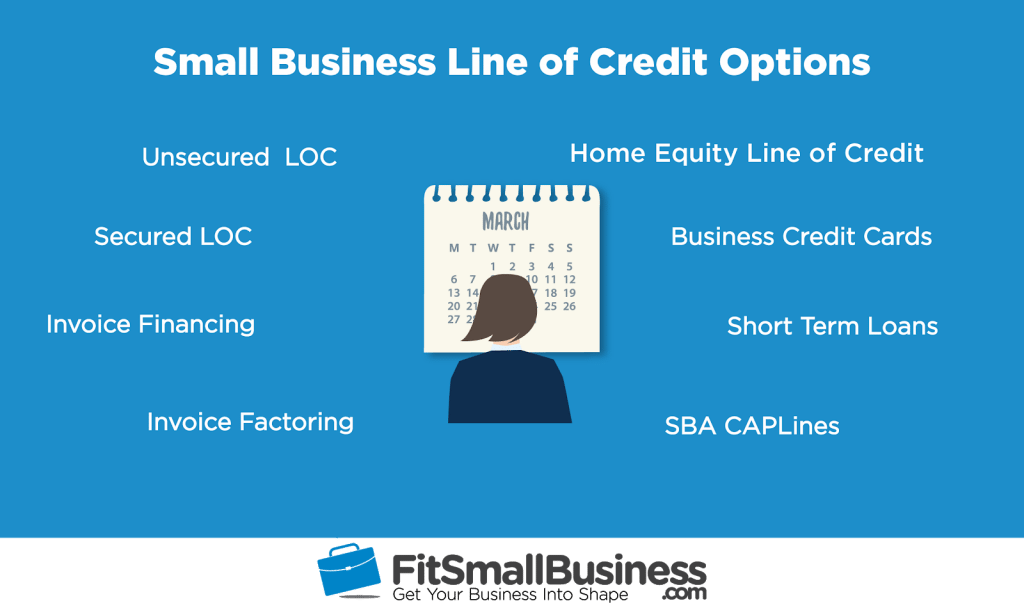

A business credit line (LOC) is fantastic for small companies that need a revolving credit line they can use over and over again for recurring or unexpected expenses. There are numerous types of line of credit products, each right for different borrowers. You are able to review each one below or take the quiz to determine which LOC is ideal for you.

Unsecured Business Line of Credit

An unsecured business line of line of credit is the easiest LOC to qualify for and can typically fund in no more than 24 hours. You won’t have to provide any security to secure your credit line and you’ll be able to borrow up to $250,000 at a time. You’ll only be charged interest for the amount you’ve borrowed and once you repay, you can borrow these funds again.

Line of Credit Amount

- Up to $250,000

Line of Credit Costs

- APR: 9.99% — 40%

Line of Credit Terms

- Repayment Conditions: Up to 12 months

- Repayment Program: Weekly or monthly

- Time to Funding: One to 3 times

Minimum Qualifications

- Minimum Credit Score: 550+ (check your credit rating for free)

- Annual Business Revenue: $50,000+

- Time in Business: One+ year

Where to Find an Unsecured Business Line of Credit

An unsecured business line of credit is normally initiated by online lenders. You can learn more by reading our article on the greatest small business line of credit suppliers.

How to Employ

When applying for an unsecured LOC, then you’ll complete an internet application and supply your basic personal and business info. This program can be completed in about ten minutes and you can be financed in a few days. You can learn more by reading our little business line of credit manual.

Secured Business Line of Credit

A secured small business line of credit (LOC) is similar to an unsecured LOC in that it’s usually revolving and you only pay interest on what you borrow. However, unlike an unsecured line of credit, guaranteed LOCs are generally provided by a traditional loan supplier, like a bank. You will likely receive a better interest rate but may also need to offer security to secure your line.

Loan Amount

- Around $1 million, but generally less than $250,000

LOC Costs

- APR: 6% — 10%

LOC Terms

- Repayment Terms: You to five years

- Time to Funding: 2 to three weeks

Minimum Qualifications

- Minimum Credit Score: 680 (check your credit rating for free)

- Collateral: Real estate or liquid Small Business accounts (savings, CD, etc.)

