A SEP IRA is an employer-sponsored retirement plan allowing business owners with 0 — 5 employees defer considerable amounts of income. A SEP lets companies and also the self-employed contribute $55,000 or 25 percent of their taxable income each year — $49,500 more than Traditional IRAs. To use SEPs, companies need to make proportional donations to all fulltime employees.

How a SEP IRA Works

Individual Retirement Accounts (IRAs) are retirement accounts utilized by self-employed persons and companies with few employees in lieu of 401(k)s. The cause of this is because 401(k)s, although beneficial, have greater prices and require more management than a traditional IRA, which makes them only suitable for businesses with a bigger number of employees.

But, traditional IRAs are restricted in the amount that can contribute. At present, you may just defer $5,500 per year in taxable income. This is much smaller than the total yearly contributions of a 401(k), which can reach as high as $55,000 ($61,000 with catch up contributions) if deferrals, matching, and profit sharing are maximized.

To circumvent this problem, SEP IRAs were created. These retirement accounts allow small business owners contribute up to $55,000 per year, just like a traditional 401(k) but in far lower price, which makes it a ideal retirement option for solopreneurs or small companies in which a 401(k) does not make sense. However, in order to be eligible, you have to contribute a percentage percent of salary to all full-time employee accounts.

This highlights a couple of issues with SEP IRAs. While there are no minimum or maximum number of workers required, the mandatory contributions make SEPs unfeasible for businesses with more than 5-8 workers. This is due to the fact that the cost of financing employee gifts at this level becomes more costly than the combined price tag of 401(k) management and some other 401(k) employer matching (that is not required).

Further, only employers can establish or contribute to a SEP, such as employee contributions. Unless someone owns their own business — regardless of how little — they can not use a SEP IRA.

