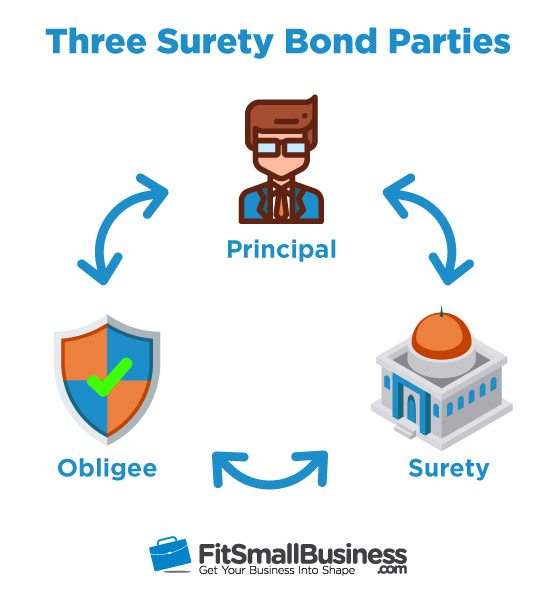

A surety bond is a contract between three parties known as the principal, surety, and obligee. Surety bonds financially ensure that a principle will meet a predetermined set of duties to an obligee. The”surety” is an insurance company or surety bond broker that offers the financial assurance to the obligee on behalf of their principal.

In this guide, we’ll discuss the ins-and-outs of surety bonds, such as the way they work, who can benefit from using themas well as where to find them. By the end, you ought to know precisely what a surety bond is and the way to use you to protect yourself.

Surety Bonds & How They Work

A surety bond is most commonly thought of as a way to transfer risk. Surety bonds are intended to protect public or private interests from the activities of a third party. You can think about a surety bond such as insurance that is for the benefit of one party, paid for by a second party, and funded with another party.

For instance, when a general contractor functions on a commercial construction project with a project owner, he’ll typically be required to buy a contract surety bond. This surety bond type protects the project owner in the general contractor’s possible failure to complete the contract as specified.

If this failure occurs, the job owner can file a claim against the surety bond. A surety bond company will cover the financial damages on behalf of the general contractor. After compensation are paid, the general contractor must pay off the surety bond company. This usually means that there are 3 parties involved with surety bonds.

Obligee

The obligee is the party which requires a surety bond as protection. Obligees are typically government agencies but can also be individuals or companies. They often use surety bonds to cover financial damages in the case of a claim, such as when a contractor fails to pay subcontractor or labor and material bills after a job is completed.

Primary

The key is the party the obligee needs to take a surety bond. The surety bond will safeguard the obligee against any breaches in contract or unethical business practices on behalf of their principal. The key of a surety bond is typically a business that’s trying to obtain a permit from a government service or bidding on a contract.

Surety

The surety is the insurance provider that backs the surety bail up into the full bonded sum. The surety stipulates the financial assurance to the obligee the principal will meet their obligations outlined in a contract arrangement. As compensation for the guarantee, the principal pays an yearly premium to the surety.

A surety bond generally functions like a hybrid vehicle insurance coverage and credit line. A principal carries out a surety bond also pays the surety that an annual bond premium between 1 percent — 15 percent of their total bonded sum until the responsibility is complete. If a leader fails to meet a bonded obligation and also a claim is submitted, that the surety covers the promise and recoups the money via indemnity.

“Indemnity is an agreed compensation for reduction.

As part of the surety bond, a principal and surety will enter into an indemnity agreement that outlines the terms of repayment should a claim be filed. Some agreements require security while some don’t.”

— Dr. Tenpao Lee, professor of economics at Niagara University

4 Main Types of Surety Bonds

There are many distinct forms of surety bonds. In fact, almost any contract or obligation could be bonded. On the other hand, the most frequent types of surety bonds include contract surety bonds, commercial surety bonds, court surety bonds, and fidelity surety bonds. Every of these financially shields an obligee across a range of possible scenarios.

1. Contract Surety Bond

A contract surety bond guarantees that a contractor will follow the specifications laid out at a construction contract. The obligee of a contract surety bond is a project owner and the bond helps to ensure that the principal contractor will carry out the work agreed upon and pay for the necessary subcontractors and supplies and materials.

2. Commercial Surety Bond

A commercial surety bond is generally utilized to safeguard public interests and are usually mandated by government agencies. These government agencies will require that all new businesses in a certain industry — like the spirits industry — as well as all companies with a license get a commercial surety bond. For these types of bonds, the obligee is your public.

3. Fidelity Surety Bond

A fidelity bond protects a business against the malpractice of an employee who handles money and other valuable assets. Fidelity surety bonds generally protect against the loss of a customer’s cash, equipment, or personal supplies. A fidelity surety bond may also safeguard your business from financial loss on account of the fraudulent action of a worker.

4. Court Surety Bond

A courtroom surety bond can be necessary by an attorney or comparable entity prior to a court proceeding to guarantee protection from a potential loss. These court surety bonds generally ensure the payment of expenses connected with lawyer fees or appealing a prior court’s decision. Other courtroom surety bonds shield an estate from malpractice of the property’s administrator.

