Retail financing helps increase online sales by up to 18% based on PayPal Credit, the new name for PayPal’s Bill Me Later service. Whatever the title, the idea is exactly the same; PayPal Credit and many others such as Blispay, Bread, and Affirm allow your online shoppers buy now and pay later. On top of that, it’s secure for you.

If you’d like to increase earnings by providing Some Form of bill me later retail financing to your own ecommerce shoppers, this guide details the Whole process and shows You How You Can get started

Before we dive in, have you heard of Blispay? Blispay provides customer financing that is free for merchants and may be used by any retailer or online seller who accepts Visa payments. Well-qualified borrowers can get approved in minutes for up to $10,000 and use the financing for in-store or online purchases. Sellers big and small can easily get up and running using Blispay at a little just 1 day.

See Blispay

The Way Retail Financing Works for Online Stores

The terms retail financing, bill me later, instant credit, and special financing refer to ways that customers can buy products today but cover them afterwards. Large retail chains and big box stores often have their own in-house invoice me after type customer financing applications. But a growing trend for both retail shops and ecommerce vendors big and small is to take part in a retail funding program such as Blispay.

With those programs, all that is required of vendors is presenting the retail funding option to shoppers. Retail stores can do this via point-of-sale displays and promotion, while online vendors can exhibit the funding option on various web pages, in marketing, and and through checkout, such as this:

Source: R. Co.. Elements & Blispay

We are going to investigate this and other kinds of retail funding programs available to internet sellers in detail below. But what you really must realize is that with every one of these apps, offering funding is as easy as accepting any other form of online payment. Funding providers incorporate seamlessly with ecommerce platforms to offer shoppers an alternate payment option. During checkout, shoppers apply, get verified, and are approved without interrupting the checkout flow. When the purchase is completed, you are paid as normal. Here’s the entire process in a nutshell:

It is the retail lending suppliers, not youpersonally, that take on the credit risk, billing, and collection headaches (if applicable). You get paid at the time of purchase just as you would any other kind of payment. Nice!

How Retail Financing Increases Online Sales

Offering shoppers the choice to purchase now and pay later with incentives like 0% interest and 6 weeks to pay closes more sales and also encourages buyers to improve their purchase. And we’re not talking only off-the-shelf things, either. With most providers, funding terms apply to the full sale, not just specific items, so shoppers could receive funding on everything from televisions to toilet paper.

Most retail funding offers have a minimum purchase value for promotional charge conditions, such as $199 with Blispay and $99 with PayPal Credit. The upside for sellers is that this encourages shoppers to improve order sizes to become exceptional terms, which leads to higher order values.

Online sales conversion and satisfaction numbers show the attractiveness of retail funding, also. According to a comScore survey conducted by PayPal Credit, shoppers benefiting from retail funding:

- Earn more purchases: 30% of PayPal Credit buyers wouldn’t have been likely to buy with no 6-months-to-pay financing deal.

- Make bigger purchases: 30 percent of PayPal Credit buyers spent more than initially planned after studying about the 6-months-to-pay financing deal.

- Wish to use PayPal Credit again: 93 percent of first-time PayPal Credit buyers would probably utilize PayPal Credit again in the future.

- Would urge PayPal Credit: 94% of PayPal Credit buyers would likely recommend PayPal Credit to others.

— Data from PayPal Credit and Forrester Research, learn more here

Retail Financing Options for Online Stores

We have mentioned PayPal Credit and Blispay already, but there are several other players in the internet retail financing sphere. When considering retail financing alternatives for your e commerce store, you have many providers to choose from, but all fall under two complete funding versions: deferred payment or payment plan. Sellers are paid upfront with every, but they work differently from the customer’s point of view.

Following is a look at both funding models in detail, and some top providers to consider for each.

Deferred Payment Retail Financing for Online Stores

Secured payment financing lets shoppers buy now but pay inside a window of time. Typically, if the complete amount is paid within that window, then no interest is charged. Blispay and PayPal Credit both offer deferred payment financing in the form of 0% interest and 6 weeks to cover. Here is how these two providers compare in more detail:

| Deferred payments funding supplier | Best for retailers who | Buy & funding conditions | Merchant prices |

|---|---|---|---|

| Blispay | Accept Visa | No Payments, No Interest on purchases over $199 if paid in full in 6 months. | Your average Visa payment fee |

| PayPal Credit | accept PayPal | No Payments, No Interest on purchases over $99 if paid in full in 6 months. | Usual PayPal fee 2.9% + 30cents/ transaction |

Here’s a closer look at each:

