When searching for a personal or business loan, your personal credit is often one of the primary factors for approval. It follows that lenders will typically pull a tricky credit check along with a gentle credit check on you. In this article, we discuss the differences between the two, including what they are and how they influence your credit.

If you’d like to look at your credit for free before we get started, you can get a free score with Nav without affecting your credit score. Nav will also supply you with a free summary of your organization credit.

Visit Nav

What’s a Hard Credit Check?

A hard credit check is one of two types of credit inquiries and can be typically used for loan and charge card applications. Difficult credit checks give people your full credit report, including private information, past payment history, credit information, public record information, previous inquiries and your own personal credit rating. All tricky credit checks require your approval.

To know more, Fit Small Business interviewed Rod Griffin, Director of Public Education in Experian, one of the three big consumer credit bureaus. Griffin explained that a hard inquiry most commonly occurs when somebody applies for a credit card, business loan, mortgage, or some other sort of loan.

To know more, Fit Small Business interviewed Rod Griffin, Director of Public Education in Experian, one of the three big consumer credit bureaus. Griffin explained that a hard inquiry most commonly occurs when somebody applies for a credit card, business loan, mortgage, or some other sort of loan.

Sometimes, other consumer-initiated trades, like registering for a brand new cell phone contract, may also trigger a tricky credit check. The key with a hard credit rating is that you need to take some sort of action, like applying for credit, to trigger a hard credit rating.

How Can a Hard Credit Check Affect Your Credit Rating?

Your credit score can be negatively affected by a hard credit pull. Ordinarily, every tricky credit pull dings your credit score by 1 — 5 factors. Although your score generally bounces back in less than a year, a tough inquiry stays on your report for 2 years, where it is visible to anyone else that does a hard pull.

For perspective, personal credit scores can range from 300 — 850. A”good” score is typically anything above 700 — 725. This implies that if you are on the borderline of a good credit score, a tricky query may drop you into a”fair” or”bad” personal credit rating.

5 points may not seem like a lot, but one too many inquiries can create a creditor wonder if you’re a good credit risk. This is because while lenders like you to have an active credit history, too many credit applications may indicate financial distress. Moreover, if you’ve got a borderline credit score, even a 5 point deduction can hurt your ability to qualify for loans or favorable loan terms.

Bethy Hardeman, Chief Consumer Advocate for Credit Karma, said that the exact impact on your credit score depends on your credit score when the question happens, the type of credit or loan you’re seeking, and the number of different questions that have occurred around precisely the exact same time. By way of example, when you’re shopping around for certain kinds of loans (like mortgages) during a short time period, your credit score is protected from several hits.

Bethy Hardeman, Chief Consumer Advocate for Credit Karma, said that the exact impact on your credit score depends on your credit score when the question happens, the type of credit or loan you’re seeking, and the number of different questions that have occurred around precisely the exact same time. By way of example, when you’re shopping around for certain kinds of loans (like mortgages) during a short time period, your credit score is protected from several hits.

A good guideline with a hard inquiry is that you can have up to two queries on your report at once with no major effect. Once you exceed 2 inquiries within an two-year period, your credit rating might begin to drop significantly and it might raise red flags with potential creditors and lenders.

However, hard inquiries may have a larger impact on your score if you only have a couple accounts or a brief credit history timeline. Of course, a large number of inquiries can also have bigger adverse consequences on your score. By way of instance, individuals with 6+ inquiries are up to 8 times more likely to declare bankruptcy than people with 0 inquiries in their reports.

What’s a Soft Credit Check?

A gentle credit check normally happens when a individual, company, lender, or creditor, checks your charge as part of a background check or pre-approval process. Unlike tough credit checks, soft credit checks may be done without your consent. However, a soft credit check gives only a high credit credit summary and it will not affect your personal credit rating.

Soft pulls can consequently occur without you taking any kind of action. For example, when you get pre-approval supplies in the email from a credit card business, the company has completed a gentle credit check on you. Secured credit checks will also occur when you request your credit report or when an employer pulls your credit as part of a history investigation.

How Does a Soft Credit Check Affect Your Credit Score?

A soft credit check does not impact your personal credit score. In reality, soft inquiries appear only on credit reports that you yourself request. Rod Griffin of Experian pointed out that even then, they’re recorded in a different section of their credit report from hard inquiries. Soft credit attracts are not visible to other things that check your credit.

