A Solo 401(k) is a employer-sponsored retirement plan which enables self-employed people to contribute up to $55,000 pretax, including $18,500 of employee deferrals. The way to prepare a Solo 401(k) requires just six measures that hinge on choosing a supplier, but having only 1 participant makes it possible to complete in only a few days.

When you setting up a Solo 401(k), the most significant step is choosing a good supplier. This is due to the fact that the supplier will supply your investment alternatives and help administer your plan and since the provider will help you get through the remaining steps. To find out more, make certain to check out our post on the Best Solo 401(k) Providers for 2018.

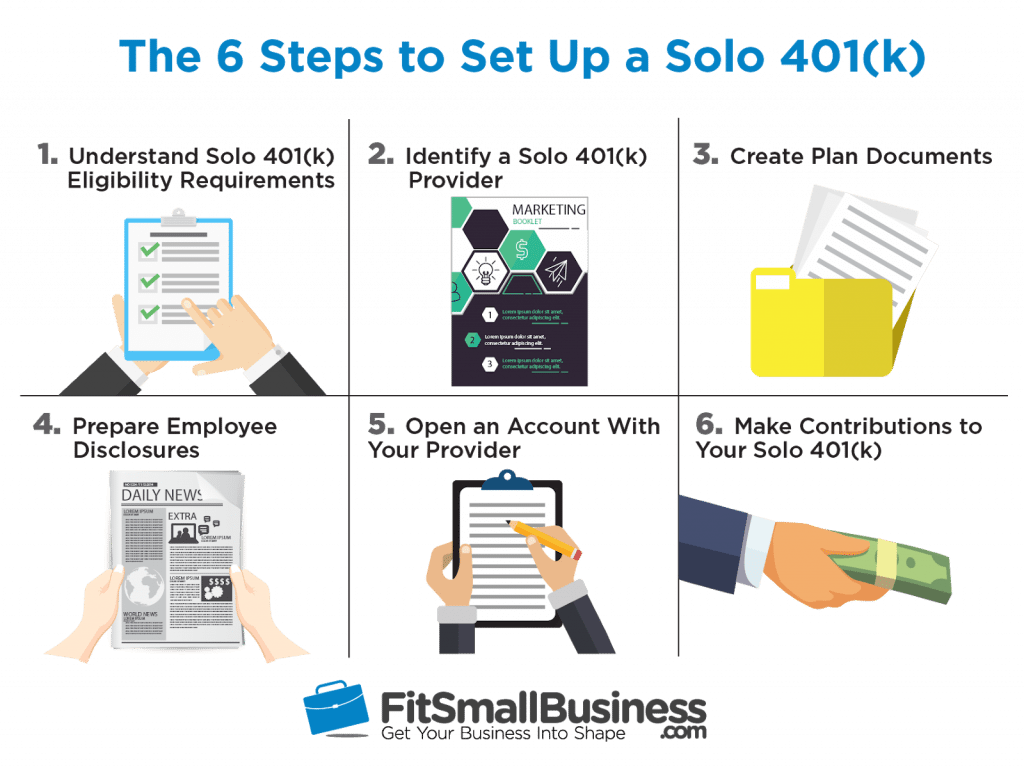

In order to set up your solo 401k you have to complete six basic steps:

1. Understand Solo 401(k) Eligibility Requirements

A Solo 401(k) or Individual 401(k) is a plan specially designed to have just one participant, which is the only qualification requirement. The sole participant in a Solo 401(k) is the company owner (and potentially her or his partner ). Individual 401(k)s are not available if you’ve got full-time workers who would qualify for a 401(k).

A Solo 401(k) is comparatively easy to start since you’re the only player. Many of the expenses associated with a 401(k) are aggressive to other investment choices you may have while giving you much more investment flexibility. Plus, these plans are much easier to administer compared to a traditional 401(k), and your supplier will be present to help you set up and administer the plan.

Who Would Benefit From a Solo 401(k)

Because IRS regulations state Solo 401(k)s may only have one participant, these strategies are only appropriate for self-employed individuals and small business owners who do not have any full-time employees.

Solo 401(k)s may be the ideal option for entrepreneurs who make less than $75,000 each year. This is only because Solo 401(k)s have exactly the identical dollar contribution limit as SEP IRAs. Nonetheless, in a Solo 401(k), it is possible to donate more than 25 percent of your pretax income, which is not allowed in a SEP.. Generally, SEPs are more appealing for people who make more than $75,000 each year.

Solo 401(k)s can also be greater than options (especially SEPs) if you think that might hire workers in the foreseeable future. This is because if you have a SEP IRA and hire employees, you are required to make gifts for every one your employees whenever you make gifts on your own. In case you have a Solo 401(k) and you hire employees, you can convert your plan to a Traditional 401(k) easily to accommodate new participants.