Blispay

Best For: Shop retailers and online sellers of all sizes that take credit cards

Merchants Must: Accept Visa

Clients Must: Apply for Blispay charge before or during checkout

Merchant Cost: $0 for support, runs under your normal Visa processing charges

Special Terms: No Deposit, No Interest on all purchases over $199 if paid in full in 6 months

Checkout Integration: None required, Blispay processes like any other Visa payment

Get Started Here: Blispay Merchant

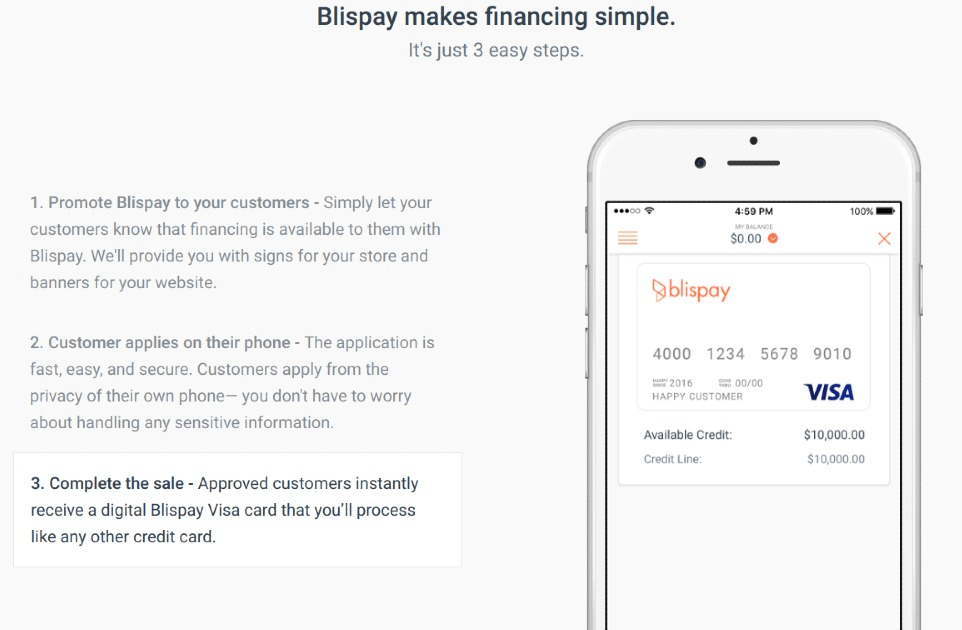

Source: Blispay

If you accept Visa payments, you can provide your clients Blispay credit. It is that simple. Blispay set out to make a retail funding alternative which makes it easy for many types and sizes of vendors to offer financing, and the application is a runaway success. In fact, there’s really no reason to not offer you this multichannel-friendly financing solution to your shoppers. All you need to do is promote Blispay as a distinctive financing payment alternative in-store or on your website. No special integrations, no added payment method, no learning curve.

Shoppers see the Blispay offer and can apply via computer or cell phone. Upon immediate acceptance, they receive a digitally delivered Blispay Visa funding card number to use to complete their payment in-store or in your website. The payment processes with your normal Visa payments, you get compensated, and your client does not have any Deposit, No Interest on all purchases over $199 if paid in full in 6 months. Blispay is perhaps the simplest way to provide retail financing to online and in-store shoppers, period.

PayPal Credit

Best For: Online sellers that accept PayPal payments

Merchants Must: Accept PayPal

Clients Must: Have a PayPal Account and use for PayPal Credit during checkout

Merchant Cost: $0 for service, you’re billed typical PayPal charges: 2.9% + 30cents/transaction

Particular Terms: No Payments, No Interest on purchases over $99 if paid in full in 6 months