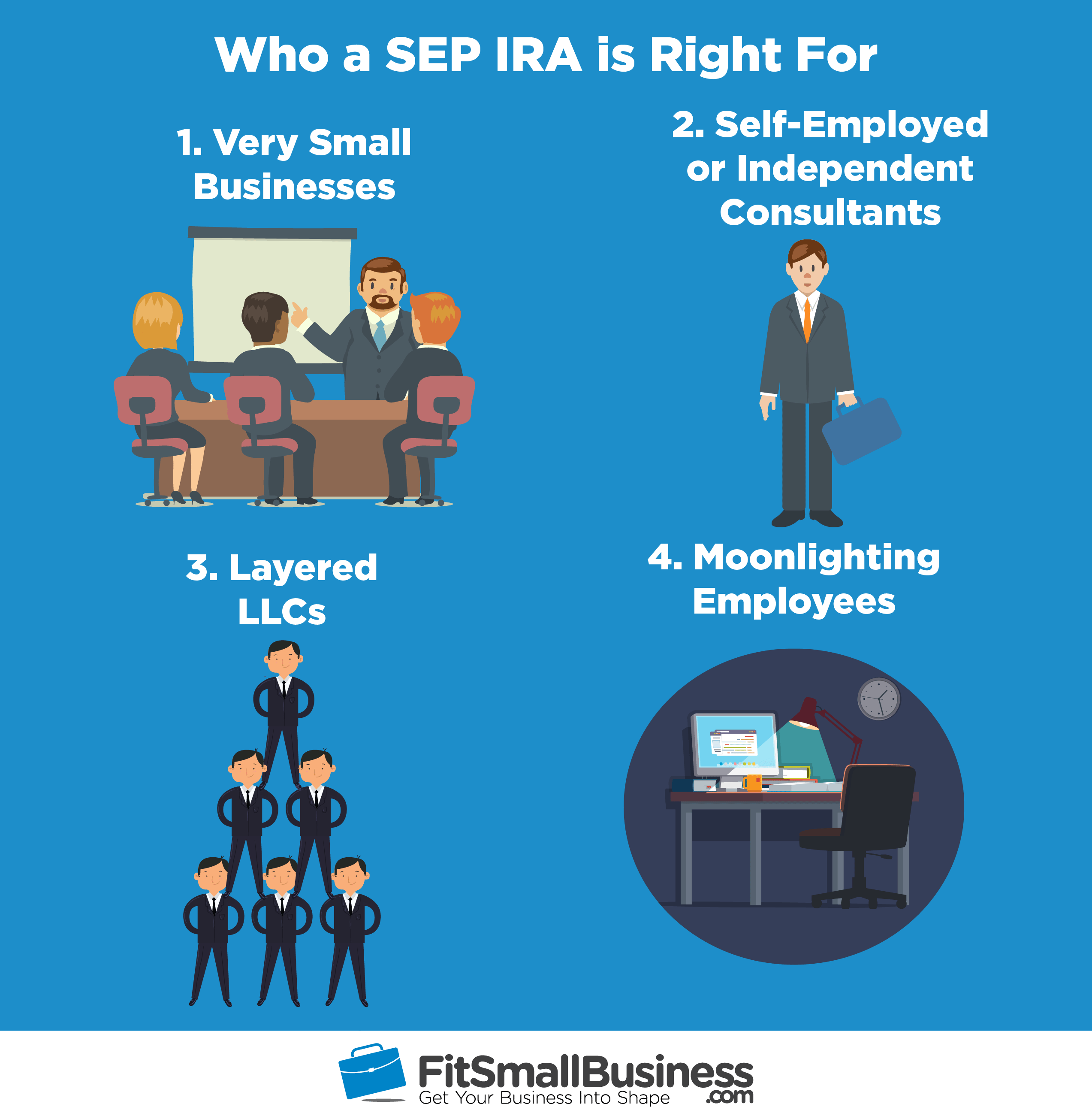

Who’s SEP IRA is Right For

SEP IRAs can be very advantageous in certain scenarios, but they are not right for everybody. Traditionally, these reports have been used by self-employed individuals or owners of businesses with hardly any workers. However, SEP IRAs can be very beneficial sometimes, though sometimes for different reasons and not always as intended from the IRS.

Listed below are a Couple of instances where a SEP IRA can be especially appropriate:

1. Self-Employed or Independent Consultants

The ideal candidate for a SEP is a high-earning business owner hoping to shield large amounts from income tax with no administrative expenses of a 401(k). They do not have workers for whom they will need to make sizeable donations or might themselves become a 1099 contractor, ineligible to their company’s 401(k).

Using a SEP, a self-employed small business owner can contribute a lot more than could be possible in a Traditional IRA, while avoiding the unnecessary expense of administering a 401(k) for just themselves.

2. Moonlighting Employees

Some people work for another company while building a business in their spare time. Since non-discrimination testing makes it nearly impossible for people to maximize 401(k) contributions every year, these entrepreneurs might not be able to contribute as much as they would like for their business 401(k). They can make their remaining contributions to a SEP IRA account by using their own company, saving more for retirement and decreasing their near-term tax burden.

3. Very Tiny Firms

These companies typically have 5 employees or fewer. They have powerful profits which are not always consistent. Contributions to SEP IRAs are optional — so they may be reduced or skipped in poor years — and tax-deductible to get a company owner. Business owners are able to utilize a SEP to benefit workers with profit-sharing contributions that aren’t taxed until withdrawn.

The reason for this is that since you need to make compulsory contributions to full-time employees, any company more than 5 employees might locate a SEP IRA uneconomical. Rather, they might be at the size in which a fully-administered 401(k) plan is a better option for their workers.

4. Layered LLCs

It’s common in some industries to use several LLCs with various functions. In real estate, there may be separate LLCs to hold and manage land or handle accounting. Some LLCs may have workers, while others have only one or two members and no employees. Owners are able to use these closely-held LLCs to shield income in SEP IRAs without funding contributions for employees of other, potentially-related companies.

“The SEP IRA is a simple, low-cost way for a small business owner to provide some type of retirement plan to employees. Contributions made to a SEP are employer-only — no employee contributions. Any employer contributions are tax-deductible to the company.”

— Carol Berger, CFP, President, Berger Wealth Management

Top SEP IRA Providers

SEP IRA providers include most banks and mutual fund companies, and many other specialists. Picking the proper partner is imperative for a plan that meets an owner’s needs. The ideal provider can help to find a balance between flexibility and cost, coordinate plan setup and management. They could upgrade workers, ease donations, and aid with taxation reporting.