- Time in Company: 2 + years

Where to Discover a Secured Business Line of Credit

You can find a secured business line of credit in an assortment of traditional lenders, mostly banks or credit unions. Since many lenders are willing to utilize your company savings account as security, your present bank is a great starting place.

How to Apply

Business Credit Cards

Business credit cards are revolving credit lines that you can use again and again as you pay off the balance. Charge cards are generally the very first type of financing any company can qualify for and they’re a good fit for any business owner. Many small business credit cards may also reward you with either cash back or points.

Loan Number

- As much as $100,000, but typically less than $20,000 for small businesses

Interest Rates & Fees

- APR: 12% — 29%, some may have a 0% APR introductory period

- Annual Fee: $0 — $250 per month

Loan Conditions

- Repayment Terms: 30 days interest-free

- Time to Funding: Instant consent, and you’re going to obtain the card in 2 to twelve days

- Rewards: Vary by card, but can be 1%-5% which convert to cash or points back.

Minimum Qualifications

- Minimum Credit rating: 640+ (check your credit score for free)

Where to Locate Business Credit Cards

The business credit card you apply for will probably depend on your personal credit profile along with the type of reward you want. To learn more, check our article comparing the ideal company credit cards or our post on the best private credit cards for small business owners.

How to Apply

The application process generally happens online within a couple of minutes. Typically, you’ll find an immediate approval decision and if approved, you’ll get your card in the mail in just two to twelve times. To learn more, read our guide on when to use a credit card to finance your company.

Invoice Financing

Invoice financing, also known as accounts receivable (AR) funding, is similar to a credit line that uses your outstanding customer bills as collateral. You get financed for the value of your client invoices up to an approved maximum, and if you repay what you’ve borrowed, you can borrow again. You generally can’t borrow the complete invoice amount, but it’s a great way to unlock the value of your bills quicker than waiting for your customers to pay.

Loan Number

- Around $5 million

Invoice Financing Prices

- Discount Rate / Fee: 2% — 4.5% monthly

- Advance Rate: 80 percent — 100%

Terms

- Repayment Terms: Up to 90 times

- Time to Funding: You to 3 days

Minimum Qualifications

- Minimum Credit Score: Not mandatory — 530+ (check your credit rating for free)

- Collateral: The invoices you fund

Where to Find Invoice Financing

Invoice financing can typically be found via internet lenders. You can learn more by comparing the very best AR financing lenders in our buyer’s guide.

How to Employ

Applying for invoice financing generally takes place online, and only requires a few minutes. Once approved, you will be able to pick the customer statements you want to fund through an online platform and you are going to become financed in as fast as one business day. You can find out more about this process by studying our ultimate guide to invoice financing.

Invoice Factoring

Invoice factoring occurs when an invoice factor company effectively purchases your outstanding invoices at a discount. They will first progress you up to 95% of your invoice values, and then charge a discount rate or fee per invoice. While you don’t get 100% of your invoices, this is a great way to get paid fast for what you’re owed.

Loan Number

- $30,000 — $20 million each month

Invoice Factoring Costs

- Discount Rate / Fees: 0.5percent — 4 percent per statement

- Advance Rate: 90% — 95 percent

Invoice Factoring Terms

- Repayment Terms: Customers have up to 90 days to repay invoice, but you make no obligations

- Time to Funding: Up to two weeks for first approval, funding in 24 hours for every bill financed after approval

Minimum Qualifications

- Minimum Credit rating: N/A — creditworthiness of your customers is much more significant

- Collateral: The invoices you’re selling to your factor

- Other Requirements: Must factor statements of $30,000+ monthly

Where to Locate Invoice Factoring

Traditional lenders, like large banks, often offer invoice factoring to businesses with $30,000+ invoices per month. You may find out more about the very best factors by reading our informative article on the very best factoring companies.

How to Employ

The application procedure for bill will change by factor, but you will need to either talk to them in person or on the phone to find out if you qualify. You may learn more by reading our guide to bill factoring.

