SIMPLE IRAs are employer-sponsored retirement programs that allow workers and companies to save around $25,000 in pre-tax contributions each year. The process for setting up a SIMPLE IRA is simple and inexpensive once you’ve determined your eligibility. The right provider will assist you to complete types, get employees enrolled, and administer your plan.

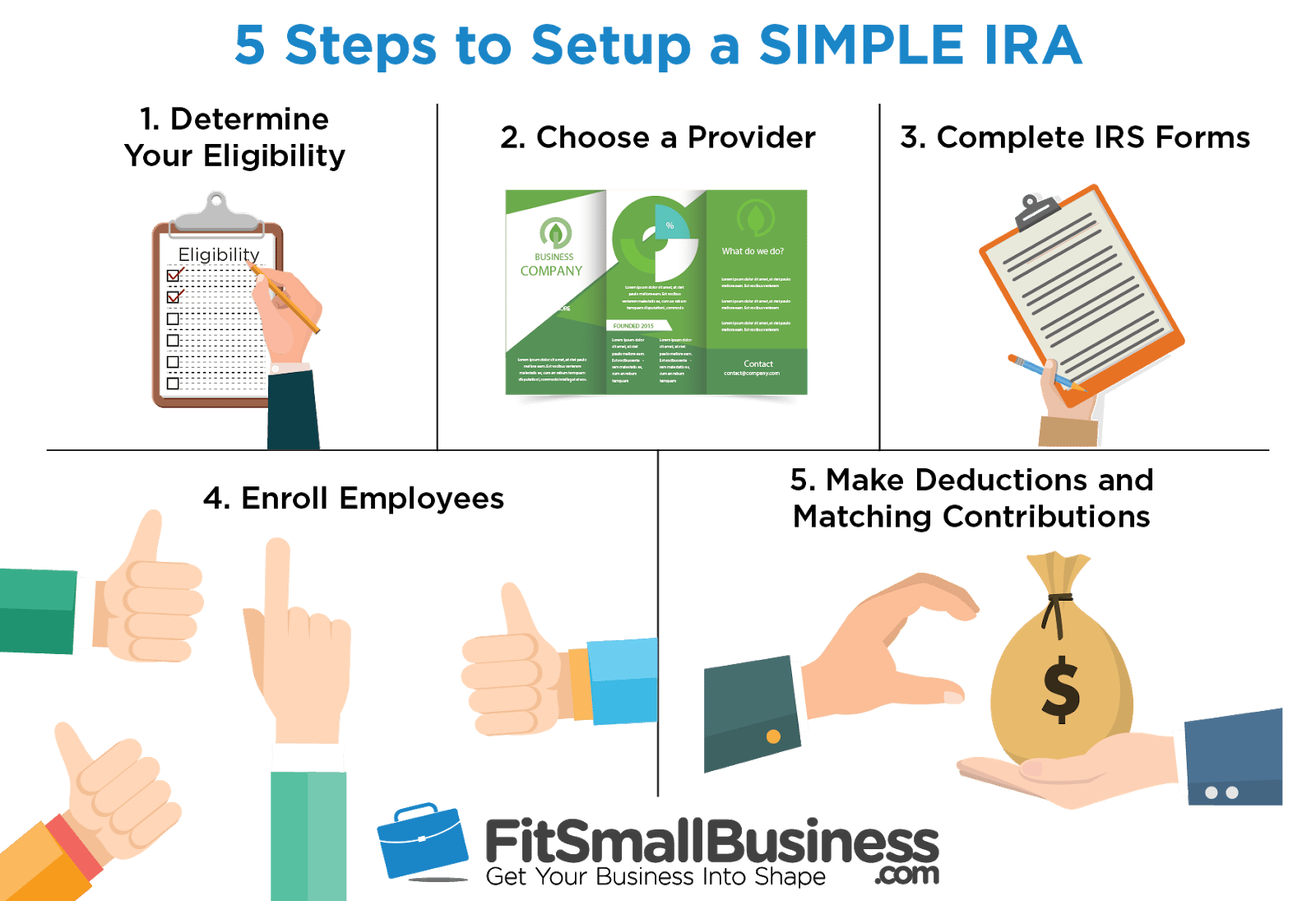

The 5 steps to establishing a SIMPLE IRA are:

1. Ascertain SIMPLE IRA Eligibility & Benefits

SIMPLE IRAs are incredibly beneficial for some business owners with fewer than 100 employees. They allow workers to make salary deferrals up to $12,500 annually, which you must match dollar-for-dollar involving 1% — 3%. For a SIMPLE to be proper, you should plan to personally contribute between $5,500-$12,500 annually and shouldn’t mind mandatory matching.

In addition to deferrals, you can gain share another $12,500, for a entire contribution limit of $25,000 each year. All profit sharing and company game is tax deductible. If those numbers make sense to you, then you are eligible to open a SIMPLE IRA but have to do this before October 1st of the current year for it to take effect that year. But, there are many other retirement programs out there which could be better, based on your specific situation.

A few cases where you may find another account form better than a SIMPLE IRA include:

- SEP IRA — If you have fewer than 3-5 workers, SEP IRAs possess higher contribution limits at $55,000 annually.

- Traditional 401(k) — Business owners who have more than 3-5 workers and do not wish to be asked to match contributions should look at setting up a 401(k).

- Safe Harbor 401(k) — Safe Harbor plans would be the cream of this crop. They’ve requirements for matching employee deferrals, but make it very easy for you to maximize yearly contributions and help you donate massive amounts without strategy compliance testing.

We discuss alternatives in further detail at the end of the article. If you’re looking for more information about what SIMPLE IRAs are and how they work, have a look at our ultimate guide on SIMPLE IRAs. Otherwise, read on for the remaining steps on how best to open a SIMPLE IRA.

Who SIMPLE IRAs Are Right For

SIMPLE IRAs are perfect for smaller businesses which are still rising or aren’t yet highly profitable. Business owners are able to use SIMPLEs to promote employee savings with no administrative costs of 401(k)s. SIMPLE IRAs contribution limits overall $25,000 at deferrals and matching — lower than 401(k)s still sufficient for many small business owners.

To qualify for a SIMPLE IRA, you must have fewer than 100 workers and match employee deferrals dollar-for-dollar up to 3%. For a SIMPLE to be appropriate for your business, you need to have over 5-8 workers and need to donate more than $5,500 annually for yourself.

Pros & Cons of SIMPLE IRAs

SIMPLE IRAs provide a number of advantages for employers, but they also possess some exceptional drawbacks. It’s important to think about both when determining if or not a SIMPLE IRA is right for you.

Experts of a SIMPLE IRA

SIMPLE IRAs have a number of benefits such as:

- No government costs — SIMPLE IRAs provide lots of the very same advantages as 401(k)s without the prices

- Employers only fund fitting — employing a SIMPLE IRA, employers are only required to match employee salary deferrals up to 3%. This is a lot more cost-effective than the SEP for small business owners with more than 1-2 full-time workers

- Investment flexibility — Like other IRA options, SIMPLE IRAs offer more investment flexibility than many 401(k)s

- Higher contribution limits than Traditional IRAs — Workers can give a total of $25,000 annually — $12,500 in deferrals and an additional $12,500 from matching, much greater than the $5,500 limitation for Traditional IRAs

- No compliance testing — Many retirement programs are subject to annual compliance testing to ensure that contributions and plan assets do not become out of balance. SIMPLE IRAs Aren’t subject to this testing

Cons of a SIMPLE IRA

Besides their advantages, SIMPLE IRAs also have some drawbacks, such as:

- Every worker who earns $5,000 per year is eligible — Employers should provide SIMPLE IRAs to all qualified employees, which will be anybody who has earned $5,000 in a calendar year and is required to match these employees between 1-3%.