Bethy Hardeman of Credit Karma added that one of the greatest misconceptions with soft pulls is that a pulling your credit will damage your credit score. In reality, you can use services such as Credit Karma and NAV to stay up to date with your own personal credit rating. A fantastic guideline is to pull your credit report once a quarter.

Visit Nav

What’s the Difference Between a Hard & Soft Credit Check?

There are 3 major differences between a tough credit check and a credit check. The first is that depth of data, the second is that the level of authorization needed, and the the third is the fashion in which the 2 sorts of credit pulls affect your credit rating. Let’s take a glance at these gaps.

However, before we do, it is important to quickly notice that credit inquiries do not affect your organization credit report or business credit score. This is the reason why this report discusses personal credit inquiries and how they relate to your credit report and personal credit score.

Hard Credit Check

A tough credit check typically occurs when you apply for a loan or credit card. Hard credit checks bring up your whole credit history. Each tricky credit check can decrease your credit rating by 1-5 points and it stays in your credit report for up to two years in which it is visible to lenders.

Soft Credit Check

A gentle credit check gives creditors a high-level summary of your credit report. Creditors do a gentle pull to verify or send you pre-approval offers. Other things, like employers and insurance companies, can also do a soft pull of your credit score. A credit check does not affect your credit score and is not visible to creditors.

When Do Hard & Soft Credit Inquiries Usually Occur?

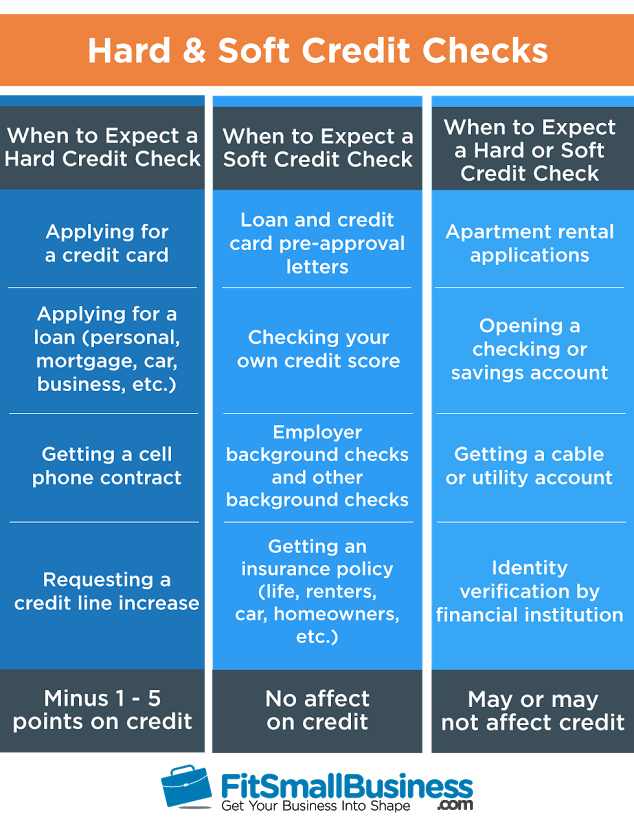

Below is a very helpful infographic showing you when to expect a hard credit pull or soft credit draw.

Generally, if you are taking on a new financial commitment, you can expect a hard credit check. For example, getting a new cell phone or moving into a new apartment will mean a brand new monthly payment, so creditors want to know your full credit history. Furthermore, if you register a document authorizing someone to check your credit, that in-of-itself can trigger a tough pull.

If you are ever unsure whether a potential creditor or financial company is performing a soft or hard credit check, inquire.

Do Creditors Want Agree to Check Your Credit Score?

A hard credit check usually requires written consent while a soft credit rating does not. This is because a difficult pull lets someone view your full credit report while a soft pull only gives a high-level summary. A hard credit check typically occurs only when you apply for a loan, credit card or something similar.

In most situations in which a hard pull is necessary, a thing has”permissible purpose” under the Fair Credit Reporting Act (FCRA) to look at your credit. For instance, a bank has permissible purpose to confirm your credit before allowing you to start an account.

If you initiate a trade and also a creditor has permissible purpose, they do not need explicit consent to perform a tricky credit pull. Rather, the initiation of your program or transaction is regarded as consent.

This is the reason it’s common practice for lenders to notify you at the fine print of a loan application or a contract that they intend to look at your creditcard. If you do not need your credit pulled, then hold off from signing the document and providing personal information like your SSN and DOB.

