A business credit report is a record of a business’s financial history which allows others to ascertain a business’s creditworthiness. The information in a company credit report is used to figure a business’s credit score. In this article, we will review all you want to learn about business credit reports, including what’s in it, that will see it, and much more.

If you would like to check your credit rating and get a business credit summary before we get started, you can do so with NAV for free. You can also get whole small business credit reports from NAV for a little charge.

Visit NAV

What is a Business Credit Report?

A company credit report is a record that assesses the creditworthiness of a company. Business credit reports typically collect information on a company’s business structure, industry, financial performance, payment history, and more. A company credit report is used by sellers, lenders, and other lenders to check the credit of a prospective partner firm.

Company credit reports are created each by the three main credit reporting bureaus as well as by FICO. They comprise:

Kinds of Business Credit Reports

| Agency | Cost | |

|---|---|---|

| Dun & Bradstreet | $61 – $229 per report | Get Yours |

| Experian | $49.95 per report | Get Yours |

| Equifax | $99.95 per report | Get Yours |

| FICO SBSS | $49.99 per report | Get Yours |

Dun & Bradstreet reports may be either self-generated or generated by sellers or lenders who report that your late or overdue payments. Experian, Equifax, and FICO reports are automatically generated using public records but business owners can also self-report information. Regardless, unlike with private credit, everyone can pay to get your small business credit report.

Typical information you should expect to find on your business credit report:

- General company data

- History of the business

- Business registration information

- Government activity summary

- Business operational information

- Industry data

- Public filings (liens, judgments, and UCC filings)

- Past payment history

While the information on the 4 company credit reports is mainly the same, each report includes its own proprietary way of calculating its individual credit rating. To learn more on business credit scores, you can read our article on how business credit scores work.

Why is a Business Credit Report Important?

A business credit report is important because it’s used by sellers, lenders, and other lenders to ascertain a company’s business credit. For example, a company with a fantastic credit report is much more inclined to negotiate favorable terms with their creditors, lessors, and providers while a firm with credit report full of negative things is significantly less likely to.

A company credit report is very important to the following companies:

- Companies that are negotiating payment terms with vendors, suppliers, or customers

- Companies that are getting pre-approved for Financing

- Creditors Which Are analyzing the application of a potential company borrower

For example, if you are negotiating payment terms with a seller, chances are that in the event that you have good credit you may receive net-30 or greater payment terms. This allows you to float payments to that vendor as you wait for payment from the clients. The result is a financially independent company which won’t need to rely on working capital loans or payroll financing.

On the reverse side, if you’re a B2B company appraising the creditworthiness of a possible client, you are able to pull that customer’s business credit. If the customer needs net-60 payment terms but you see they have poor credit, it’s possible to instead require upfront payments rather than net terms. This will secure your company from overdue or late payments.

What’s more, unlike personal credit, everyone can pull your enterprise credit report. At any point in time a creditor or vendor can check your small business credit, and vice versa. However, while inquiries on a personal credit report may have a (small) negative impact on your credit score, that’s not the case with company credit ratings.

Further, business credit reports are typically generated by the bureaus using public records and data from creditors and sellers. This usually means that there is a good possibility that you have a business credit report even if you haven’t filled out any information yourself.

This makes it extremely important to test on your business credit report and make sure it is true at least once a quarter. Unfortunately, many small business owners don’t do this.

I spoke with Jay DesMarteau, Head of Small Business Banking in TD Bank, that told me :

“TD bank lately asked 550 small businesses earning

$1 million or less about their credit clinics. The survey found that as many as 69% of small business owners believe that they don’t already have a credit report, they do. Further, just 15% of respondents had seen their small business credit reports”

Where Can You Get a Business Credit Report?

Company reports are generated by the three big credit agencies below. FICO also has a business credit score that pulls information directly from those three credit bureaus. Let us take a closer look at the 4 credit reports including how to find every and every one.