For more information on Solo 401(k)s, make sure you check out our article on Personal and Solo 401(k)s.

2. Identify a Solo 401(k) Supplier

The next step, and possibly the most important, of how to set up a Solo 401(k) would be to recognize a good provider. Make certain to think about reputable, low-cost businesses that may meet your specific needs. If you would like additional flexibility to invest in assets such as property, you will find other suppliers who can help you set a self-directed account.

Business owners who want a Solo 401(k) have special concerns that differ from companies needing to utilize a Traditional 401(k), SEP IRA, or another alternate. These programs are about your future individual objectives and future business plans. You are going to require a supplier that you could afford but also one that has a strong reputation for administering Solo 401(k)s.

When you start looking for a Solo 401(k) provider it is important to consider these three items:

- Cost-effectiveness — You do not need to choose the provider with the lowest prices but realize that paying unnecessarily significant fees will impact your account balance over the long term.

- Good reputation — Most 401(k) providers are national firms with extended histories. Others are smaller companies that specialize in alternative investments or additional services. No matter the size, be sure to work with a reputable company that is properly enrolled and has a good track record.

- Reasonable investment flexibility — Investors have different investment plans and goals. Make certain to pick a provider that will provide you access to the investment options you desire.

Chances are you already have relationships with brokers or companies that could show you how you can set up a Solo 401(k). If you do, think about their offering to see if it meets your needs. If you do not have a connection or do not like what they provide then you should search for a cheap, reliable company that will help you.

The majority of people looking to establish a Solo 401(k) simply need a simple, straightforward plan with low costs. If you are aware that you specifically wish to invest in other resources, research suppliers that offer self-directed accounts or checkbook control. If property is an especially alluring investment, be sure to check out our post on utilizing a Self-Directed Solo 401(k) for Real Estate Investing.

Top Solo 401(k) Providers

We’ve researched the best Solo 401(k) providers in the marketplace today, and have narrowed them down into a few of the most reputable and high-performing businesses. You can read an summary of some of their top providers below. For more information, take a look at our post on the Best Solo 401(k) Providers.

Vanguard

Vanguard is the biggest mutual fund company in the world with more than a hundred low-cost mutual funds and over $4.5 trillion in assets under management. In addition to its line of mutual funds, target funds and ETFs, Vanguard also provides easy, cost-effective retirement account including Solo 401(k)s.

Though Vanguard is extremely cost-effective and has a fantastic reputation, they don’t offer you additional services that might be valuable to a small business owner. There’s no business banking or individual investment advice, and they also don’t let account holders to borrow against Solo 401(k) assets. But, Vanguard is the perfect supplier if you would like to concentrate on passive investing in low-cost, professionally-managed mutual funds.

Charles Schwab

Charles Schwab is a huge financial company that offers a huge collection of services. It’s its very own line of mutual funds and ETFs and securities brokerage services, individual investment advice, business banking, and other services. It doesn’t charge account maintenance fees and waives trading commissions on its own mutual funds and ETFs.

Schwab is a terrific alternative if you could benefit from additional services like business banking outside your Solo 401(k).

Fidelity

Boston-based Fidelity is the biggest privately-owned financial services company on the planet. It is extremely reliable and provides enough services for a one-stop-shop for small business owners. Much like Schwab, Fidelity has its very own line of mutual funds together with securities brokerage for one to trade stocks, bonds and ETFs. Fidelity is a good option if you need business banking and investment advisory services along with your Solo 401(k).

MySolo401k Financial

MySolo401k is an excellent alternative supplier that specializes in Solo 401(k)s for midsize business owners. Since it specializes in market investments and has added outlays, MySolo401k is ideal for sophisticated investors who know what they’re doing and need to invest specifically in alternative assets such as real estate.

In case you’ve got a Solo 401(k) through MySolo401k, then you will have access to a lot of add-on services including lending facilities in addition to tremendous flexibility among investment options through a self-directed account. However, these extra investment options come with added costs.

TD Ameritrade

TD Ameritrade is another good provider of Solo 401(k)s. Though it does have some offices around the country, it isn’t in every market physically and its services are available largely online. TD Ameritrade’s core offering is securities brokerage, therefore it may not be your very best choice unless you want to actively trade stocks on your Solo 401(k). TD Ameritrade is a great option in the event that you already have a relationship with the organization or want a substitute for Fidelity or Schwab that also offers in-person advice.

3. Create Plan Records

Once you decide on a provider, you want to complete paperwork from the provider that can come as a”employer kit” or”employer program” in order to prepare a Solo 401(k). Within this paperwork is going to be a substantial item — a”plan adoption agreement” or comparable document — that is how to prepare a Solo 401(k) formally. This is a huge document, and it is important to have a supplier you aspire to help walk you through the plan production procedure.

