A new hire checklist helps to make sure you don’t miss any important steps when you add new employees to your group. If you are adding an employee to your company for the very first time, you may be unsure of what is required. To assist you, we’ve supplied a free downloadable checklist that includes these significant hiring jobs which you may check off as you finish them.

Should you use payroll software, the majority of the measures below can be done and filed online. Our recommended software provider is Gusto. Gusto can help you install workers compensation and payroll taxes, while keeping all of your employee data in a secure location.

Try out Gusto Free For 30 Days

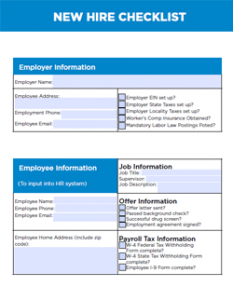

New Hire Checklist Template

Employing the 10 checklist measures we’ll describe below, we have created this easy template you can download and customize. Use it to make certain you’re ready for your first worker. If you are hiring a 1099 contractor rather than a W2 employee, then read our article on using an employment contract to employ a builder instead.

Employing the 10 checklist measures we’ll describe below, we have created this easy template you can download and customize. Use it to make certain you’re ready for your first worker. If you are hiring a 1099 contractor rather than a W2 employee, then read our article on using an employment contract to employ a builder instead.

- Download the New Hire Checklist Template as a DOC or PDF

Once you’ve set up your employer identification number (EIN), taxes, and workers compensation’ (steps one through five under ), you can alter the template above by omitting most of what is in the first section since you’ll already have completed those first few measures.

The remaining part of the template may be used for every additional new employ to make sure that you don’t miss a critical hiring step.

The 10-step New Hire Checklist

There are five essential things you need to do before you hire your first employee, from getting an EIN to setting up taxes and insurance. Then, there are another five jobs such as obtaining I-9 forms and other files which you need to complete with your very first and subsequent new hires.

In case you have already begun that new worker, you really need to get these done before your first payroll. We’ve documented these 10 tasks into a step-by-step checklist template which you can download and customize.

For Your New Hire

Step 1: Obtain an Employer Identification Number

| EINs are used by the IRS for tax administration. Before you hire your first employee, you’ll need to apply for an EIN on the IRS site. | Due: Before you hire your first employee |

Step 2: Register for State Taxes

| when you have not already, ensure that your company is registered for local and state taxes. Your state will probably provide you with an ID or amount that you will need later when filing payroll taxes. | Due: Before your first hire (in many countries ) |

Step 3: Obtain Workers’ Comp Insurance

| Most states require businesses with one or more employees (besides owners) to buy workers’ compensation insurance. This can typically be bought through the country or through a private carrier. To locate your state’s policy and service, check out the National Federation of Independent Businesses (NFIB). Payroll software or even a PEO can help you set up your workers’ comp. | Because: Before your initial hire (in many countries ) |

Measure 4: Post Required Notices and Posters

| based on the state you’re located in and your business, you’ll probably be required to post labor law notices around the office. These are known as labor law posters and contain matters like at-will employment, minimum wage rates and anti-discrimination legislation. Most federal and state agencies will provide these posters for free (or at least give you PDFs to print out). The United States Department of Labor has an interactive questionnaire that will help you figure out which national poster you need. You’ll also need to consult your state office for additional required notices. | Due: On or before your employee’s first day |

Step 5: Determine State Unemployment Tax Rate

| Your state unemployment insurance (SUI) tax rate often changes from year to year, based upon salaries or wages. You ought to be given your SUI tax rate every year in the email, or log into your country tax registration website to locate it. New companies will utilize a default rate. | Due: Before your initial payroll |

for Most Following New Hires

Step 6: Conduct Any Pre-screening or Background Checks (Optional)

| While not mandatory, it’s a Fantastic practice to ensure the worker you’re hiring has been truthful during the interview and application process. Therefore, consider running post-offer, pre-hire background tests or drug screening (if legal in your state), so there are no surprises. | Due: Post-offer and pre-employment |

Step 7: Acquire Signed Federal W-4 Form

| Have your employee fill out and sign a Federal W-4 type on or before his or her first day of work. The W-4 is where an employee specifies their tax withholding preferences. You may find the form here on the IRS website. You do not need to submit this to the IRS but if maintain a copy on file. | Due: On worker’s first day |

Step 8: Obtain Signed State W-4 Type (If Required in Your Nation )

| This is applicable only to states that collect income tax (such as California, New York and Illinois). You’ll locate your state’s W-4 form or equivalent on the Bureau of Labor Statistics website. | Due: On employee’s first day |

Step 9: Have Employee Total Form I-9

| The Form I-9 verifies an employee’s eligibility to work in the U.S.. You do not need to submit an application to the authorities, although you do have to keep it on file for 3 years following the date of employ (or one year following an employee’s termination, whichever is later). | Because: Within three days of hiring |

Step 10: Register with New Hire Reporting Program

| All companies need to report their new employees into their state’s New Hire reporting program. The objective of this registry is to help the government enforce child support obligations, among other functions. Each state has its own center, which you may find on the U.S. Small Business Administration’s (SBA) web site. | Due: Within 20 days of hiring |

A Final Step: Document Storage

As a last step in our new hire checklist, you’ll also want to designate a secure place to store files. In particular, I-9s and W-4s will need to be kept on-hand. We warning against storing paper files in an unsecure location for confidentiality purposes, therefore we advocate using a secure electronic provider like Gusto to home all of your employee files.

Additional New Employee HR Resources

Since your business is Beginning to grow, you Might Want to consider looking at a few other employee-oriented tools in our HR segment, including:

- New Hire Employee Forms

- Offer Letter Template

- Non-disclosure Deal

- Non-compete Agreements

- Employee Handbook Sample

- Employment Agreement Template

- Greatest HR Software Comparison Guide

- Outsourcing HR

- Greatest Payroll Software Comparison Guide

- Federal Labor Laws Every Small Business Should Know

The Most Important Thing

The 10 steps of the new hire checklist with the template above might feel overwhelming to the small business owner who is just starting to hire staff. But, go through these steps in sequence to make sure you don’t violate any state or federal labour laws. When the employee is hired, you can move forward with onboarding and training your new employee.

Alternatively, look at working with Gusto to simplify hiring, onboarding, payroll and benefits and also to make sure new hires and all that paperwork is handled correctly. You’ll be supporting your new employees with a great hiring experience from the procedure.

Try out Gusto