Agencies That Provide a Business Credit Report

| Agency | Cost | Report Contains | |

|---|---|---|---|

|

Dun & Bradstreet |

$61 – $229 per report |

Paydex Score, Financial Stress Score, Commercial Credit Score, Liens, bankruptcies, and collections, Credit limitation recommendation, Payment histories, Industry trends, Business profile |

Get it Now |

|

Experian |

$49.95 per report |

Credit Ranking score, Liens, bankruptcies, and ranges, Credit limitation recommendation, Payment histories, Business profile |

Get it Today |

|

Equifax |

$99.95 per report |

Business Credit Risk score, Business Failure score, Liens, bankruptcies, and ranges, Payment histories, Business profile |

Get it Today |

|

FICO SBSS |

$49.99 per report |

SBSS Score, Liens, bankruptcies, and collections, Payment histories, Business profile |

Get it Today |

Dun & Bradstreet Business Credit Report

The Dun & Bradstreet company credit report, also known as the D&B credit file, is the most widely used company credit report for trade partners. It takes into consideration such information as overdue payment information, early or on-time payments, historic financial performance, company and business information and more to evaluate a organization’s creditworthiness.

The information is used to generate three Chief scores on the D&B business credit report:

- PAYDEX score (1 — 100) — Employed to rate a organization’s capacity to cover its previous debts within a 2-year interval, with 100 being the greatest.

- Commercial credit rating (101 — 670) — Used to predict the chances that a firm will default on its payments over a year, with 670 being the least likely.

- Fiscal pressure score (1,001 — 1,875) — Employed to predict the likelihood that a business will go out of business in a year, together with 1,875 being the least probable.

To learn more on your Dun & Bradstreet company credit file, you can read our post on your own D&B credit report.

Where to Get a Dun & Bradstreet Business Credit Report?

Dun & Bradstreet generates its business credit reports in 1 of 2 ways. The first is that a record is self-generated by a firm. The next is that a report is generated by a vendor or creditor when they a late or delinquent payment is submitted to the Bureau.

When obtaining your Dun & Bradstreet company credit report, the first step would be to search their site for an present report. You can do that by navigating to their website and clicking”company search” in the top right-hand corner.

If your company exists in the database you’ll already have a DUNS number, which is that the Dun & Bradstreet 9-digit identifier. If this is the case, it’s probably because a creditor or seller reported a overdue or late payment you’re making. You can purchase your existing report for as little as $61. Then, you can confirm that the information is correct in addition to self-report additional company details.

If you don’t have an present report it usually means that no creditors or sellers have reported you. If that is the case, you can create and purchase your account by applying for your DUNS number and filling out the required information. The one-time fee is $229.

Alternatively, you can purchase Dun & Bradstreet’s Creditbuilder Plus, which provides you unlimited access to your enterprise credit report. Monthly rates start at $159.

Experian Business Credit Report

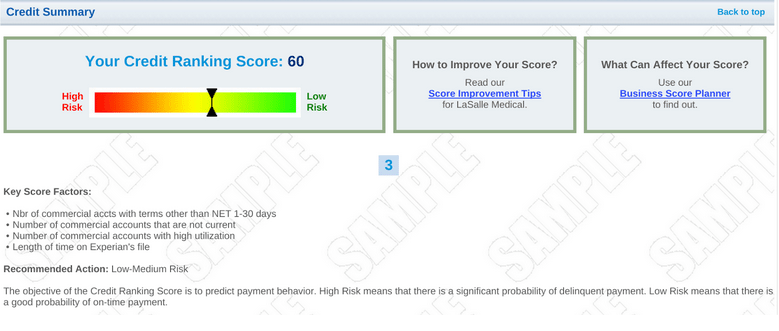

The Experian company credit report assesses the creditworthiness of a company based on its trade and financial payment history and company financial information. Unlike the D&B company credit report, the Experian company credit report provides only one score and is known as the very straight-forward report available.