“The most common type of surety bond is a

contract surety bond, commonly for the construction of buildings or streets. Usually, two contract surety bonds have been issued on a single construction project. One is used to guarantee performance of the building contract and the other one is utilized to make sure the payment of suppliers and subcontractors.

— Wendell Jones of Kentucky Surety & Construction Law

How to Know if a Surety Bond is Ideal for You

The simple fact of the matter is that depending on your industry or company-type, surety bonds may be a necessity. A surety bond may be required in case you’re obtaining a building permit, bidding on a public works job, or part of a specific business like alcohol and tobacco. You might also willingly receive a surety bond to lessen an obligee’s hazard.

We caught back up with Dr. Tenpao Lee, professor of economics in Niagara University, that told us that a fantastic guideline is that a surety bond is ideal for companies that want to minimize risk, ensure the compliance and completion of a project, or do business with a new partner. Especially, surety bonds are right for the following types of companies:

- Construction & other businesses with government-issued licenses

- Building companies with government jobs over $100k

- General contractors who are bidding on new projects

- Firms in high-risk or high-tax industries, including alcohol and tobacco

- Firms that need to guarantee customer property, like auctioneers

- Companies that want to protect themselves against employee theft

- Companies that expect to face litigation in the near future

When to Acquire a Surety Bond

A surety bond is required or voluntarily taken out with a principal to decrease the danger of an obligee. This means that there are two scenarios where you could find a surety bond. However, irrespective of whether it’s required, a surety bond ought to be taken out before the initiation of a contract.

As an instance, if you’re a contractor trying to get your license from the state authorities, you’re going to be required to take out a surety bond as part of this application procedure. This usually means that the surety bond is obtained prior to the process is complete. This is how it is for all scenarios in which a surety bond is needed.

There are other circumstances, but where a surety bond isn’t mandatory but still might be a fantastic idea. By way of instance, when a general contractor is bidding on a new project, they might”bail” the bid to show the job owner that there’s not much danger. In such scenarios, contractors will need to acquire surety bonds until they place any bids.

Surety Bond: Prices, Terms, & Qualifications

The prices, terms, and qualifications of a surety bond ranges dependent on the bond-type as well as the insurance company. Regardless, the specific constituents of a surety bond that you’ll want to check at include the bond premium, the highest bond amount, the period of the bond, and the minimum qualifications. Let’s take a look at each.

Surety Bond Costs

The sole cost generally associated with a surety bond is the surety bond top. This premium is paid by the key to the surety each year and is based on a proportion of the entire bail amount. For example, you may find a $10k surety bond in a 1 percent bond premium, which means that you pay $100 each year.

It’s common to find the following bond premiums based on the personal credit score of the business owner under:

- 1% — 3 percent annual bond premium for credit scores 700+

- 4 percent — 15% bond premium for credit scores between 550 — 699

However, sureties may also take into account the experience of the business owner. In addition, some sureties include the operation of a business when calculating the bond top. Business items that a surety will consider include the following:

- Business’s working capital

- Business’s combination of equity and debt

- Business’s web worth

- Business’s D&B credit report and business credit score

- Small business lines of credit

- Business references

Along with this bond premium, a few building surety bonds are guaranteed by the SBA. If you buy a construction surety bond that’s guaranteed, you’ll be charged an SBA guarantee charge of 0.75percent yearly. This guarantee reduces the risk of the surety making it easier for you to obtain a construction surety bond.

Surety Bond Amount and Conditions

There’s absolutely no hard cap on the size of a company’s bonded amount. Rather, Sureties normally require a company has at least 10 percent of the bonded amount in working funds. Further, many sureties limit the complete sum to 10x — 15x the worthiness of a firm’s equity. The maximum bonded amount is known as a company’s”bonding capability.”

Sureties will typically limit the bonded amount of both individual surety bonds as well as the aggregate secured amount of outstanding surety bonds. With construction surety bonds, for instance, a general contractor may have 5 jobs, each using its own surety bond. A surety might limit each bond to $5 million and the total bonded sum to $25 million.

The term of a surety bond is between 1 — 4 decades. But, there are a few surety bonds which denote that they’re”continued until cancellation.” This usually means that the surety bond protects the obligee indefinitely until the primary cancels the bond. For surety bonds using an expiration date, the bond could be revived by the principle.

Surety Bond Qualifications

A surety bond’s qualifications are largely dependent on a business owner’s personal credit rating. Scores of 550+ qualify along with the score generally dictates the quantity of the bond premium. However, depending upon the principal, they will also take into account other variables, such as a business’s financial operation, existing lines of credit, as well as the company owner’s industry experience.

Specifically, another surety bond qualifications can comprise the following:

- Business financial performance — Beyond 3 years financial statements, including the quantity of business’s liquid resources.

- Existing business lines of credit — Higher credit constraints is seen as a benefit as it decreases the likelihood of financial distress during a project.

- Industry experience — The previous experience of both the business owner as well as the company is assessed, including the amount of similar previous projects done.