Checkout Integration: All PayPal Payments enabled shopping carts

Get Started Here: PayPal Credit Merchant

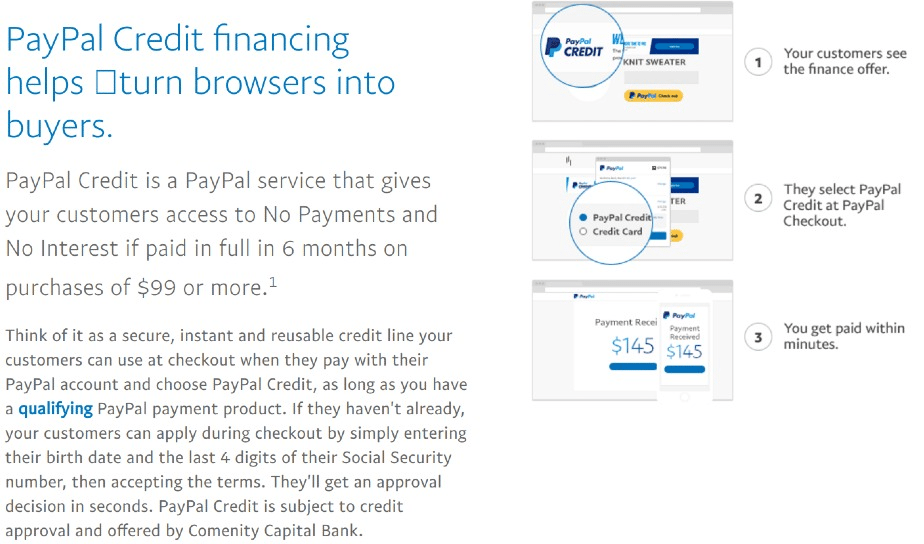

Source: PayPal

If you accept PayPal Payments or use PayPal as your own online store’s payment gateway, then you can offer your clients PayPal Credit. It is that easy. When they don’t have a PayPal account, shoppers will need to create one to access PayPal Credit, but PayPal makes this simple and quick also.

PayPal Credit works within your normal checkout stream for PayPal, including PayPal Payments Standard, Advanced, Pro, and PayFlow payment gateways.

Both Blispay and PayPal Credit work with any size seller, so they are perfect ways for small businesses and startups to provide retail lending to shoppers. You can even provide both choices to your buyers if you wish. However another choice, payment strategy retail funding, functions differently and is geared toward sellers who want to have more control over their promotional offers.

Payment Plan Retail Financing for Online Stores

Payment strategy retail funding lets shoppers cover purchases over time together with set payments each month. Basically, these are installment loans that your retail financing supplier makes to your shopper. You, the seller, are paid up front less your transaction fees, and the buyer pays off the purchase following the payment program they pick at the time of purchase.

Payment plan financing provides longer payment terms, such as 12, 24, and 36 months to cover, with lesser interest in comparison with deferred payment plans like PayPal Credit and Blispay. These usually apply higher interest rates in case shoppers’ purchases are not paid off over 6 months.

Longer payment windows and lower interest rates create payment plan funding a great sales tool for vendors of big-ticket things like furniture, electronics, and luxury products. The only real drawback is that these financing providers typically work with stores grossing over $2M annually. But most sellers of goods that match this funding model don’t have any trouble meeting that sales minimal. Here’s a look at two top names for This Kind of retail funding:

| Payment strategy financing supplier | Finest for retailers who | Buy & financing terms | Merchant costs |

|---|---|---|---|

| Bread | Want to Supply a seamless self-branded financing expertise | Installment payments based on amount financed | Transaction fee based on strategy, starts around 3.1percent of sale |

| Affirm | Wish to offer payment plan funding for a payment option | Varies based on amount financed and payment strategy selected | Transaction fee based on strategy, begins around 3 percent of sale |

Here’s a closer look at both of these payment plan-type retail financing suppliers:

Bread

Best For: Online vendors who need a self-branded financing program

Merchants Must: Average around $2M/yr. In gross sales

Clients Must: Apply for GetBread charge on your site or during checkout

Merchant Cost: Transaction fee based on strategy, begins at 3.1percent of sale

Particular Terms: 0% APR Promos, customers choose payment plan at approved interest rate

Checkout Integration: Integrates into your checkout

Get Started Here: Bread

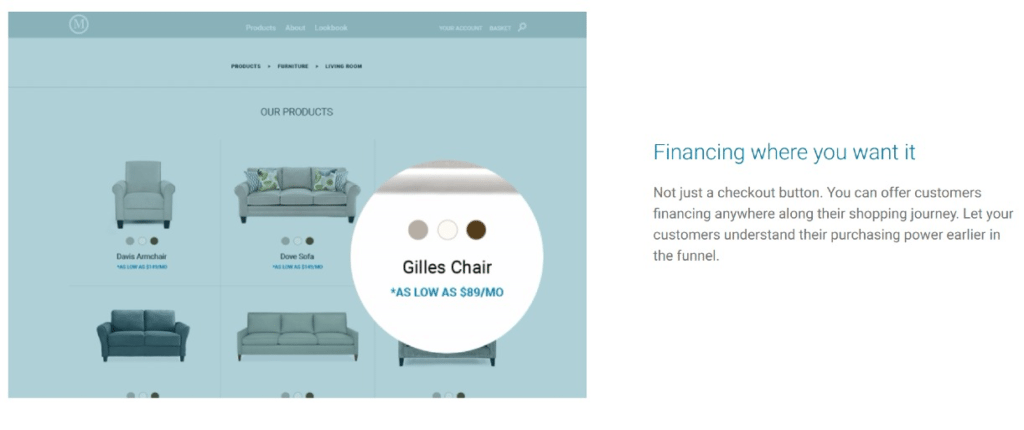

Source: Bread

Bread incorporates into your online store seamlessly so customers can research their funding choices anytime as they shop your website. It incorporates in a white tag manner, meaning it closely ties in with your manufacturer so you don’t see Bread’s name on your goods or checkout pages where funding is cited. On top of that, shoppers apply and receive approval right on your own website. They are not taken to another website in order to apply.

