan

|

5 to 7%

(fixed or variable) |

$250,000+

|

75-80%

|

5-10 years using balloon payment

|

Hard

|

|

Online Marketplace Loan

|

8 to 12 percent

(fixed or variable) |

$25,000+

|

Up to 80 percent

|

6 weeks – 5 years

|

Moderate

|

|

Hard Cash Loan

|

10 to 18 percent (fixed or variable)

|

$50,000+

|

50-55percent

|

6 weeks – 3 years

|

Moderate

|

*Insurance companies and conduit lenders make commercial real estate loans, but they mostly work on jobs which are worth more than $2 to $3 million. We only briefly mention them in this informative article as most small businesses are ineligible for these types of loans.

How Commercial Real Estate Loan Rates Work

Commercial property loans are collateralized by commercial property, therefore these loans typically have lower rates than other types of business loans. Generally, commercial property loan rates are influenced by four factors:

- The creditworthiness of the borrower and the company — The higher your credit rating and the credit rating of the company, the lower your rate will normally be. (Check your credit rating for free )

- The kind of commercial property loan that you get — We cover each type of creditor in much more detail in another section.

- The dimensions and duration of the loan — Larger, longer-term loans generally have higher prices. The exception is hard money lenders, which charge high prices for short-term financing because they work with lower credit borrowers.

- Prevailing market rates — Just like residential mortgage rates, commercial property loan rates fluctuate based on how the market is doing.

Most creditors provide both fixed rate and variable rate commercial property loans. For fixed rate loans, your rate of interest will not change during the term of this loan, along with your monthly payments are the same for the entire term. The massive majority of borrowers don’t qualify for a fixed rate loan.

With a variable rate loan, your interest rate and monthly payments increase or decrease during the term of this loan based on market rates. Usually, the rate resets every 1 to 5 years. Tthat he Prime speed is the most common indicator of market rates. The Prime speed is currently 4.50 now, and banks usually have speeds of Prime +1.50 to Prime +3.50 (that equals rates of 5.5% to 7.5 percent) on commercial real estate loans.

If you have been in business for 2+ years, plan on occupying at least 51 percent of the construction, and have a credit rating above 680, you might be eligible for an SBA 7(a) loan using Northeast Bank. Northeast Bank offers rates as low as 5.5percent and loans up to $5MM.

Prequalify For a SBA Loan with Northeast Bank

Just how Much Do Commercial Real Estate Loan Rates Change Over Time?

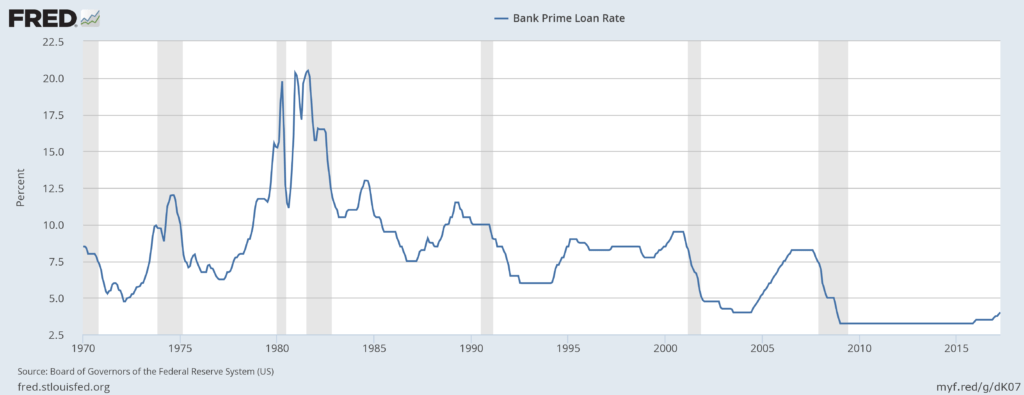

While there is generally not too much variation in commercial property loan rates from year to year, there may be substantial variation over the duration of a 10 or 20 year commercial property loan. Since lenders usually offset the interest rates they charge to the Prime rate, we could see how commercial loan rates have shifted over time by seeing how the Prime rate has shifted over time.