Home Equity Loan or Line of Credit

A home equity line of credit (HELOC) is a type of financing that utilizes the equity on your personal house as collateral. Even though this isn’t financing right for your business, it can be used for business functions. The home equity line of credit gives you a revolving credit line to use over and over again and functions just like a conventional small business credit line.

Loan Amount

- Up to 80% — 90 percent of your home equity

Interest Rates & Fees

- Interest Rate: 4% — 8 percent

- Fees: Closing prices of 2% — 5% and you could be charged an Yearly fee or prepayment penalty

HELOC Conditions

- Repayment Terms: Five to fifteen years

HELOC Terms and Qualification

- Minimum Credit Score: 620+ (assess your credit rating for free)

- Other Requirements: Must have 20%-30% equity in Your House and a favorable fiscal history

Where to Locate a Home Equity Line of Credit

You are able to be given a HELOC from specialization lenders who give using property as collateral. A good place to find lenders is LendingTree, which is an internet marketplace where you are able to review offers from multiple lenders at once.

How to Apply

The application process will vary by lender but it will demand documentation on your home, like a evaluation and evidence of ownership. Read our HEL or HELOC post to find out more.

Short-Term Loan

Some business line of credit products are advertised as small-term loans but actually function as a revolving credit line. You can draw against your loan like revolving credit, but each draw is treated as a small loan with fixed payments. Secured loans are typically more expensive financing products, but the total cost of capital is aggressive with other LOCs.

Loan Amount

- Up to $250,000

Interest Rates & Charges

- APR: 30% — 50%

Loan Terms

- Repayment Terms: Up to 12 months

- Time to Funding: You to three times

SBA Loan Qualifications

- Minimum Credit Score: 550+ (assess your credit score for free)

- Time in Company: 1 + year

- Minimum Annual Revenue: $50,000+

Where to Locate Short-Term Loans

These loans are typically originated by lenders that are online. You can learn more by reading our comparison of both best short-term loan providers, Kabbage and OnDeck. Both these lenders also offer a business line of credit product.

How to Employ

You’ll complete an online application that asks for basic personal and business information within about 10 minutes. You are able to acquire pre-approved instantly and funded in as fast as one day. You may find out more about these online lenders by reading our article on the very best business line of credit products.

SBA CAPLines

The Small Business Administration (SBA) offers a program to help companies get approved for up to a $5 million working capital line of credit. Each line of charge financed is for a specific purpose, like for contractors needing to buy stuff and pay for labor associated with contracts or seasonal companies needing to prepare for their busy period. For this reason, an SBA CAPLines loan isn’t a fantastic match for unforeseen expenses or to keep for a rainy day.

Loan Amount

- As much as $5 million, however small asset-based lines have a limit of $200,000

Interest Rates & Charges

- Interest Rate: 5% — 10% (check present SBA loan rates)

- Origination Fee: 0.5percent — 3.5percent

- Loan Packaging Fee: $2,000 — $4,000

- SBA Guarantee Fee: 0% — 3.75% (Know more about SBA guarantee fees)

SBA CAPLines Terms

- Repayment Conditions: Up to five years

- Time to Funding: 45 — 90+ times

Minimum Qualifications

- Minimum Credit Score: 680 (check your credit score for free)

- Collateral: Accounts receivable, inventory, purchase orders, or customer contracts

- Additional Prerequisites: No current bankruptcy, foreclosures, or tax liens; company owners must personally ensure 20%+ of the total funding amount

Where to Find SBA Loans

SBA CAPLines financing can be found at many traditional lenders that offer additional SBA loans. You may learn more by reading our informative article on the top 100 SBA lenders.

How to Employ

Any SBA financing process is long and needs a great deal of paperwork. You may learn more by reading our article on how to apply for an SBA loan. You may even find out more about SBA CAPLines by studying the section we have on them in our forms of SBA loans post.

Bottom Line

If you’re looking for a line of credit to pay for recurring or unexpected expenditures, then you’ve got plenty of options. For quick financing, we recommend a unsecured line of credit from an online lender. But you can check out all of your options above or by reading our article on the greatest little business line of credit to discover the very best lender for you.