Retail analytics provides the data behind each trade and interaction that occurs in your shop. Metrics like revenue per square foot, gross margin, foot traffic, walk-in pace, and comparable sales growth tell the narrative of your store and allow you to make profitable decisions. Advertisers turn into point-of-sale (POS) systems to monitor 10 important analytics points which we investigate below.

Point of sale (POS) systems such as Lightspeed POS have analytics built-in to every transaction you make. Revenue mechanically reduce inventory, purchases are tracked per-customer, profits calculate in real time, and trend and comparison reports are available at the touch of a button. If you don’t use it , test-drive Lightspeed POS for free today.

Visit Lightspeed

Now let’s research 10 essential retail analytics which every store operator should track, the way to compute them, and exactly what they mean to your bottom line.

1. Revenue Per Square Foot

What can it be?

The average quantity of revenue earned per square foot of selling area.

How to Calculate it?

Total In-Store Sales / Selling Area (in Square Feet)

Take your overall in-store sales– typically for a year– and then divide this by your square footage of selling space. This excludes back areas such as your stockroom, office, and employee lounge.

What Does it Tell You?

Revenue per square foot monitors how well you are utilizing your retail area or displaying products to increase earnings. Whether you are comparing year-over-year, month-over-month, or comparing your pace to other shops in tracks your business, this retail metric acts as a”score” for your visual merchandising.

Average Sales per Square Foot for Major Retailers

| Store | Sales per Square Foot (Annual) |

|---|---|

| J.C. Penney | $165 |

| Vitamin Shoppe | $455 |

| CVS | $666 |

| Coach | $1,183 |

| Apple | $5,546 |

Source: Motley Fool, Emarketer and Retailsales.com

Most small retailers should plan for at least $500 in annual sales per square foot, however, this will vary widely depending upon your industry. Broadly , stores which sell consumables, hardware and other essential goods are going to have lower earnings per square foot, since their products are less valuable compared to the total amount of space they consume. Boutiques and electronics stores will have the highest sales per square foot because their products are small and expensive.

2. Gross Margin

What is it?

Total sales minus the cost of products sold. Gross margin is usually expressed as a percentage and can be considered the normal margin of your products.

How to Calculate it?

(Total Sales Revenue — Cost of Goods Sold) / Total Revenue

The very first step would be to take your total sales revenue in the time frame (typically annually ) and subtract the price of goods sold (COGS), that is the wholesale or production/labor costs associated with your items.

For instance, if you sold $100,000 and the COGS was 80,000, this would yield $20,000. Now divide this by your total sales revenue to seek out your gross profit margin. For instance, this could be ($20,000 / $100,000) * 100 = 20%.

What Does This Tell You?

Gross margin lets you know just how much you are earning vs. how much you’re spending to get goods. This makes it an important retail analytical to monitor because it lets you know how much you can afford to spend on additional operating costs, like payroll, lease, and marketing. Additionally, it is used to compute many other retail metrics we are going to be covering in this report.

Gross Margin for Major Retailers

| Shop | Gross Margin |

|---|---|

| Kroger (groceries) | 22.19percent |

| Walmart (general products ) | 25.35% |

| Barnes & Noble (novels ) | 33.58% |

| Zales (jewellery ) | 52.10percent |

Source: Ycharts (2017) and Zales (2013)

Your goal gross margin will change based on your industry. Grocery stores tend to have the lowest margins (around 20%) whereas luxury retailers such as jewelers can experience margins of 50% or greater.

As we’ll explain next, you can raise your gross margin by stocking more high margin items in your shop.

3. Gross Profit Margin by Item

What is it?

Gross product profit margin calculated for a single item or category of items.

How to Calculate it?

(Total Sales Revenue for Item — Cost of Goods Sold for Item) / Total Revenue for Item

The formulation is just like gross margin. But, instead of using your total sales revenue and cost of goods sold, you are going to focus on just one thing (or group of items).

What Does This Tell You?

Most shops require a balance of high and low margin items. A digital retailer, by way of instance, might gross just 5-10percent in their iMacs, but 40-50% on accessories such as carrying bags and headphones. Despite the vast difference in price tags, the two sorts of products are essential to their bottom line.

Learning your gross profit margin by item is the initial step to enhance your profit strategy. First, make certain you have plenty of high margin items available, like accessories and consumables. Then display these items in highly visible areas throughout your store, for example to right of the entranceway (the”powerwall”), and also next to the checkout register.

4. Internet Profit Margin

What is it?

Net profit margin is similar to gross margin, but it factors in all business costs including marketing and labour.

How to Calculate it?

(Total Revenue Revenue — Total Business Expenses) / Total Revenue Revenue

The formulation, again, is the same as gross margin. However, you may factor in your total business expenses including the price of products sold, in addition to advertising, payroll, rent, utilities, transportation, etc..

What Does it Tell You?

The significance of your internet profit can never be understated. This is the number that lets you know in the event that you’ve got a gain in a given month, or if you’re in the red.