Bread provides retail financing provisions all the way out to 36 weeks. Should you sell larger ticket items such as furniture or luxury goods, this can make a difference in conversions since it lowers your customers’ monthly payments. Bread also enables you to manage finances offers, eligible products, promotional APR’s, and more to help drive earnings.

Bread prices a merchant fee beginning at 3.1% of the total financed purchase, but does not have any startup fees. They generally concentrate on companies selling over $2M annually, but they’re flexible, so don’t hesitate to call them if you fall just under this amount.

Affirm

Best For: Online vendors who want an integrated promotional lending program

Merchants Must: Typical around $2M/yr. In gross earnings

Clients Must: Apply for Affirm charge prior to or during checkout

Merchant Cost: Transaction fee based on plan, starts around 3% of sale

Particular Terms: 0 percent APR Promos, clients choose payment plan at approved interest rate

Checkout Integration: Integrates into your checkout flow

Get Started Here: Affirm Merchant

Source: Affirm

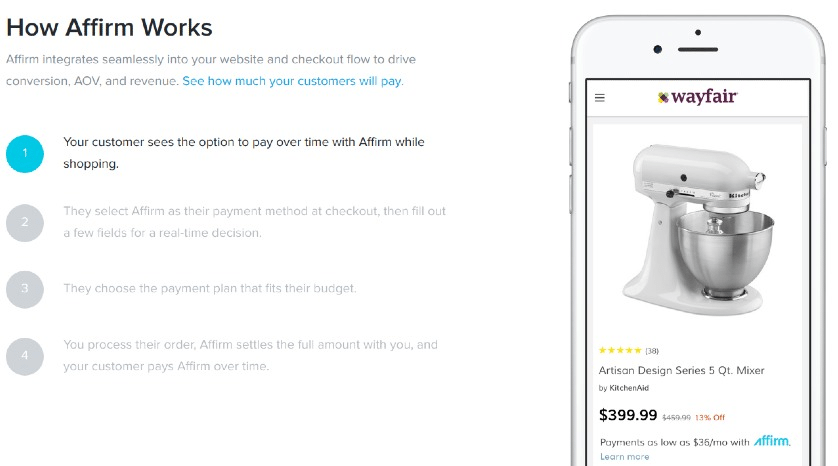

Affirm integrates into your online store to display Affirm as a retail financing option on your product and checkout pages. Like Bread, Affirm needs more setup than Blispay and PayPal Credit because it directly integrates with your online shop. But that guide integration allows clients explore payment programs as they store and gives them the flexibility of paying larger-ticket purchases over timeup to 24 months.

Affirm also gives you tools to manage financing offers, eligible products, promotional APR’s and much more to help drive sales. Affirm charges a merchant fee per financed sale that fluctuates based on the deals you offer your shoppers. Fees start at around 3 percent of the sale amount and, like Bread, there are no startup or onboarding fees. They also concentrate on companies that sell over $2M annually.

The Most Important Thing

It’s a simple fact that retail financing and invoice me after payment options drive more and higher value online earnings. Any dimension vendor, from startups to those moving millions per year, can benefit from this trend utilizing popular invoice me later suppliers Blispay and PayPal Credit. Blispay functions for almost any in-store or internet retailer who accepts Visa, while PayPal Credit requires vendors to take PayPal. That’s all the criteria you have to meet. Both are a cinch to set up and add to your existing checkout and everything you’ve got to do is promote the funding choice.

Other suppliers such as Bread and Affirm fully integrate with your shop so you can offer customers a vast range of long-term payment strategies at varying promotional prices. However, these providers charge added per-transaction fees and are really geared for sellers who need a hands-on, self-managed funding solution. Plus, they tend to have an entry threshold of $2M in annual earnings.

Either way, ecommerce sellers big and small have access to appealing, cheap and, best of all, risk-free retail funding to help drive earnings. With no upfront costs and simple integrations, there’s really no reason not to try them out.

Can you offer retail funding or bill me after payment choices to your shoppers? Which providers would you prefer? Please share your thoughts and experiences in the comments below.

Visit Blispay