A Rollover for Business Startups (ROBS) enables one to get the funds on your tax deferred retirement account, like a 401k or conventional IRA, for the purpose of starting or purchasing a company. However, you must establish a ROBS properly in order to avoid taxes and early withdrawal penalties.

Preparing a ROBS correctly can be challenging if you don’t have the ideal provider helping you. Our recommended provider, Guidant, will be able to enable you to get financed in about 3 weeks. See them to program a free ROBS consultation.

Visit Guidant

How to Establish a ROBS

Setting up a ROBS can be complicated, but ROBS suppliers, like Guidant, take good care of most of the effort for you. If you’re unfamiliar with ROBS, browse our Ultimate Guide on ROBS and come back to the article when you’re ready to get started. Or if you’re prepared to move forward it is possible to choose one of the recommended ROBS suppliers to partner with.

Here are the 8 steps to set up a Rollover for Business Startups (ROBS):

Step 1: Determine if a ROBS is Right for You

You primarily want the following three things to Qualify for a ROBS:

1. A Qualifying Retirement Account

Guidant works with a Wide Selection of retirement accounts, such as:

- 401(k)

- 403(b)

- SEP

- TSP

- Keogh

- Traditional IRAs (Roth IRAs aren’t eligible)

2. A Minimum of $50,000 in Your Retirement Account

Guidant requires that you have at least $50,000 to rollover. Rolling over less than this would not be cost effective because of the up front charge and ongoing maintenance fees.

3. Retirement Account Can’t be From a Present Employer

Most employers prohibit you from rolling over a retirement accounts as you still work on them. You can, however, utilize a retirement account from a prior employer.

Having a ROBS, you do not need to fulfill conventional underwriting criteria. There aren’t any credit checks, and you don’t need to think about security, because a ROBS isn’t financing.

Step 2: Request a Free Consultation with a ROBS Provider

As soon as you believe a ROBS may be a fantastic match for you and your organization, you should speak to some ROBS professional. Each ROBS is indeed unique, and structured to meet the requirements of your own company and personal circumstance. You can ask for a free consultation through whichever supplier you choose.

Step 3: Talk to a ROBS Consultant

A funding consultant will usually call you in one business day to be certain that you’re a fantastic match for a ROBS. If you qualify, the adviser will then arrange a time to get a longer, more thorough call.

If you want to proceed following this call, you’ll be asked to give information on your retirement strategy and company. This is basic information with no heavy documentation needed, as the screenshot below, from Guidant, shows.

Step 4: Purchase the ROBS Setup Fees

Your initial payment to set up your ROBS is because at this point. You’ll be required to pay the $4,995 installment fee, and also the first month’s cost of $139. If you later determine that a ROBS isn’t for you, some providers offer a generous money-back guarantee.

For example, through Guidant you will be refunded your setup costs without the hard costs, such as attorney time and corporate filing fees, which can be subtracted from the refund should you decide to back out. Robert Newcomer-Dyer, Sales Manager at Guidant, states about 20% of the total fees, normally, are usually deducted if the consumer requests a refund.

Step 5: Establish an C Corporation & File IRS Paperwork

In order to perform a ROBS, your company has to be set up as a C Corporation, because the rollover involves a sale of stock to a retirement accounts. Your provider will generally will submit the required filings with your state to be able to set up your business as a C Corp (if it is not yet structured as a C Corp). They’ll also file all necessary paperwork with the IRS.

Step 6: Get Questions Answered by Two Independent ERISA Attorneys

Guidant is the sole ROBS supplier that we know of which provides you with access to independent adviser prior to or during your ROBS installation. This provides you with a chance to ask questions and evaluate whether a ROBS is a fantastic match for you. If you use a different provider then you may anticipate to bypass this step.

With Guidant, you will normally have two 1/2 hour consultations with independent ERISA attorneys, at no extra cost to you. ERISA, or Employee Retirement Income Security Act, is the law that governs ROBS. A few questions to ask the attorneys include:

- Can I confront an increased audit risk if I do a ROBS?

- What happens in the event of an audit?

- How much salary do I have to cover myself if I am doing a ROBS?

- How many hours do I have to work if I am doing a ROBS?

- Will my employees have the ability to buy stock in the organization?

- Will my company have to be appraised before inventory can be issued?

- What’s going to happen to the company retirement accounts if the company fails?

On infrequent occasions, the individual adviser will discover something about your small business or retirement accounts that invalidates the deal. In that case, you would get a complete refund, says Dyer.

You can find out more about general responses to some of these questions by reading our ROBS Ultimate Guide, however your personal situation may be different. This is why it’s important to go over those with independent counsel.

Step 7: Develop a New Retirement Plan for Your Corporation

Whenever you do a ROBS, a fresh 401k or profit sharing retirement program is made under your C Corporation. Your ROBS provider can help you design the company retirement program. It has to be open to all eligible employees, which is described differently for everybody based on how you setup your company 401k.