- Mandatory employer contributions — Employers must (1) contribute 2% of each worker’s salary, whether they donate, or (2) match employee contributions on a dollar-to-dollar between 1%-3% of their wages

- lower participation limitations than SEP IRAs and 401(k)s — Where SEPs and 401(k)s allow up to $55,000 in annual donations, SIMPLE IRA participants are limited to $25,000 in total annual contributions involving salary deferrals and employer matching

- Strict obligations — SIMPLE IRAs have to be set up until October 1st of the year that they take effect. Unlike some other types of IRAs, prior-year contributions aren’t permitted at SIMPLE IRAs.

2. Choose a SIMPLE IRA Provider

Once you’ve decided on a SIMPLE IRA, setting one up is fairly easy. The first and biggest decision is choosing a supplier. The task of picking a provider is comparatively important because different providers have different investment options, fees, and commission structure. What is more, your supplier will typically walk you through the remaining steps to establishing a SIMPLE IRA.

Some of the best SIMPLE IRA providers include Vanguard, Schwab, and Fidelity. As some of the best SIMPLE IRA providers, each offers their own benefits and drawbacks. Let’s now take a closer look.

Vanguard vs. Schwab vs. Fidelity SIMPLE IRA

When choosing a provider, familiarize yourself with their commission arrangement, commissions, and available investment choices. It’s critical to get the right balance between strategy cost and flexibility to attain your goals. Vanguard, Schwab, and Fidelity are some of the most reputable SIMPLE IRA suppliers available, but only one will be best for you.

| Vanguard | Schwab | Fidelity | |

|---|---|---|---|

| Account prices | $25/year per finance (waived for customers with over $50,000 in invested assets) | Not one | $25/year per account |

| Investment Options | Mutual funds only | Mutual funds, stocks, bonds, ETFs and much more. | Mutual funds, stocks bonds, options, ETFs and much more. |

| Transaction Fees | Only if you buy loaded shares. Otherwise, investors are only charged mutual fund expense ratios that typical only 0.12% per year | None for Schwab mutual funds

$4.95 per US stock trade (buy or sell) $76 per mutual fund buy (purchase only) |

None for Fidelity mutual funds

$4.95 per US stock exchange (buy or sell) $50 per non-Fidelity mutual fund (purchase only) |

| Experts | Vanguard gets the best low cost mutual funds. Their customer service is also perfect for novices. | Completely free to start an account.

Wider choice of investments, such as stocks |

Wider selection of investments, including stocks. |

| Disadvantages | No shares, bonds, or ETFs offered for SIMPLE IRAs | Perhaps not the best selection of mutual funds. You are able to put money into non-Schwab funds, but with a $76 fee | Not the very best selection of mutual funds. You can invest in non-Fidelity money, but with a $50 fee |

| www.Vanguard.com | www.Schwab.com | www.Fidelity.com |

Vanguard SIMPLE IRA

Contrary to Schwab or Fidelity, Vanguard is merely a mutual fund firm — the largest in the world, but still only a mutual fund company. Though Vanguard does not provide any extra services such as banking or brokerage services, they have the largest array of in-house mutual funds for account holders to choose from.

If you want to provide your employees a”hands off” SIMPLE IRA investment choice, Vanguard is the way to go. They’re famous for having some of their best and lowest-cost mutual funds with expense ratios as low as 0.12% that are well-diversified and professionally-managed on your behalf. As opposed to managing a single portfolio individual bonds and stocks, workers can invest in only a few mutual funds and let the managers choose particular stocks.

Vanguard is also the best option for target date funds, that are mutual funds designed specifically for retirement. Target date funds are designed to provide you the optimal balance of shares and bonds depending on your age. According to an analysis by BeginToInvest, Vanguard defeats Schwab, Fidelity and T. Rowe Price when it comes to goal date funds with lower fees (expense ratios) and also a lesser required minimum balance.

Vanguard provides its own customer service on the internet and over the phone — in addition to promoting its capital by financial advisors who can help clients one-on-one, but Vanguard can’t give customers the same access to direct in-person advice that Fidelity offers.