Some of the Greatest SEP IRA providers include:

Vanguard

Vanguard is known as the largest mutual fund company in the world, with more than $4.5 trillion in assets under management. Though investments are limited to mutual funds, SEP IRAs are very easy to set and cost practically nothing to set up or administer.

TD Ameritrade

As an online trading system, TD provides account holders a higher amount of investment flexibility. Investors may invest cheaply in any listed stock or bond, in addition to ETFs and other tools. Installation and administration continue to be easy and very low cost.

The Entrust Group

Entrust is an excellent solution for those who want to own alternative assets in a SEP IRA. However, providers like Entrust are far pricier than suppliers who don’t offer you alternative investments. While Entrust doesn’t have any setup costs, annual administrative charges range from $200-$2,000 and exclude a plethora of trade fees and other costs.

Ally Invest

As associations move, Ally is a more conventional bank, so it has investment choices tend to be more limited for SEP IRAs. It is inclined to push account-holders toward CDs and other low-risk, low-return goods. However, Ally does possess a broker option for those seeking to spend their SEPs in stocks, bonds, and even ETFs with comparatively low trading costs.

Charles Schwab

Schwab is essentially a one-stop store for financial services. They provide brokerage and investment advisory services, management for 401(k) programs, and an array of other solutions. In addition to providing custodian services to IRAs, Schwab can counsel on investment plan and assist customers trade securities, if they select.

SEP IRA Costs

Unlike a 401(k), implementing and administering a SEP IRA costs almost nothing. Besides employee contributions, the principal SEP expense is a custodian fee that’s typically $25-$50 paid out of worker accounts. Some custodians specializing in other investments also have yearly government charges at $200 or more, also paid from worker accounts.

The specific costs for a SEP IRA contain:

- Custodian Fee — Each year, SEP IRA account holders incur fees in the financial institution holding their accounts in their behalf. These fees start around $25-$50 and can range to $2,000 for specialization custodians focused on niche investments.

- Employer Contributions — Unlike 401(k) plans and other IRAs, a SEP requires that employers fund all contributions for their own accounts as well as all employees. Contributions are tax-deductible and optional for the company operator, but by law must be directly proportional based on each employee’s yearly compensation.

SEP IRA Contribution Limits 2018

SEP IRAs Contribution Limits for 2018 would be the lower of $55,000 or 25% of taxable income. Though limits are equivalent for employers and employees, employers make all contributions, which should be directly proportional for all workers. Contributions can be changeable from one month to the next but must be faulty immediately.

If a business owner works for a company where they’re eligible for a 401(k), they could be able to set a SEP by using their own company while still participating in their 401(k) in the workplace. If their 401(k) contributions are less than $55,000they can lead the difference to their SEP, given their overall contributions don’t exceed 25 percent of their taxable income.

If a SEP IRA is specifically structured to allow for non-SEP donations by employees, plan participants over age 50 can also elect to create around $6,000 catch-up donations through salary deferrals. These are the sole employee deferrals allowed by workers participating in a SEP IRA.

The Way SIMPLE IRAs Setup: Contribution Limit Comparison

| Form of Plan | Worker Contribution Limit | Total Contribution Limit (w/o Catch Up Contributions) |

|---|---|---|

| Traditional IRA | $5,500 | $6,500 |

| SEP IRA or solo 401(k) | $55,000* | $55,000* |

| 401(k) | $18,500 | $55,000 |

*Contributions must be from employers, rather than through employee deferrals.

“SEPs, by design, are simplified so that the challenges administratively are minimal — the only challenge was on funding execution. The other challenge that I have seen is what I predict Money Market/saving exhaustion – financing a SEP at $54,000 in 1 lump sum includes a constraining impact on cash flow. Implementation of funding is often better on a monthly basis”

— Chad Wing, CLU, ChFC, CFP, Wealth Management Advisor, Wynge Financial

SEP IRA Rules

The IRS sets strict rules for SEP IRAs. While SEPs are more flexible than many programs, they are still employer-sponsored retirement programs governed by the IRS and the Department of Labor. Failure to follow these rules can result in a plan’s disqualification, along with penalties or other tax obligation for a business owner.

Rules that companies need to follow in setting up a SEP IRA include:

1. Automatic Enrollment for Eligible Employees

As soon as a worker becomes eligible for a SEP, then they have to be automatically enrolled unless they decide to revoke their account. However, there may be a waiting period before an employee becomes eligible for the program if it’s stipulated in program documents.