The Experian Credit Ranking Intelliscore ranges from 0 — 100 and it measures the likelihood of a late payment. The goal of the score would be to predict future payment behavior. The higher the score the lower the danger of a payment.

To compute its own score, Experian takes into account company background information, establish history, business financial information, along with other public data.

Where to Get an Experian Business Credit Report?

Unlike Dun & Bradstreet, Experian doesn’t ask that you make an account or receive a number. Rather, Experian combs publicly accessible data such as government documents to compile information on your organization and generate a company credit report.

But such as Dun & Bradstreet, Experian allows you to submit company-specific data like financial performance. You can update your data and find a business credit report for $49.95, here.

Equifax Business Credit Report

Equifax uses business data, public records, trade payment and financial payment history to evaluate the creditworthiness of a company. However, unlike Experian and Dun & Bradstreet, Equifax does not collect information on the financial performance of a company.

Equifax uses this information to create two company credit scores:

- Business credit risk score (101 — 992) — Evaluates the probability that a business will be more than 90 days overdue on fiscal obligations, together with 992 being the least likely.

- Business failure score (1,000 — 1,880) — Evaluates the likelihood that a company will go bankrupt in the next 12 months, together with 1,880 being the least probable.

Equifax computes these scores by taking into account available credit, late payments, age of fiscal accounts, adverse payment transactions, and much more.

Where to Have an Equifax Business Credit Report?

Much like Experian, Equifax doesn’t require you to obtain an I.D. number or complete any paperwork. Rather, Experian employs all available public data, such as new business filings with the Secretary of State, to create a business credit report.

It’s possible to receive your Equifax business credit report for as little as $99.95 by navigating to their website and clicking on the”contact us” button.

FICO SBSS Business Credit Report

The Fair Isaac Corporation, better called FICO, also supplies a business credit record of its own. The report is most commonly employed by banks and creditors to accept loans and lines of credit. The FICO business credit report is most widely used by lenders when approving an SBA loan.

FICO pulls data from the three credit bureaus to generate its own report. The score found on your FICO business credit report is known as the LiquidCredit Small Business Scoring Service (SBSS). This SBSS score ranges from 0 — 300 and steps the chance that a corporation will become delinquent on its own obligations. A rating of 300 is the least likely this will take place.

The Way to Get Your FICO SBSS Business Credit Report?

Since FICO pulls data from the three existing company credit reports, the SBSS is much more of a score than it’s a report. Still, it’s crucial that you understand that your company’s FICO score. Your SBSS score is currently available for sale with NAV for $49.99.

Average Information Found on a Business Credit Report

All four company credit reports normally contain the very same sorts of information. Once you receive a copy of your business credit report it’s important to review the information in detail. To assist you better understand your document, we have listed the primary sections of a standard business credit report under.

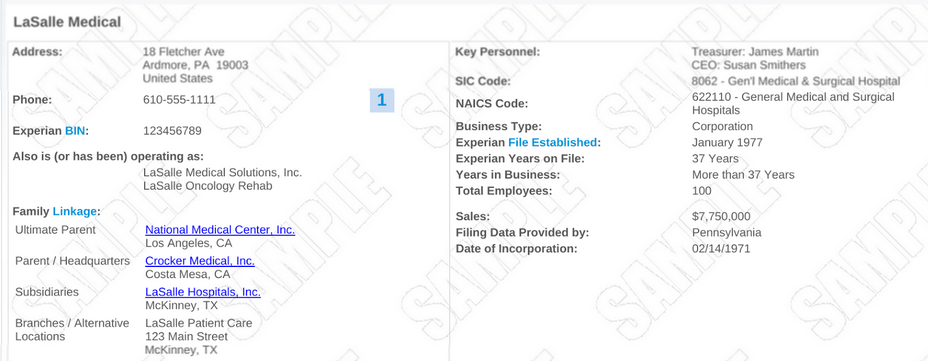

To illustrate each section, we have supplied screenshots from a sample Experian report. If you prefer to you utilize just one of the other two bureaus, you can even see a sample company credit report from Dun & Bradstreet or Equifax.