The program will be held with a third party administrator (TPA), which is a company you hire to run most of the daily operations of your 401k program. Typically, they will offer certain investment funds your employees can invest their retirement money into. They will work with you to understand what the aims of your retirement plan are.

The TPA will develop default investment funds based from these goals, but worker’s wanting to personalize their investment plan will undergo the TPA directly. Many large banks offer TPA services, and these services aren’t unique to using a ROBS. You’d use a TPA if you provided a 401k plan to your employees without using a ROBS too.

Step 8: Total Rollover & Access Funding for Your Business

The final step of establishing a ROBS is the rollover of funds. Your own personal retirement funds are transferred into the business retirement plan. Your company retirement plan afterward purchases shares of stock in the Corporation. From the proceeds of the inventory purchase, you can start a new business, buy a business, or use for any business goal.

ROBS Administration After Setup

You are not done overseeing your ROBS once it’s properly set up. You’ll have to complete an IRS Form 5500 annually your retirement funds are invested in your business. Based on your company, these kinds could be difficult and time consuming to complete. For a small fee, a ROBS supplier, like Guidant, will handle that for you. They will take the effect on keeping track of the financial and insurance documentation that’s needed, and then they’ll complete the form and then submit it on your behalf.

Additionally, your workers could become eligible to invest in your company 401k at different times of year. When you have a ROBS, there could be extra documentation and notices your workers will need to receive when they become qualified. Your supplier keeps track of all this for you too, permitting you to know when an employee is eligible and giving you the necessary tools and information that you’re required to provide that employee.

While it may seem hard to keep tabs on, and manage, your ROBS as your company moves forward, it’s not. Possessing the ideal ROBS provider makes this as straightforward as possible, which makes you time to concentrate on your company.

Why We Recommend Guidant

We advocate Guidant as the most effective overall ROBS supplier for a lot of reasons. Since 2003, more than 11,000 small companies have trusted Guidant to do a ROBS, totaling more than $3 billion in funding. They are well versed in making certain that your ROBS is installed the way it must be, and they’ve never had a plan disqualified during an audit.

Along with the fact that they have so much experience helping small business owners Establish a ROBS, there are 3 main advantages to utilizing Guidant:

Outstanding Customer Service

You may work one-on-one using a Guidant consultant during the ROBS set up process. Many Guidant advisers have banking experience, have worked for a small business, or owned a small company before, so they’re well-equipped to answer inquiries and simplify the process for you.

High Degree of Expertise

Guidant finishes more ROBS trades every year (~1,600) than some other provider we have reviewed. They also have a lower percent of the customers which were audited last year than any other supplier, and they’ve never had a strategy disqualified during an audit.

All of this points to their long history of knowledge and high level of expertise in the ROBS area. They’re a supplier you can depend on to get you off the floor with a ROBS, then see it through with your company until the ending.

Access to Independent Counsel Throughout the Setup Process (No Price )

Guidant is the sole ROBS supplier we know of which offers access to independent outside counsel, at no additional cost, during ROBS set up. Independent counselor can help you objectively assess the tax and legal dangers of a ROBS and determine if it’s a fantastic choice for your business.

To learn more about why we advocate Guidant and how they compare to other ROBS suppliers, take a look at our guide about the Best ROBS Providers.

Costs to Establishing a ROBS With Guidant

There are two Chief fees for setting up a ROBS using Guidant:

- Setup Fees of $4,995

(Can’t come from ROBS cash ) - Ongoing Tracking prices of $139/month

(Covers 10 employees, then $3.33/month for each additional worker after 10)