2. Just Employer Contributions

Employers can’t allow employees to make salary deferrals into a SEP IRA. Rather, the employer must make all donations into their own and employee accounts.

3. Proportional Contributions

All donations to employee accounts must be drawn up at the exact same period and directly proportional to worker compensation. When an employer makes a contribution for their account equalling 10% of the own salary, each worker must also get contributions equaling 10% of their pay.

4. Immediate Vesting

When employers make contributions to worker SEP accounts, these donations must be vested immediately. This stands in contrast to 401(k) programs and some other SEP options, which sometimes allow employers to structure vesting schedules for their contributions. Because donations are immediately vested, workers aren’t penalized for leaving a company early.

SEP IRA Deadlines

In addition to other rules and regulations, the IRS has set strict deadlines for setting up and contributing to a SEP IRA that must be followed closely. Most deadlines are based on the employer’s tax-filing deadline (including any extensions). Failing to adhere to those deadlines can result in unforeseen tax liability and penalties.

The 3 SEP IRA deadlines to know include:

1. SEP IRA Formation

A company can set up a SEP IRA and account for both themselves and their workers anytime before their very own tax-filing deadline. Even though SEP IRAs can be shaped after the taxation year for which they will succeed, this generally is not suggested.

2. Employee Disclosure

As soon as a worker becomes eligible for a SEP IRA, they need to be provided with appropriate disclosures about the plan. These disclosures include advice on SEP IRAs, employer contributions, and tax treatment. When a plan is initially created, there may be some employees who will become eligible immediately and must receive disclosures the moment the plan is established.

3. SEP IRA Contribution Deadline

Employers are allowed to make donations anytime prior to their tax-filing deadline, including any extensions. Contributions can be — and often are made for the previous calendar year. Since contributions are tax-free for employees and tax-deductible to companies, they don’t have any impact on employee income taxes.

How to Set up a SEP IRA in 6 Measures

A SEP is really easy and economical for employers to install and administer. In 2013, over 9 million American households — 7.5percent — possessed Employer-Sponsored IRAs such as SEPs. While everybody uses a supplier to help in the process, it helps to get an understanding of the steps involved, once a supplier has been selected.

The steps for setting up a SEP comprise:

1. Identify a Trustee or Provider

A SEP IRA can be held by almost any bank or mutual fund company. For those who want to have more flexibility with investment choices, there are a number of internet suppliers who focus on alternative assets including property or stone.

2. Publish and Adopt Plan Document

Most suppliers have their own paperwork for preparing a SEP, including several types required by the IRS. These forms are generally part-and-parcel with a new account application, and require very little time to complete.

3. Give Appropriate Disclosures to Eligible Employees

Once an employer has set up a SEP, they must give notice to qualified employees. These disclosures explain information on SEPs, details on the new strategy, and worker rights and responsibilities — such as an employee’s right to reverse their account if they select.

4. Open Accounts to Hold Deposits for Eligible Employees

Accounts for newly-eligible workers have to be opened for the same tax year they become eligible for a SEP IRA through their own employer. Accounts can be created up until the donation deadline, which is the employer’s tax-filing deadline (including any extensions).

5. Make Discretionary Contributions

Employers may make contributions at any time throughout the calendar year, but it is ideal to wait until the deadline nears so an employer is aware of the taxable earnings and can determine their particular contribution limit for the year. Employers then make one or a set of deposits before their tax-filing deadline.

6. SEP IRA Administration

After a SEP IRA is established, it has to be handled in accordance with plan documents and prerequisites from the IRS. This includes making contributions on time, making sure that account statements and disclosures are offered to employees, ensuring that gifts are the exact same proportion of every worker’s compensation (including their own) and therefore are vested immediately.

Pros & Cons of a SEP IRA

For solopreneurs and lots of small business owners, SEP IRAs can pose tremendous advantages. However, these programs are not without their drawbacks. In most conditions, a SEP IRA represents the best possible option, but if you believe that a SEP may be perfect for your business, make sure to consider the good with the bad.