Business Profile

Your business profile is normally the first thing that shows up on your business credit report. Within your profile, you’ll find your business’s name, trade name, since the address of your headquarters. The business profile section will have extra company background data, such as incorporation information, parent and subsidiary details, and the number of employees.

Financial data are also included on your typical business profile department. This information consists of annual sales and profit pulled from the company’s past 3 years financial statements. For small companies, business owners can choose whether they would like to self-report this info. Just remember that accurate and up-to-date information can benefit your business credit report.

SIC and NAICS Industry Codes

From the screenshot above you’ll realize that the company profile segment also shows your company’s SIC and NAICS industry codes. These codes are used to describe the kind of business you operate inside. While it appears simple, it is important to have the appropriate codes on your business credit report because different businesses have different levels of credit risk.

For example, a transport software firm like Uber or even Lyft might be categorized as a transportation company rather than a software development firm. This would boost their business risk and make it harder for them to acquire the correct insurance for their companies, among other items.

Listed below will be the 5 highest-risk SIC categories:

- Real estate investing and other types of investing

- Automobile sales

- Travel/transportation industry

- Cash lending/collecting

- Restaurants

Businesses in these industries can prevent being categorized as insecure by minding their business actions. If you want to invest to property, as an example, you may create a business which does property marketing or business consulting, then run your property investment as an arm of the enterprise.

If you have been misclassified, you can update your company profile on the agency’s website or by contacting the agency directly. Industry codes are received through public record data such as responses to Census surveys or administrative records, so be certain that you correctly identify your company on such records going forward.

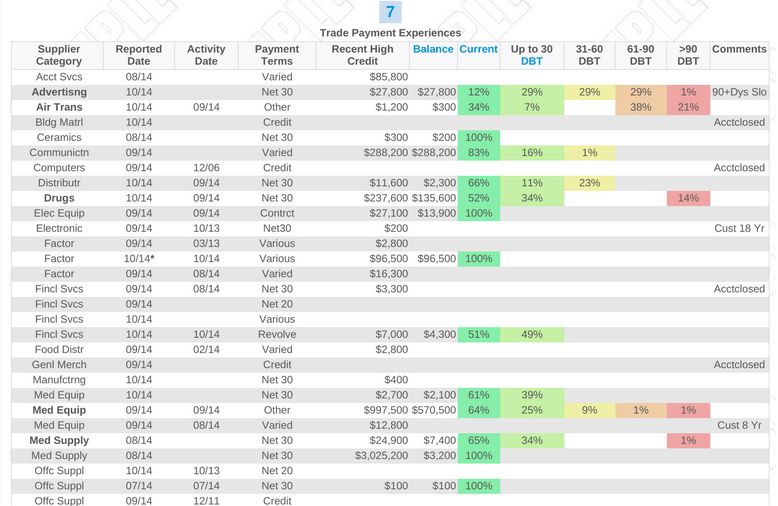

Trade Payment History

The payment history section shows your payment history for the past 2 — 3 years. Typically included in the payment history section are payments made to vendors. Included with each payment is your date of sale, the quantity of the sale, payment provisions, in addition to the payment date.

Overdue or late payments have been reported to collection agencies and credit reporting bureaus who then report the overdue obligations to the credit reporting bureaus. Early or on-time payments have to be reported from the vendor themselves to the credit reporting bureaus. This makes it important to use vendors that are willing to report your obligations.