You may also consider the retail metric because the supreme”fact checker.” By tracking net gain and all of its elements, you can always locate and test new strategies. For instance, if your spend on marketing or payroll is comparatively low, consider raising these by starting new marketing campaigns or hiring more employees to expand sales. After that, see your revenue and net profit statements to see how well they pay off.

5. Pedestrian Foot Traffic

What can it be?

The amount of pedestrians who pass by your store in a particular time period. This may be measured as a raw count within the course of a day, or tallied by the hour with more particular demographic information; such as the age ranges and genders of pedestrians.

How to Calculate it?

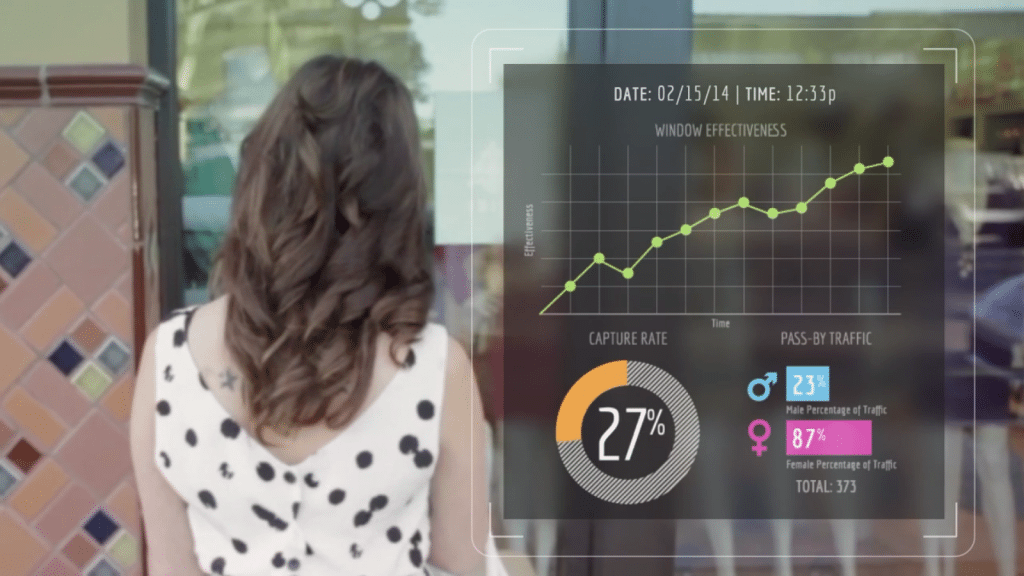

Foot traffic can be counted manually using a clicker, or automatically using on-line applications. Especially, Lightspeed’s RetailNext integration”pings” all location-enabled cellular phones that pass your shop, as shown below.

Picture source: Lightspeed POS/RetailNext

Besides the convenience of automatic foot traffic reports (you can literally just log-in and create a report vs. clicking a button all day) Lightspeed POS & RetailNext gives you much more detail than just raw numbers: You can see how many men and women pass by your store daily, track each shopper who walks into, and see what they do once indoors. You can also see demographic reports, like the age variety and gender of both sellers and passers-by.

What Does This Tell You?

Pedestrian foot traffic is just one of the most important retail metrics for selecting a location. It’s essential to budgeting how much rent is”worth” paying in a location. And of course, online foot traffic trackers’ demographic information helps you determine if a locality is a good demographic match for your small business, and tweak your store to attract more passersby.

Foot traffic reports are also used by established companies to improve their marketing efforts. For instance, you can discover where most passersby reside (by zip code), then hit them using a direct mail effort. Or, decide the most economical hours for foot visitors to plan a pavement promotion. These are only a couple of many ways you can use wealthy foot traffic data to attract and engage customers.

6. Walk-In Rate

What is it?

The proportion of pedestrians that input your store.

How to Calculate it?

(Quantity of Store Visitors / Number of Pedestrians) *100

Take the number of people who entered your shop in a particular time period and divide this by the total number of all pedestrians in the exact same period. By way of example, if your shop had 100 visitors on given day, and 2,000 passersby, your walk-in speed would be 5 percent (100/2000 = 0.05).

To count the amount of visitors, you can use infrared counters, security camera footage, or manually count with a clicker. However, on-line solutions such as Lightspeed POS and RetailNext provide far more shopper data than simple people counts.

What Does This Tell You?

By comparing the walk-in rate over several days, you can test how effective different storefront displays or promotions are for bringing visitors.

For example: Try measuring visitors and pedestrians on 3 separate days. For every day, set up a different storefront display, including different products, color schemes, and chalkboard messages/promotions. The results will tell you which screen was most successful. Because it looks at the general rate (vs only the raw number of people ), it can account for differences because of weather, events, and other organic factors.

7. Client Retention Rate

What can it be?

The proportion of customers who are repeat traffic versus first-time buyers.

How to Calculate it?

(EC — NC) / SC *100

EC = Total number of customers in the end of this time frame

NC = Amount of new clients in that interval

SC = Total number of customers at the start of their time period

If you wished to discover your retention rate for 2017, you would take the whole number of customers who bought from you in 2017 and subtract the amount of new customers. Then, divide this by the entire number of consumers from the preceding year, and multiply by 100.