As soon as you’re accepted, a surety may also need you to submit interim financial statements each 1 — two quarters to monitor the way the season is progressing. Furthermore, contractors Will Have to prepare a quarterly program of work in progress, which comprises:

- Total contract cost

- Approved changes to requests

- Amount charged to date

- Costs incurred thus far

- Revised estimates of the cost to finish

- Estimated gross profit and end date

How to Get Surety Bond Insurance

Surety bonds are underwritten by insurance companies and offered directly by those insurance companies or by surety bond agents. Often times, those businesses which provide surety bonds compete on the annual surety bond premium. It’s therefore wise to shop around for the very best premium if you’re looking for a surety bond. This can allow you to save money.

The ordinary places to acquire surety bond insurance is through a national insurance provider such as Nationwide in addition to through agents like SuretyBonds.com.

Surety Bond Insurance Bonding Process

The”bonding process” is the vetting process that surety bond providers run within this application process. Prior to a surety bond is issued, a surety will evaluate and qualify the principal to make sure he or she has the tools and capacity to satisfy the stipulations of a bonded contract in the benefit of the obligee.

As part of this bonding process, a surety will require your personal credit score, your latest year-end financial statement, as well as the past 3 years of your company’s year-end financial statements. If there are multiple business owners, the individual creditworthiness of each owner is taken into consideration during the bonding process.

From that point, insurance providers will underwrite a surety bond depending on the financial data gathered during the bonding procedure. Quite often, a principal will be required to post collateral with the surety, sometimes up to 100% of the bonded amount. However, this is not necessarily the case and is largely dependent on the personal credit score of the business owner.

Once the surety bond is underwritten, the key will have to sign an indemnity agreement in favor of the surety. This agreement stipulates the repayment terms between the principal and surety should a claim by the obligee be registered. Repayment terms can be monthly payments of principal plus interest just like a line of credit but is dependent on the agreement.

What to Look for in a Surety Bond Provider

There are a vast selection of surety bond suppliers available. There are typically two kinds of bond providers, including insurance companies in addition to surety bond agents working with numerous insurance companies. When looking for a provider, it is important to inspect a possible surety’s bonding permit, bond offers, average bond premiums, in addition to internet capabilities.

- Suitable bond license — All surety bond providers have to have a bond permit. Make sure that your possible surety has the proper bonding licenses for the locations where they offer surety bonds.

- Adequate bond offerings — Surety bond providers can specialize in a specific bond or provide a complete range of surety bonds. Make sure the surety you utilize not only has the specific bond you’ll need but also other offerings should your needs change.

- Competitive surety bond premium — The significant factor that bond suppliers compete is the surety bond premium. When you’re looking for a surety, always make certain you’re getting a competitive surety bond top.

- Online program & draw capabilities — It is typical for surety bond suppliers to offer their services with an internet portal where you can apply online in addition to get the funds to pay a claim in the kind of a line of credit.

Differences Between a Surety Bond & Business Insurance

Even though a surety bond is issued by an insurance company and often known as”surety bond insurance,” that there are many differences between a surety bond and conventional business insurance. The 3 big differences are the underwriting qualifications, the purpose of the financial guarantee, as well as the particular party being insured.

1. Underwriting Qualifications

Traditional business insurance is risk-based while surety bonds are credit-based. Once an insurer writes a policy to cover workplace injuries, for instance, the underwriter may utilize statistical probabilities to determine the ordinary likelihood of injury. The insurance premium is then based on the premise that risk is distributed among different policyholders.

With surety bonds, the underwriting credentials are based on the creditworthiness of the principal. Insurance providers typically wish to see that the past 3 years financial statements in addition to the private credit rating and annual taxation return of the company owner. The higher the creditworthiness the lower the annual bond premium.

This also suggests that the cost of the surety bond is put entirely on the principal. With traditional small business insurance, even when a claim has been filed the liability falls upon the insurer the insured entity isn’t required to cover anything except for a contingency. Together with surety bonds, but the principal is responsible for repayment to the surety in the case of a claim.

2. Goal of Financial Guarantee

Traditional small business insurance is typically used to cover unexpected accidents. An insured party will pay a monthly or annual premium to an insurance company for financial coverage in the event of a claim against the insured.

A surety bond, on the other hand, is used to safeguard a third-party against the possibility that a company fails to meet contractual obligations or acts in an unethical way. In cases like this, the principal will cover an annual bond superior to the surety so the surety will cover the price of a claim if a contractual obligation isn’t met.

3. Covered Party

The most vexing difference between a surety bond and conventional business insurance is the covered party. With conventional small business insurance, you typically take out your policy which covers you in the event of some injury or malpractice. With a surety bond, the main takes out a bond that guards the obligee out of a breach of contract or basic custody on behalf of their principal.

Bottom Line: Surety Bonds

Overall, a surety bond is a means to get a leader to financially protect the interests of an obligee. That is sometimes a necessity, like when applying for a business license, but can also be sometimes a fantastic idea even if it’s not required. This is because it reduces the risk to an obligee and may make them more likely to work together with you.

Surety bonds are offered by insurance companies as well as surety bond brokers. If you require a surety bond to your business, check out the insurer Nationwide as well as the surety bond agent SuretyBonds.com. Both offer a complete selection of surety bonds to your business.