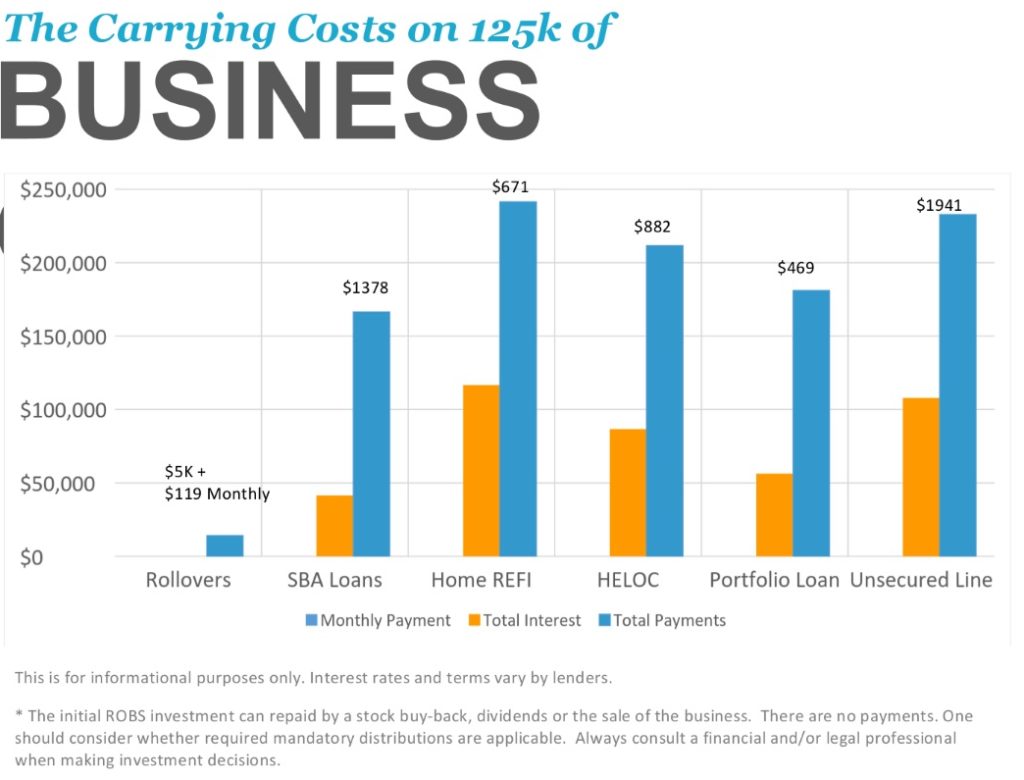

When these fees may seem high, setting up a Rollover for Business Startups using Guidant can actually be much more economical than acquiring a small business loan. Business loans are debt that you need to pay back, together with curiosity, bit by little every month.

Debt servicing, since it is known, can take a huge chunk from your company revenues. By comparison, a ROBS is not a loan. There is no interest or debt to repay, which means that your small company keeps more earnings.

Below is a contrast from Guidant that appears at the price of ROBS versus other types of financing for $125K in company funding. As you can see, the monthly payment for a Guidant rollover is only $119 for a business of 10 individuals. That is less than 1/10th of the monthly payment in an SBA loan!

Source: Guidant

There’s no interest or debt to repay, and if your business grows, the stock that is in your company sponsored retirement accounts will even grow. That translates into more retirement savings for you.

So is it too good to be true? Well, just as with any other small business financing option, ROBS has its share of pros and cons.

ROBS Pros & Cons

Whether you select Guidant or a different company that will help you set up a ROBS, the dangers are alike. The biggest danger, of course, is the reduction of your retirement funds if the company fails. This is a scary”what if,” however, the thing that lots of individuals forget is that the danger of entrepreneurship is present regardless of how you finance your business.

By way of instance, if you buy a business loan, then you typically have to sign a personal guarantee. If the business fails, you could lose your house and other assets. Having a ROBS, you are at least not putting any other personal resources at risk.

Just like with any other type of business finances, we advocate balancing the advantages and disadvantages of your own ROBS before making a decision whether it’s the correct choice for you.

Pros of a ROBS:

- No earnings taxation or premature withdrawal penalties.

- No debt

- No loan payments

- No credit checks or personal guarantees

- Retirement funds may increase in a tax-advantaged account

Cons of a ROBS:

- Possibility of business failure and loss of retirement funds

- Potential to become audited

- Must administer a Business retirement program

- Must operate as a C Corporation

The best method to ascertain whether a ROBS is the best alternative for you will be to talk to a professional ROBS firm like Guidant. Their financing consultants are small business specialists, and you also get access to independent counsel who will go over the risks of a ROBS with you in detail.

For Richard Hoad and his wife Jo-Anne, owners of this The Parsonage Inn in Cape Cod, Massachusetts, the risks were worth it. The Hoads failed a ROBS with Guidant in 2012 to accomplish their dream of having a bed & breakfast.

Richard stated,”My wife and I had been relatively confident since the inn was already being conducted as a business. It had been underperforming, but Jo-Anne’s family had conducted a B&B in the past, so we understood what was entailed and how we could make it effective. We place all our eggs in 1 basket, but the economy was beginning to grow, we obtained the inn for a fantastic price, and we all knew what we can do to achieve success.”

Four Decades later, the Hoads have almost doubled the Inn’s revenues.Richard had any words of advice to provide for additional small business owners who may be contemplating a ROBS:

“Look in your business plan, make it realistic, see exactly what you wish to do with the business, and make sure you can achieve it. If the fundamentals of the company are strong and you are confident in what you can do to add value, that’s what’s critical.”

Richard also recommends business owners utilize the services of a professional company like Guidant which will walk them through the procedure. “Guidant was really professional and helped us accomplish our goals, and they continue to do so for this day”

Bottom Line: How To Set Up A ROBS

If you’ve at least $50K on your retirement accounts, carrying out a ROBS might be the ideal alternative. Preparing a ROBS by yourself correctly can be hard and time consuming. We advocating using a ROBS provider to help you set it up and manage it to protect your business and avoid any unnecessary charge or tax payments.

We advocate Guidant for their excellent customer service and access to separate counsel. Guidant simplies what might be a complex process by caring for the administrative work for you. They could typically get your ROBS installation in about 3 weeks.

Visit Guidant