Commuter benefits, also known as transit advantages or transportation benefits, are an employer-provided program that helps employees reduce their monthly commuting costs. As a pre-tax payroll deduction, transportation benefits can decrease worker income taxes and employer payroll taxes. Commuter benefits interval public transit, vanpooling, bicycling, and work-related parking costs.

Commuter benefits laws make them compulsory in certain cities including New York, Washington DC, and San Francisco.

In the following guide, we’ll clarify what commuter benefits are, whether or not you are required by legislation to provide them, and how to offer them to your staff.

One option we recommend for setting up commuter benefits would be to operate with an HR / payroll provider like Gusto. They may set up transit rewards for your workers, ensure your business stays compliant, and help you get the ideal tax breaks.

Visit Gusto

What Pre-Tax Commuter Benefits Could Be Used For

Commuter, transit, or transportation benefits are a means for employers to let employees use pre-tax dollars because of their work-related transportation expenses, for example:

- Transit or bus passes

- Parking prices or paid parking place

- Motorcycle maintenance expenditures

- Vanpooling (Provided That van seats 6 & 80 percent of the miles are work-related commuter miles)

Commuter benefits began in 1993, when the IRS needed to invite people to use transit. Bicycling gains were inserted in 2009. Regulations vary by country, which we will talk more in the next section.

Neighborhood Commuter Benefits Laws

The areas listed below have commuter benefits legislation that require companies to provide commuter benefits. With the exception of Berkeley, these laws apply to firms with 20 or more fulltime employees. The commuter benefits law in Berkeley applies to firms with as few as 10 employees, even though those employees only work part time.

Click here on a town name below to view more information on particular commuter benefits laws and regulations in these places:

- New York City

- Washington, D.C.

- San Francisco (and 9 surrounding counties)

- Berkeley, CA

- Richmond, CA

If you do not do business in one of these locations, you might be still be able to get a tax break by offering commuter benefits, but aren’t required by law to provide them to workers.

How Pre-Tax Transportation Benefits Work

Commuter and transit benefits are available only through an employer, so your employees cannot merely go get them in their own — unlike life insurance or health insuranceplan.

Here’s how pre-tax commuter gains operate:

- Your worker chooses a predetermined amount to cover their monthly transportation expenses. This sum is processed as a pre-tax payroll deduction. 2018 monthly limits by type of transport include:

- Parking: $260/month

- Transit Passes or Vanpooling: $260/month

- Bicycling: $20/month

- Your worker receives / utilizes a card to pay transport costs. This can be a transit pass, membership card, or debit card (for transit usage only, similar to a debit card they’d get with an FSA or HSA), depending on the type of transport they use along with the provider you go with to offer commuter benefits.

- The worker’s taxable income is lowered, since commuting costs are deducted from their income using pre-tax paycheck dollars.

- Your employer payroll taxes are also lowered from the entire amount that all employees contribute pre-tax, because that sum is no longer categorized as taxable payroll dollars (salary or salary) for your business. A few U.S. states shown below also offer state tax incentives.

Example: If the employer pays $500K in payroll, that $500K is taxed. However, if total payroll is decreased to $470K due to employee commuter benefits being deducted pre-tax, then the employer only pays payroll tax on $470K, not $500K. If the employer contributes money to cancel the employees’ transportation expenses, that cash can also be tax deductible from their business income taxation.

Workers cannot get the tax savings in their unless you, their company, provide these sorts of transit advantages. Therefore, we encourage you to look at offering commuter benefits. It’s a win-win situation — you save payroll taxes and your employees save income taxes.

Next we will cover how to give commuter benefits for your workers.

3 Ways to Provide Commuter Benefits For Your Employees

There are three distinct ways to provide commuter benefits to your employees.

1. Utilize an Online Transit Benefit Provider

There are just two main online transit benefit providers:

- TransitChek (supplied by WageWorks) — Offers debit cards, parking cards, metro cards and vouchers that companies can purchase for their workers using workers’ pre-tax dollars. Products are sent directly to employees’ homes, and worker enrollment is done online. Additional options are available for workers in New York.

- Alice — Lets employees use their own debit or credit card to pay for parking, transit passes, or bike repairs, and then integrates with your payroll software for worker pre-tax deductions. It employs a cellular program to communicate with workers for enrollment and to confirm whenever their preferred card seems to be utilized for a qualified cost. Alice also generates IRS forms that you register up and shop with an electronic signature to streamline year end tax reporting.

Employing a third party provider such as TransitChek or Alice will assist you to manage commuter benefits, by making sure the ideal employees have the ideal passes.

If you are in one of those cities that requires commuter benefits to be offered, there may also be a local government service that eases companies providing transit benefits. We advise you assess your city’s website. By way of instance, search the internet for”domain” +”commuter benefits”.