The chart below shows how the Prime rate has fluctuated over the previous 60 decades. As you may see, since 2008, the Prime rate has been at a historic low. Before that, but the Prime rate shifted a bit from year to year. If history is a good guide, that means that your rate of interest may change over the course of the upcoming several years.

The Type of Lender Has the Biggest Impact on Your Rate

A variety of lenders create commercial property loans. They each utilize a different pair of borrowers and kinds of properties, and they charge different prices.

SBA Loans for Commercial Real Estate

Maximum Rates: 504 loans4.88% to 5.15percent and 7A loans7.00 % to 9.50 % (see latest rates here)

With highest rates in the assortment of 4.88 percent to 9.50 %, SBA loans are often the least expensive way to fund buying commercial real estate. The Small Business Administration (SBA) guarantees repayment of a part of the loan, which reduces the possibility of creating the loan for the lender and raises the favorability of the terms for the debtor. We recommend using Northeast Bank for an SBA loan.

In general, it’s easier to get an SBA 7a loan for commercial property. The 7a loan program is the SBA’s most popular loan program, and it is faster and easier to obtain a 7a loan, particularly for smaller loan sizes. That having been said, 7a loans have slightly higher prices than 504 loans. Prices start at a changeable 6.75 % and are tied to the Prime Rate.

SBA 504 loans are a better choice for loan dimensions around $1,000,000. These loans come in 3 parts: 50% of the loan is from a bank, 40% is by an SBA-approved Certified Development Company, and 10% is the borrower’s deposit. The prices on the CDC portion of the loan are in the 3-4% range and therefore are fixed rate. The prices on the bank portion are in the 5-6% range and might be variable or fixed. Our advocated SBA 504 lender it Liberty SBF. If you have been in business 4years, are profitable, and looking to borrow $1,000,000+, then set up a time to speak to some Liberty SBF loan officer today.

If you have been in business for 2years, plan on occupying at least 51% of this building, and possess a credit score above 680, you may qualify for an SBA 7(a) loan with Northeast Bank. Northeast Bank offers rates as low as 5.5percent and loans up to $5MM.

Prequalify For an SBA Loan with Northeast Bank

Traditional Bank Loans

Average Charges : Approx. 5 to 7 percent

Based on C-Loans, over 70 percent of commercial real estate loans are made by banks. Banks generally work with borrowers who have strong credit unions and mid-sized projects (over $250,000), and they offer competitive prices.

Rates on traditional bank loans range from 5 to 7 percent, just slightly higher than prices within an SBA 504 loan. Most borrowers are approved for variable rate loans, where the rate resets every 1 to 5 years.

Just as with a 504 loan, you need to get a good credit score (over 660) to qualify. The property doesn’t have to be owner occupied, but which makes this a fantastic alternative for a larger selection of commercial properties. Most banks will need a deposit of 20% and will give loans 5-10 year conditions. This makes the upfront out-of-pocket expenditure and also the monthly payments greater than they would be on an SBA 504 loan.

Banks also regularly charge a prepayment penalty if you pay off the loan . Usually, the penalty is 2-3 % of their outstanding loan balance, but sometimes, prepayment penalties are on a sliding scale, decreasing as loan maturity nears. SBA 504 loans also have a prepayment penalty, but only for the first 10 years.

If you’ve been in business for 2+ years, plan on occupying at least 51 percent of this construction, and possess a credit score above 680, you might be entitled to a commercial property loan with Northeast Bank. Northeast Bank offers competitive rates & provisions on loans up to $5,000,000.

Prequalify For an SBA Loan using Northeast Bank

Hard Money Loans

Average Rates: Approx. 10 to 18 percent

About 20% of commercial real estate loans are hard cash loans. A hard money loan is a non-bank loan funded by private investors or a private company. Of the available types of commercial property loans, hard money loans have the greatest rates, which range from approximately 10 to 18 percent.