The pros and cons of SEP IRAs include:

Experts of a SEP IRA

- High Expense Limits — SEP IRA contribution limits are $55,000 or 25 percent of taxable income, whichever is less. This is far greater than Traditional IRAs and much more in line with SIMPLE IRAs and 401(k) programs, but a lot easier to maximize.

- Low Administrative Costs — hardly any time or money is required to set up or administer a SEP IRA. There aren’t any substantial fees except those required by custodians.

- Discretionary Contributions — If a company has a bad year, an employer is not required to make SEP IRA gifts for themselves or their employees. This manner, a SEP IRA is almost just like a profit-sharing component of a 401(k).

- Investment Flexibility — Most retirement accounts with similar contribution limits have very limited investment options. Unless an employer pays big commissions, most are limited to just a handful of mutual funds. SEP IRAs, on the other hand, can easily invest in just about any stock, bond, or mutual fund, in addition to alternative assets if employers work with certain providers.

- Numerous Applications — SEPs can be used in many different ways to shelter large amounts of income from taxes. SEPs can be readily implemented by freelancers, self-employed people, small business owners with few employees, or part-time entrepreneurs in conjunction with a business 401(k).

Cons of a SEP IRA

- Expensive Contributions for Many Workers — SEP IRAs are usually uneconomical for businesses which have more than a few of full-time employees. This is because employer contributions must be proportional for all eligible full-time workers. Luckily, all contributions are tax-deductible to the employer, so there’s a tax advantage to offset the expense of contributions to employee accounts.

- Immediate Vesting — Unlike 401(k) programs and some other alternatives, SEP IRA contributions must be immediately vested for all employees. While companies often use vesting programs to discourage workers from departing early, this”golden handcuff” can not be used by employers who choose a SEP.. This can potentially lead to greater employee turnover.

Alternatives into a SEP IRA

A SEP IRA is not right for everybody. Many small business owners, particularly those with few employees, enjoy a SEP’s flexibility. Contribution limits that are much higher than a Traditional IRA with no 401(k)’s price could be attractive. On the other hand, the cost of funding employee contributions or other aspects can make some alternatives advantageous in certain conditions.

Alternatives to SEPs include:

1. SEP IRA vs Traditional IRA

SEP IRA contribution limits are much higher (10x) than Traditional IRAs. SEPs have to be established by a company proprietor, where Traditional IRAs can be used by anyone not eligible for an employer-sponsored retirement program. Traditional IRAs are great for people contributing $5,500 or less annually, providing equivalent investment flexibility and low administrative costs since SEPs.

2. SEP IRA vs SIMPLE IRA

SEP IRAs and SIMPLE IRAs have identical contribution limitations but quite different constructions. Even though SEPs only allow employer contributions, SIMPLE IRA contributions are mostly voluntary employee salary deferrals. Employers match those contributions based on predetermined formulas. SIMPLEs are good for employers who can’t fund all employee contributions or want to match employee deferrals.

3. SEP IRA vs 401(k) Plan

A 401(k) is organised like a SIMPLE IRA, together with contributions included of employee deferrals, employer matching, and discretionary profit-sharing. SEP IRAs are similar to profit-sharing in just a 401(k). 401(k) plans have significantly more substantial administrative costs, but companies with over 5-8 employees typically find 401(k) plans to be exceptional options.

4. SEP IRA vs Safe Harbor 401(k)

Safe Harbor 401(k) plans usually cost less to administer than most 401(k)s but more than SEP IRAs. Contribution limits are the same, but are easier to achieve with SEPs. Greater fitting requirements can increase employer costs for Safe Harbor, but SEPs are still more expensive once a company reaches 8 or more workers.

5. SEP IRA vs. Solo 401(k)

Like any 401(k), Solo 401(k) plans have administrative costs higher than SEP IRAs. Solo 401(k) contribution limits are $55,000, as in SEPs. Unlike SEPs, Solo 401(k) contributions are comprised of deferrals and profit-sharing. Where SEPs may be used for company with workers, Solo 401(k)s are just for single-employee companies.

Bottom Line

There are a number of reports which employers and employees can use to save for retirement and shelter income from taxes every year. A SEP IRA can be a fantastic avenue for large pre-tax contributions in certain conditions. To utilize a SEP, an employer should make appropriate disclosures to qualified employees, contributions proportionally to accounts for all their employees, and vest those contributions immediately.