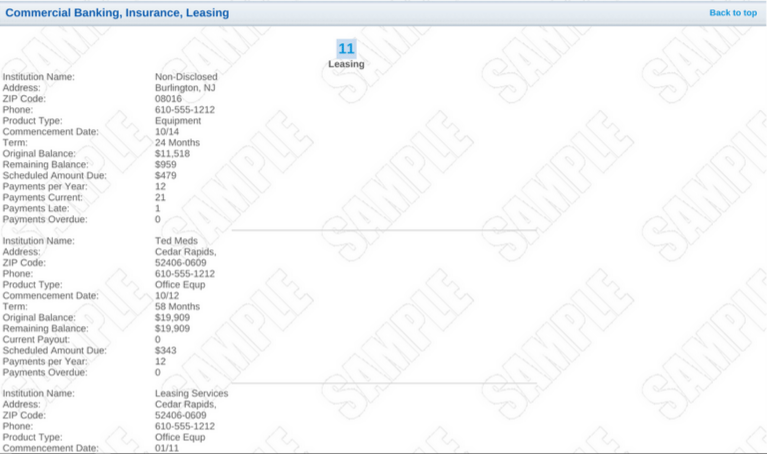

Commercial Financial History

The industrial financial history department tracks your payment history to creditors, lenders, and insurance. For instance, any payments made on a business loan, insurance policy, line of credit, equipment leases, and more will appear here.

Included in the part is such funding activity as the amount of credit you have received from lenders, the type of the item, the term of the loan or policy, as well as the original balance and remaining balance. When you are looking around for a loan or working capital, lenders will probably use this section when creating an evaluation of your application.

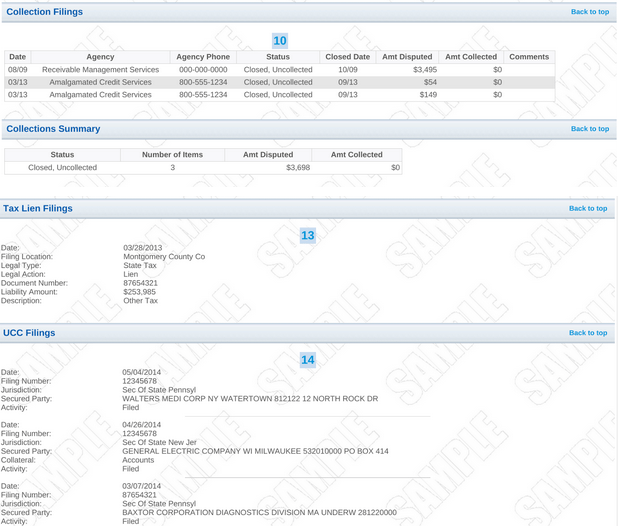

Legal Filings, Bankruptcies, & Collections

The legal filings, bankruptcies, and sets section is used to evaluate your business’s liquidity and financial health. Specifically, the segment will record UCC filings for the previous 5 years, which are liens put on your company’s assets to serve as collateral on a loan.

Such liens influence if and when a lender will loan money to you. By way of instance, if you own a retail shop and a creditor has filed a UCC lien on your fixtures on your retail space, you can not pledge the fixtures as collateral on another loan until you repay the first.

The credit report will also show other legal filings, for example business bankruptcy judgments, tax exemptions, and accounts that were placed into collections, typically after 90 days delinquent. Possessing legal judgments against you or late accounts can disclose financial distress and also make creditors hesitate to work together with you.

Business Credit score

Based on the information in your document, each business credit bureau will issue your company a score which predicts payment behaviour. What exactly counts as”a good score” depends on the bureau that is reporting your credit score. For more information on your company credit rating, read our informative article on how business credit scores operate.

Bottom Line

A company credit report is a record that compiles information to assess the creditworthiness of a firm. A company credit report will generally report on a organization’s structure, industry, payment history and historical financial performance. Company credit reports are important since they, unlike personal credit reports, they can be seen by anyone, such as your sellers, lenders, lenders, and spouses.

NAV is an internet company that provides instant access to your business and personal credit reports. They offer 2 free summaries of your business reports and also offer full business credit reports beginning at $29.99. Visit them today:

Stop by NAV