The reason they’re so pricey, says Nick Marra, Senior Vice President in Webster Bank, is since hard money lenders lend primarily based on the home, not on the borrower’s creditworthiness. “Because they are not verifying income and lending strictly depending on the asset,” he clarifies,”the interest is a lot greater than traditional loans.” In addition, he states that upfront fees can considerably boost the expense of hard cash loans.

Hard money loans are extremely short-term loans. The average term is 6 months to 2 years. Many hard money loans are known as”bridge loans” because they provide you rapid interim money that you then refinance into a longer term bank or SBA loan. Do not expect hard money lenders to cover the complete price of your project either, says Marra. Their limitation on loan-to-value is usually approximately 55%.

Speak with our advocated hard money lender, South End Capital, for quick approval and financing as fast as 2 weeks.

Visit South End Capital

Online Marketplace Loans

Average Rates: Approx. 8 to 12 percent

A newer supply of funding for buying commercial property are online marketplaces which meet borrowers who want to buy real estate and investors that are willing to fund them to get a return. These lenders are sometimes known as”soft money lenders” since they charge longer than banks less than hard money lenders. Their prices are typically between 8 to 12 percent.

Examples include RealtyShares, RealtyMogul and Blackhawk. These companies facilitate short-term loans of 6 weeks to 5 years.

Additional Lenders

A small percentage of commercial real estate loans are made by life insurance companies and conduit lenders. These lenders charge very low prices, but the typical small business operator will not qualify. They have quite selective approval standards and usually only finance multi-million dollar jobs, such as hotels, shopping malls, and high-rise complexes.

How Commercial Real Estate Loans Are Structured

There are three main ways in which Commercial Real Estate Loans can be ordered:

- Fully amortizing loans

- Interest rate resets

- Balloon loans

Fully Amortizing Loans

Whenever you’ve got a fully amortizing loan, you pay back the entire principal and interest on the loan during the term of this loan. A fantastic case in point is that the SBA 504 loan, which is a fully amortizing 20 year mortgage. During that time, you make monthly payments of interest and principal. By the end, the loan is completely paid off.

Balloon Loans

Most commercial real estate loans issued by banks are balloon loans, with the exclusion of SBA loans, which are not permitted to get balloon payments. Having a balloon loan, the amortization period is more than the duration of the loan, leaving you with a large balance to pay off at the close of the term. At the point, the small business owner pays the remaining balance in full, or more commonly, refinances the loan so he or she is able to continue to make monthly payments.

Example: Suppose your lender gives you a $500,000 commercial real estate loan with a 5% interest rate and a 10-year term that’s amortized over 30 decades. Your monthly payments for 10 years will be roughly $3,300. In the conclusion of the tenth year, you’d owe a $314,407 balloon payment. Most individuals can’t afford to pay such a large amount of money all at once, so they would likely refinance this using a new loan. Use this Balloon Loan Calculator to learn more.

Interest Rate Resets

Variable-rate commercial property loans typically have an interest rate reset. The borrower is billed a fixed interest rate for a first period, generally 1 to five decades. At that point, the interest rate varies based on a market rate such as the Prime rate. The debtor pays this new rate of interest either until the loan reaches maturity or before the next reset date. Utilize our Commercial Real Estate Loan Calculator to estimate payments on a loan which has a reset speed. Despite the speed resets,

Even with the rate resets, buying commercial real estate can lead to significant savings when compared to leasing commercial property. In can be a excellent way to grow a business’s assets and there are certain tax benefits as well. Read our guide for a complete analysis of purchasing vs leasing commercial real estate.

Bottom Line

As your company grows you may have to obtain commercial real estate or refinance an present commercial property loan. Commercial real estate loan rates vary widely based on which kind of lender you operate with. Most commercial loans these days are made by banks or hard money lenders, which provides choices for those with fantastic credit and those that have credit. Whichever financing option you choose, make certain you know exactly how much you’ll need to pay and if.

If you have been in business for 2years, plan on occupying at least 51 percent of this building, and possess a credit rating above 680, you might be eligible for an SBA 7(a) loan using Northeast Bank. Northeast Bank is a national SBA lender that provides rates as low as 5.5percent and loans up to $5MM.

Prequalify For an SBA Loan with Northeast Bank