In regards to a gentle credit rating, FCRA allows creditors to perform a gentle pull without you even knowing about it (except for history checks, when written consent is required). Creditors most frequently do soft pulls so they can send you pre-approval offers in the mail.

If you do not wish to receive prescreened offers for credit cards and insurance, you can call toll-free 1-888-5-OPT-OUT or see optoutprescreen.com. Do remember that opting out restricts your ability to access special incentives and reduced rates for credit cards and other financial products.

By requesting a free copy of your credit file, you can view every query that has been performed in your credit, both soft and hard. If you find a deceitful hard inquiry in your accounts, you can dispute it. Should you file a dispute, credit reporting bureaus have 30 — 45 days to investigate and respond.

There’s typically no use in disputing a soft credit check. This is as it doesn’t make a difference in your score and is invisible to everybody but yourself.

How Does Rate Shopping Affect Your Credit Score?

When you apply for a loan, then it’s common to shop around for the best speed. Fortunately, FICO and VantageScore, both major credit scoring units, have special rules which don’t punish you for speed shopping.

FICO ignores mortgage, vehicle, and student loan inquiries that occur together within a 30 day interval. Such inquiries will still appear in your credit report but won’t affect your score. After 30 days, further inquiries throughout the next 45 days are grouped together and treated as a tough inquiry for scoring purposes.

As an instance, if you submit an application for 3 automobile loans through a 30 day period, these programs will not affect your score in any way. After that, if you submit an application for 3 more car loans within 45 days of one another, the software will depend as one challenging inquiry and only lessen your credit score by up to 5 points.

VantageScore doesn’t limit its speed shopping questions to simply a mortgage, car, or student loan. Rather, they lump together all inquiries made through a 14-day window collectively as one for scoring purposes. By way of instance, if you apply for multiple credit cards throughout a 14-day interval, VantageScore will count that as one hard inquiry.

These special rules imply that it is okay to shop around for certain types of loans without worrying about it damaging your credit score. However, different lenders use different scoring models, so it’s hard to predict which rate shopping rules will apply when.

In accordance with Rod Griffin, Director of Public Education in Experian, a good guideline is that if it’s not a mortgage, car loan, or student loan, assume every query will be counted as an independent inquiry for scoring purposes. This means that if you are an entrepreneur shopping around for small business finances, it’s wise to limit the amount of software you fill out thus that your credit does not get hit too many times.

Credit Inquiries For Your Business Credit

If you are a company owner, you might be wondering how business credit fits into this. To find the response, we contacted NAV, a company credit monitoring services.

Caton Hanson, NAV’s co-founder and General Counsel, says that company credit works somewhat differently than private credit since permissible purpose (FCRA protections) doesn’t apply. Everyone can pull anybody else’s company credit–all they really need is your business’s name and address.

Caton Hanson, NAV’s co-founder and General Counsel, says that company credit works somewhat differently than private credit since permissible purpose (FCRA protections) doesn’t apply. Everyone can pull anybody else’s company credit–all they really need is your business’s name and address.

As it’s a lot easier to look at out a business’ commercial credit, you won’t be penalized for inquiries into your company credit. According to Hanson, funding and credit-related inquiries can appear in your business credit report, but they won’t impact your score.

While similar, business credit reports and scores have lots of critical differences from personal credit. In reality, you’ll find as many as 3 different business credit report and over 4 big company credit scores. If you’d like to understand your business credit, take a look at our greatest guides on company credit reports and the way that company credit scores work.

For view, Dun & Bradstreet is one of the leading company credit reporting agencies and are often employed by commerce partners and providers. To pull your D&B credit report, begin by generating a DUNS number and your basic small business credit report. As soon as you’re able to pull on your D&B file, read our ultimate guide on your D&B credit report to help decipher it.

Bottom Line

Both tricky credit checks and soft credit checks play a significant role in your own personal financial health. This is because the two types of private credit inquiries are used by associations, creditors, and lenders when assessing the creditworthiness of your organization. Difficult credit inquiries may typically impact your personal credit rating while tender inquiries will not.

That makes staying on top of these credit inquiries important as, as a small business owner, your own financial health impacts your company’s finances. Nav lets you check your personal credit score free of charge (with no effect on charge ) and will even get you a summary of your business credit. It is a superb spot for any business owner to present their credit rating a test up.

Visit Nav