If you would like to provide your employees more control over their investments, like the ability to trade individual stocks, Vanguard is not a good option. Vanguard SIMPLE IRAs are limited to mutual funds only, whereas Schwab and Fidelity offer a massive assortment of investments, allowing account holders to trade individual stocks, bonds, or ETFs.

Schwab SIMPLE IRA

Charles Schwab is a diversified financial services firm that supplies a whole menu of private and business banking services along with securities brokerage, wealth management, and insurance solutions. While the company doesn’t charge for investing in its mutual funds, there are charges if you decide to invest in different options.

These fees include:

- Commissions on Trades — Any time you purchase, sell, or trade, you’re going to be charged a commission starting at $4.95.

- No Commissions on Schwab ETFs — in the event that you simply invest in Schwab ETFs, then you will not be charged commissions, otherwise, you are going to need to pay any penalties particular to the non-Schwab ETF you want.

- Expense Ratio on Funds — While Schwab waives commissions on trading in mutual funds, mutual funds also charge expense ratios to pay the expenses of trading and management. While 1.5percent is the typical expense ratios for accessible third-party funds, Schwab’s proprietary index funds have expense ratios of below 0.1percent per year.

One of the greatest advantages into account holders is Schwab’s network of offices in a lot of communities around the nation that are staffed by financial professionals who can provide in-person advice. If you are thinking about using a full-service broker firm to your SIMPLE IRA, then you will find an advantage with Schwab because they don’t have any annual account fees.

Fidelity SIMPLE IRA

Like Schwab, Fidelity is a securities brokerage firm which allows account-holders to invest in securities, providing access to thousands of additional options. Like Schwab, Fidelity also has a nationwide network of offices which Vanguard does not. Fidelity also has lower transaction fees — which can be beneficial if you plan to do a lot of trading.

A number of those fees include:

- Commission prices — $4.95 per trade for US equities, $1 per bond for US bond trades

- International Fees — Commissions for trading stocks in 25 foreign markets that vary by country

- Additional Fees for Wire Transfers and other services — Fidelity costs $10 for cashier’s checks, $15 for returned checks, $10 for bank wires pioneered online, as well as 3% for overseas cables

- ETF and Mutual Fund Expense Ratios — Mutual funds and ETFs offered through Fidelity possess their own expenditures which pay trading and management expenses. They start as low as 0.035% for Fidelity Index Funds.

Fidelity also features an array of additional financial services. The downside is this can get complicated for employees that are new to investing, and the costs can quickly add up for those who aren’t careful.

After choosing a provider, the remaining measures are generally contained into account applications and other documents, and suppliers will walk you through them effortlessly. That is why it’s important to decide on the best one for your situation.

3. Total IRS Types

To set up your SIMPLE IRA, there are a variety of forms you need to fill out. Some are specific to your provider, while the IRS needs to fill out one of 2 specific forms offering details on your SIMPLE IRA. As you don’t have to submit this form to the IRS, your supplier may request a copy.

The two IRS forms, of which You Will Need to finish one, include::

- IRS Type 5305-SIMPLE — Choose this form if you plan to establish a designated bank to receive your employees’ funds. (Most Frequent )

- IRS Type 5304-SIMPLE — Choose this version if your workers will get to decide where they deposit their capital. (Less Frequent )

A few of the details you will need to disclose include who’s qualified, when you’ll make employer contributions, and what donation program you are likely to use. In Selecting a company contribution model, you’ll need to Select between 2 SIMPLE-specific options, such as:

- Employer fitting — You can choose to match employee salary deferrals dollar-for-dollar up to 3 percent. You are able to reduce the game for as little as 1 percent, but can not lower then match from 3 percent for more than 2 of the previous 5 years

- Nonelective employer contributions — you’re able to contribute 2% of each employee’s pay to their SIMPLE account, regardless of whether they donate themselves

4. Enroll Employees

SIMPLE IRAs could be established between January 1 and October 1st. Once employed, all eligible employees should get plan disclosures including wages reduction choices and company contributions. Page 3 of both IRS documents above provide convenient forms for this purpose.