In addition to private information and information on your business, this paperwork might contain certain things that would go on IRS Form 5500, but you won’t have to file this form until you have $250,000 on your accounts or have added plan participants. You’ll want to make elections in your investment options in this phase of the process but they may be changed afterwards.

“There are many technical rules you can apply to your plan that dictate things like loan provisions, participation rates and fitting terms. This is often called the”plan design” and it is exceedingly important to design your own strategy correctly so it allows you to get flexibility and the most tax benefit. There are businesses out there which solely concentrate on plan design so that you can make certain to produce a 401(k) program the best first your personal and business needs.”

— Samuel Rad, CFP, UCLA Instructor and Certified Financial Planner, Affluencer Financial

4. Prepare Employee Disclosures

To the IRS and other regulators, a Solo 401(k) is just like a Traditional 401(k) using just one participant. So, though you do not have employees who can participate on your Solo 401(k), then you will need to prepare disclosures that contain certain details on the plan along with the benefits of tax-free savings.

While these disclosures might not appear necessary from the event, they are still needed for many 401(k) programs — even those that have just one participant. That is because, in the event that you ever employ personnel, your Solo 401(k) will automatically convert into a Traditional 401(k) and become subject to additional rules for example worker disclosures requirements. That way, disclosures will be ready whenever worker becomes eligible.

You should include the following information in most worker disclosures:

General 401(k) disclosure — The IRS needs to ensure employees know how employer-sponsored retirement plans operate, like around the tax benefits and so on.

Details regarding your plan — you have to provide employees with specific information in your strategy such as where accounts are being held and available investment options.

Employee rights and duties — Employee disclosure need to include info regarding available matching (even though you won’t have formal fitting while you’re the only participant), timeline for company contributions, eligibility information and any vesting programs you want to use.

5. Open an Account With Your Provider

Once you’ve selected your provider and officially adopted a plan agreement for your new Solo 401(k), the next step will be to start and set up your Solo 401(k) account with your supplier. This account can be formed any time before your tax-filing deadline (including any extensions) and needs to be formed in accordance with any guidelines on your plan documents.

Technically, you are allowed to establish a Solo 401(k) account after the year ends and also create prior-year contributions. But it’s typically better to set up a new account in the exact same year that it will be effective and make your first gifts in the exact same calendar year, and therefore you don’t raise any red flags with the IRS.

6. Make Contributions for Your Solo 401(k)

As soon as you’ve chosen a supplier, adopted plan records and set up your account, the only thing left to do together with your Solo 401(k) is use it. You can do it by scheduling automatic, digital contributions or by making a single donation any time prior to your tax-filing deadline up into the $55,000 limitation.

In Traditional 401(k)therefore gifts are broken into employee deferrals, employer matching and profit-sharing. Since a Solo 401(k) has only one participant who is both employee and employer, contributions are generally all lumped together. But they still can’t exceed annual contribution limits determined by the IRS.

It is possible to make contributions throughout the year or all at once — even following year-end — provided that it is prior to your tax-filing deadline for a given year. Once your account reaches $250,000 in assets, you’ll have new requirements including filing Form 5500. If you ever hire workers who become eligible to your plan, you’ll need to make alterations to adapt those new participants.

Solo 401(k) Costs

Because Solo 401(k)s have one participant there are few government prerequisites, but your supplier will help you through every one of the ones which are required, for a fee. Most suppliers charge custody fees and mutual fund expense ratios and commissions for trading individual stocks, bonds or ETFs. You might also pay fees per fund you use or other fees to an alternate supplier if you invest in things like property.

The average costs for a Solo 401(k) comprise:

- Custodian fee ($25 to $50) — Charged by many suppliers to maintain your 401(k) account.

- Trading commissions ($5 to $25 per trade) — You pay commissions should you put up your Solo 401(k) to exchange stocks, bonds or ETFs.

- Mutual fund and ETF expenditure ratios (0.035 percent to 1.5 percent) — Funds automatically deduct expense ratios each year to pay the expenses of trading and finance administration.

- Administrative charges for self-directed ($200 to $2,000) — Charged by other providers that are devoted to specialization investments like real estate. These might be flat fees, a percent of your account value or a fee per advantage in your account and can be as large as several thousand dollars per year.

Solo 401(k) Pros and Cons

Like all kinds of accounts, Solo 401(k)s have advantages and drawbacks. When considering eligibility and also the suitability of an Individual 401(k), business owners will need to consider the benefits and disadvantages relative to other types of accounts. Remember, however, that a Solo 401(k) is just likely to operate for business owners who have no fulltime workers.

Experts of a Solo 401(k)

Solo 401(k)s are often the best option for people in certain situation with benefits that far exceed those available in different kinds of plans. Chief among those benefits is how easy it is to set up and administer a Solo 401(k). Remember that a number of advantages of Solo 401(k)s, including tax-deductible gifts are available with different kinds of accounts.