2. Use Your Current HR, Gains, or Payroll Software

Should you utilize HR advantages or payroll software, like Gusto, that has the choice to offer commuter benefits, then you can set up employee deductions and your employer contribution directly inside the software. The program will manage the rest.

Or if you’ve been considering a Professional Employer Organization (PEO) like Justworks, today might be the time to add commuter benefits to your package. However, Justworks supplies commuter advantages through WageWorks, so if you or your employees have questions, they’ll be redirected to WageWorks.

In reality, we advocate using HR applications or a PEO to ensure that you correctly link employee benefits to payroll deductions, and stay compliant with transportation advantage laws and limitations since they change. They’ll also ensure you are able to make the most of all state and federal tax breaks.

3. Set Up Transit Benefits Yourself

You could offer the commuter benefit yourself by simply setting up a business account with the local transit agency and registering for passes under the company name for engaging employees.

Or, you could simply purchase the passes yourself and sell them in your office. Providing transit advantages providing yourself gets the tax deductions a bit more complicated because you need to track who bought what, when, and for how much. You’d then need to make the right deductions in your payroll system manually.

Cost of Offering Commuter Benefits

The true cost of supplying pre-tax transit benefits is all up to you as the company operator, based on how much you really want to contribute (if anything) on behalf of your employees. If the employee pays 100% of their commuting costs employing pre-tax dollars, it costs you nothing. The wonderful thing is that even if you contribute nothing, you and your workers still receive the tax savings.

As a company, you can offer up to the limits shown above, or you could pay a set amount per worker every month, for example $25 or $50 per month, to help them pay work-related transport costs. Your contribution is offset by federal small business tax deductions for the very same amounts, so why don’t you help out with a contribution that workers will appreciate?

Added Commuter Benefits Tax Savings

In accordance with WageWorks, workers can save between 30-40percent in their commuting costs or roughly $400-$500 each year by using commuter benefits. WageWorks even provides a free calculator to let your employees determine in advance how much they may have the ability to save if they sign up for commuter benefits.

As stated previously, even if you contribute nothing to your employees’ commuting costs, you will benefit from a payroll tax deduction by creating commuter benefits available to your employees. And your employees will save their federal income taxes. It is a win / win.

If you choose to pay a portion or all your workers’ commuting costs, then you receive the payroll tax violate and a federal income tax deduction based on the amount that your contributed. Some states offer additional savings on state income taxation for employers who subsidize some or all their employees’ commuting costs.

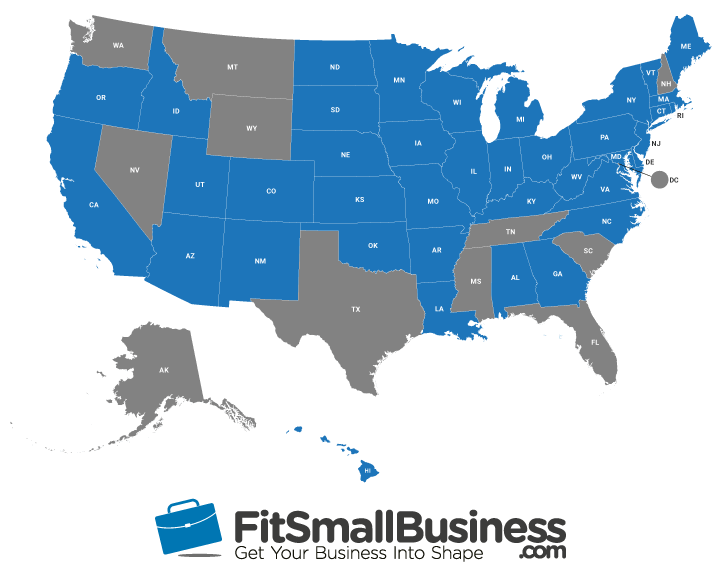

If your business is in one of those countries displayed in gloomy , along with federal income taxes, you and your workers may save state income taxes or get additional tax breaks. By way of example, in Maryland, companies can find a 50 percent tax break in their contributions toward their employees’ commuter benefits. In case your company in is one of gray states shown below, there are no additional state income tax breaks for you or your employees.

Commuter benefits in America by state

Review our nation tax article to go directly to your state tax agency to learn more on state taxation deductions.

To ensure you get the tax savings you deserve, consider using tax preparation software or a bookkeeping support.

Bottom Line

Should you employ 10-20 or more workers in one of those locations that demands transportation advantages, then it is not really an option — you need to offer commuter benefits to your employees.

Even if you’re not in one of those locations, transit advantages might be great, low cost option for you to help workers save money on transport costs, while lowering your payroll taxes. You might even discover that providing commuter benefits helps you recruit new hires that value your willingness to help them offset their transport costs.

We recommend working with a rewards provider like Gusto to provide transportation benefits to your employees, stay compliant, and find the most tax savings for your business.

See Gusto