The webpages outline SIMPLE IRA plan information and ask workers for their contribution amounts. Again, you do not need to submit this form to the IRS. You just have to have it filled out, then file it for safekeeping.

Typically, your plan provider can help you through this procedure, making it painless and quick for you the business owner. When picking a provider, ensure that they’ll have the ability to assist you enroll all workers so you remain consistent with the IRS.

“The biggest negative if you have workers is establishing a SIMPLE IRA accounts for each individual employee. Unlike a 401(k), where there’s a master accounts and the employee is just making an investment election, in a SIMPLE IRA workers have individual accounts so account set-up is a longer process.” -Richard Reyes, CFP, President, The Financial Quarterback

5. Create Deductions and Matching Contributions

Once your accounts are set up, the last step is to prepare your payroll system so it can begin making automatic salary deferrals for employees and program employer contributions. Remember that employees are donating devoting bucks to their accounts. You have to deduct payments and send them for the investment provider before you process payroll taxes — differently, these deductions will be exposed to payroll taxes.

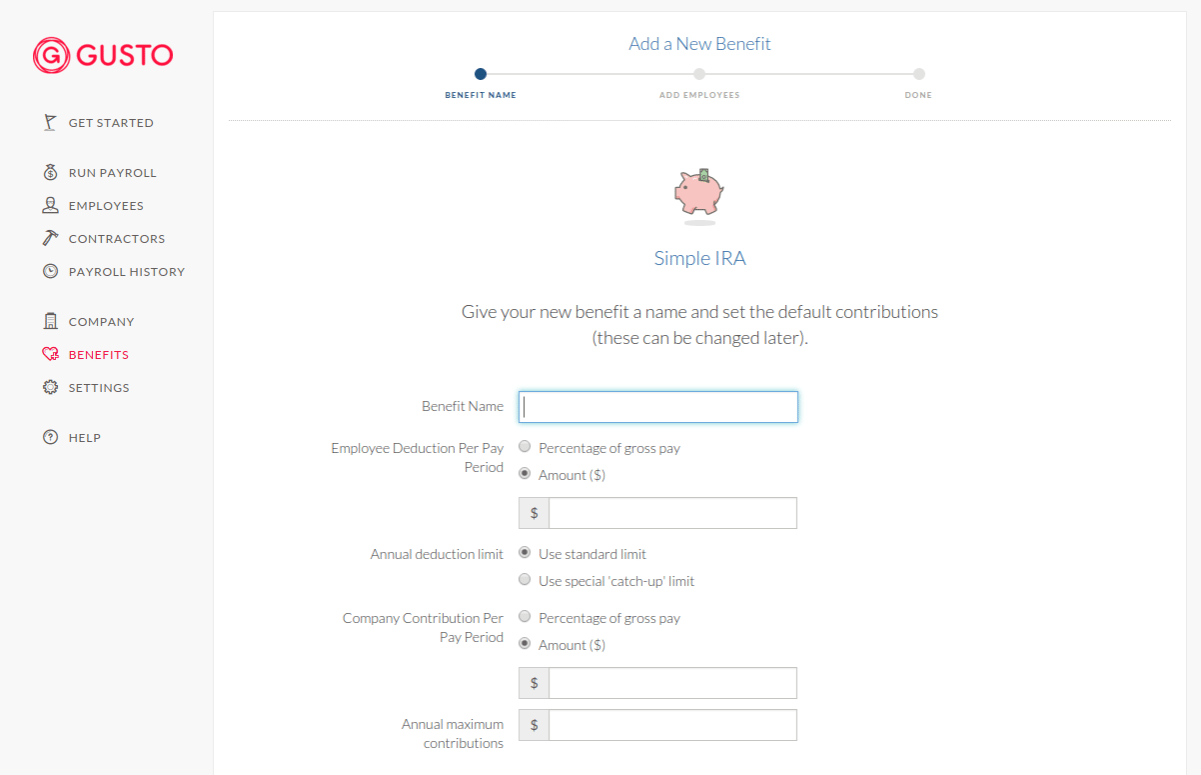

Whether you choose to meet employee deferrals or contribute 2% irrespective of employee participation, payroll software can allow you to set up automatic gifts. Even if you opt to contribute 2% to every employee (if they participate or not) you will still need to allow for employee deferrals, which are made easier with software.