Some of the most important Benefits of Solo 401(k)s include:

- Easy to administer

- Can contribute a higher percentage of income than IRAs

- Accounts can be self-directed for more investment flexibility or”checkbook control”

- Possible for lending part in Order to borrow from assets

- Contributions are tax-deductible and grow tax-free

- lower prices than Conventional 401(k)s

- Can be converted to accommodate prospective workers

- Business owner’s spouse could participate

- Since the employer and employee will be the Exact Same person, gifts are aggregated, instead of being segregated into deferrals, matching and profit-sharing

Disadvantages of a Solo 401(k)

There are also some downsides to Solo 401(k)s that you need to know about. These pitfalls include having stricter compliance requirements compared to IRAs, which can be one of the principal options you might be looking at in the event that you qualify for a Solo 401(k).

- More compliance requirements than IRAs

- Higher potential administrative prices

- Must file annual Form 5500 after your account has more than $250,000 in assets

- Can only be utilized by self-employed or businesses with one full-time employee

“Setting up a Solo 401(k) is not as complex compared to a Traditional 401(k) and not as costly. Assuming you (and perhaps a partner ) are the only worker, the Solo 401(k) can be a great option to help minimize your taxes. Solo 401(k)s are not much more work to start than the IRA or a SEP.. The advantages are more than just a little additional work. Larger contributions imply larger tax deductions.”

— David Rae, CFP, AIF, Financial Planner, DRM Wealth Management

Alternatives to a Solo 401(k)

A Solo 401(k) is not right for many self-employed people. If you make more than $75,000 annually or can afford to donate a couple thousand dollars per year, you might gain more from another kind of accounts such as a SEP or a Traditional IRA. Both offer benefits and, because they’re IRAs, they prevent the administrative costs of a 401(k).

SEP IRAs

Opening a SEP IRA could be a terrific alternative for self-employed people and small business owners who intend to contribute around 25 percent of revenue or $55,000. SEPs are a superior option if you make more than $75,000 per year, do not plan to employ any employees in the long run and want to prevent the headache of administering a 401(k).

Traditional IRAs

Traditional IRAs are the most inexpensive kind of retirement account and the easiest to set up. But at just $5,500 per year Traditional IRAs also have contribution limits far lower than other kinds of retirement accounts. Traditional IRAs are great alternatives for small business owners who wish to contribute a few million dollars every year and can’t afford to match employee contributions or discuss gains.

You can read our article on small business retirement programs to find out more about Traditional IRAs, SEP IRAs, and other popular choices.

Frequently Asked Questions (FAQs)

What is a Solo 401(k)?

In other words, a Solo 401(k) is a 401(k) with just one participant — the company owner (and his or her partner ). However, Solo 401(k)s have the exact same contribution limits as routine plans in addition to more investment flexibility and fewer government requirements since there aren’t additional participants.

Could You Proceed an IRA Into a Solo 401(k)?

It’s likely to transfer funds from an IRA to a Solo 401(k) as long as it’s not a Roth IRA. However, it may not be a good idea to roll IRA assets into a Solo 401(k) unless you are utilizing a low-cost Solo 401(k) provider and may benefit from the cost savings of consolidating accounts.

Can You Establish a Solo 401(k) on Your Own?

Preparing a Solo 401(k) in your own is possible provided that you meet the following three criteria:

- You have your own business

- You are not eligible for a 401(k) with the other company

- You have income from your own business. If you do not have pretax income, then you can not contribute to a Solo 401(k).

However, we advise that you use a Solo 401(k) provider to be sure you prepare the plan correctly and to allow you to discover the very best investment opportunities.

Can You Contribute to a Solo 401(k) and an IRA?

It’s likely to contribute to either a Solo 401(k) and an IRA so long as your aggregate contributions do not exceed annual limitations. But if you’ve a Solo 401(k) and an IRA, then you’re most likely paying duplicate costs you could prevent by removing one of these.

How Much Can You Contribute to a Solo 401(k)?

The Solo 401(k) contribution limit for 2018 is $55,000. However, you can’t contribute more than your pretax income in a particular year.

Bottom Line

Solo 401(k)s can only be used by business owners without a fulltime employees. A Solo 401(k) can offer many benefits, particularly in the event that you make less than $75,000 or wish to borrow against your plan assets. How to prepare a Solo 401(k) is relatively straightforward. Once you decide on a strategy and pick a provider, it can assist with the remainder.

Among the most significant steps in setting up a Solo 401(k) which meets your unique requirements is picking the ideal provider. If you want to find out more about good providers of Solo 401(k)s, be sure to check out our article on the Best Solo 401(k) Providers for 2018.