What Does it Tell You?

The above example tells you the percentage of customers who visited your store in 2016 and then returned the following calendar year. Ideally, you want this number to be close to 100 percent as possible.

For one, this implies customers had a positive shopping experience and have been invited to come back later on. Secondly, high retention rates are good for business. Since ordinary wisdom holds that new clients are much costlier to acquire compared to existing clients, your marketing dollars will extend much further the higher your retention rate.

What’s considered a”good” retention rate will vary widely based on your business. Grocery stores aim for 90% retention since they rely tremendously on customer loyalty. Restaurants have lower retention rates, together with many top chains averaging 50-60% retention over 6 months, based on FiveStars. Meanwhile, gift stores and specialty shops could have retention rates as low as 20-40% and find this powerful.

To increase customer retention, look at implementing a loyalty program, or voucher advertising to existing clients.

8. Comparable Store Sales Growth

What is it?

A contrast of high-income earnings.

How to Calculate it?

(Year 2 Total Revenue — Year 1 Total Revenue ) / Year 1 Total Revenue *100

Find the total sales revenue for your latest 12-month interval (year 2) and subtract the entire revenue from the year prior (year 1). This tells you the change in earnings over the past year. Now divide this by your total year 1 earnings and multiply by 100 to find your growth rate.

Note: If you’ve got several locations, you’ll use a comparable metric called same-store sales. Use the identical formula over, but merely tally-up revenue for shops that have been open at least 1 year at the start of the time period. Also, exclude any stores that closed down during the time period.

What Does it Tell You?

Since retail is often seasonal, comparing yearly revenue allows you to produce apples-to-apples comparisons about the performance of your business. If you wanted to know how your company performed during the 2017 Holiday season, you could use the same formula over, but compare the 2-month interval of Nov-Dec 2017 into Nov-Dec 2016. This will offer you a more accurate picture than appearing at Sept.-Oct. Whenever there isn’t a significant vacation boost.

9. Total Lifetime Value of a Client

What is it?

The entire amount a customer spends, normally, over the span of the relationship with your business.

How to Calculate it?

(Average Purchase Value * Average Number of Visits per Client ) * Gross Margin

You can gauge the total amount spent per customer by searching at 3 key pieces of data:

- The average amount customers spend per buy

- The average amount of times a customer visits your Organization

- The typical margin of your merchandise

So, for instance, if the average purchase value is 50 and the average number of visits is 2.5, this would mean $125 in earnings per client. Multiplying this by your own gross margin allows you to estimate just how much of this you net. If your gross margin is 25%, this would mean net earnings of $31.25 each customer.

What Does it Tell You?

The entire lifetime value of a client tells you how much it is worth paying to obtain a customer. By way of instance, if an average customer earns you 31.25 within the course of their life, you might conclude it is worth paying around $10 to acquire that customer (through advertising, coupons and other promotional expenditures ).

Figuring out how much it is worth investing (the purchase cost) will require some additional calculations. You will have to factor in all working costs to the gross margin, such as payroll, rent, and utilities (basically everything but advertising and marketing expenses.) The resultant number will be the quantity you can budget for advertising, per client.

10. Payroll Twist

What can it be?

The percentage of gross revenue that’s spent on taxpayers.

How to Calculate it?

(Actual Payroll Prices / Total Revenue Revenue) * 100

To compute your payroll percentage, you are going to split your actual payroll costs (such as wages + FICA taxes + holiday days + employee benefits, etc.) by your total sales revenue during the time period– typically 1 year. Make sure you use your gross earnings, and not your net gain.

What Does it Tell You?

Most retailers aim to get a payroll proportion of 15-30%. This usually means that 15-30percent of your overall revenue ought to be spent on employees.

To ascertain what a fantastic percentage is to get your organization, you first must check out your gross profit (covered previously in this report.) Your gross margin is total earnings minus the cost of products sold. To put it differently, if a TV sold for $1000, however cost you $900, the gross margin would be $100.

Businesses with low margins have to spend less payroll, relatively speaking, compared to their high gross counterparts. By way of example, if a supermarket has a gross margin of 25%, and a taxpayers percentage of 15 percent, that leaves just 10% for most additional company expenses + profit.

On the other hand, a jewelry store with a 50% margin can devote a lot more on payroll. Their payroll percentage may be 40 percent and they’d have the same amount left over (10%) for extra business expenses + profit. This is the reason why high margin retailers like The Apple Store can spend a lot on client service.

The Most Important Thing

While retail analytics can provide you many powerful insights about your business, they’re only useful when measured correctly and consulted regularly. If you aren’t keeping tabs on your customer walk-in rate and earnings per square foot frequently, by way of example, you won’t have the ability to test and improve them.

The optimal solution is to utilize software which makes retail analytics simple. POS software such as Lightspeed POS makes these reports easily available, and you’ll be able to add integrated tools like RetailNext to track foot traffic and in-store customer behaviour information in rich demographic detail.