Set Up Your Payroll System for Deductions

The easiest way to prepare your SIMPLE IRA for automatic donations would be to add this advantage through your payroll system. Using an app like Gusto, the system will automatically subtract each worker’s contribution as well as the employer game. The system may also monitor and stop donations once you reach your yearly limit.

Visit Gusto

Alternatives to a SIMPLE IRA

If it seems like a SIMPLE IRA may not be the right match for your small business, make sure you carefully look at some other alternatives. A recent poll showed that 56 percent of Americans believe all IRAs are the same, but contribution limits vary in different programs, as do filing and participation deadlines, government costs, and investment flexibility.

SIMPLE IRAs vs SEP IRAs

The contribution limits of a SEP are 55,000 annually — more than twice those of a SIMPLE IRA. To be able to utilize a SEP IRA, employers are required to fund donations for all employees proportional to their own contributions. Unlike a easy, prior-year contributions are permitted in a SEP — in actuality, they are standard practice.

SEP IRAs are a terrific option for solopreneurs and small business owners with less than 3-5 employees. If you do not have any employees and are seeking to set up a retirement plan just for yourself (or a spouse), consider a SEP IRA. For more information, check out our detailed guide on SEP IRAs.

SIMPLE IRA vs 401(k)

A SIMPLE IRA is often called a poor-man’s 401(k), with good reason. Of the choices, SIMPLE IRAs are most like 401(k)s. They make provisions for employee salary deferrals and employer matching contributions. However, the gaps are numerous.

First, the total contribution limits of $55,000 in a 401(k) are more than twice the $25,000 permitted in a SIMPLE IRA. Unlike SIMPLE IRAs, companies using a 401(k) have some flexibility in structuring a match, in which SIMPLE IRA users should choose between two alternatives. Also, SIMPLE IRAs don’t have a supply for profit-sharing contributions.

Last, and possibly most significantly, is the administration price. SIMPLE IRAs cost virtually nothing to administer, while 401(k)s have costs related to plan administration, yearly testing (to which SIMPLE IRAs aren’t subject), recordkeeping, and custodian fees — not to mention the expenses of fitting contributions and any profit-sharing.

Generally, 401(k)s are much better for more established companies, whose owners wish to donate more than $25,000 per year and may afford the higher government expenses. But if you’re okay with the limitations of a SIMPLE IRA, it’s a much easier option for small business owners. For more information, check out our article on the best 401(k) providers.

SIMPLE IRA vs Traditional IRA

Compared to a SIMPLE IRA, Traditional IRAs have considerably lower participation limits — only $5,500 annually, or $6,500 if you are 50 or older. Where other programs offer options for employer matching or profit-sharing, Traditional IRAs are financed entirely by workers — there is not any match or profit-sharing. Employees each have to prepare their very own; but they can choose their own providers, investment options, and donation schedule. Prior-year contributions are permitted in Traditional IRAs.

Anybody who’s eligible for an employer-sponsored retirement program is ineligible for a Traditional IRA, but as a supplement when their donations to a employer-sponsored plan fall short of their Traditional IRA limit. Traditional IRAs are perfect for individual contractors and small businesses that can not afford to match employee contributions. They are also beneficial for business owners that can not donate more than $5,500 per year.

The Most Important Thing

SIMPLE IRAs are amazingly beneficial retirement plans due to their low cost and relative ease of set up. Employers can also claim a tax deduction of 50% of their qualified startup costs around $500. Using a SIMPLE IRA, employers can incentivize worker saving by providing matching gifts, as well as considerable investment flexibility for participants — all without the administrative expenses of a 401(k).