SBA startup loans are the same as traditional SBA 7a loans for existing businesses but are more challenging to qualify because there is a higher risk of default. These loans are still potential but you will typically be expected by SBA lenders to come up with 25 — 30% as a deposit as well as additional collateral.

One fantastic way to produce your down payment is via a Rollover for Business Startups (ROBS). If you’ve got $50k+ at a tax deferred retirement account you can program a complimentary 1-on-1 consultation with our recommended ROBS provider, Guidant, to learn more. What is more, they can help you with SBA loan packaging, increasing your chance of approval.

Visit Guidant

The 7 steps to obtaining SBA startup loans are:

1. Know the Types of SBA Startup Loans

Before you begin applying for an SBA startup loan, it is important to see that these loans would be just like any other SBA loans but are harder to qualify for. Most SBA lenders will not function with startups and the ones that do make it more difficult qualify when compared to existing businesses due to the larger required down payment (25%- 30%) and increased scrutiny on your business plan.

The reason for this is that only half of startups last beyond their initial five decades. Still, there are a couple kinds of SBA loans available for startups, offering prices from 6.75 — 9.25percent and favorable repayment terms. In the end, the ideal SBA startup loan for you depends on how much money you are borrowing and how you plan on using the entire financing amount.

SBA startup loans typically will fall into one of these 4 main SBA loan forms:

SBA 7a Loans

SBA 7a loans are the most popular kind of SBA loan used now and are ideal for businesses that need working capital. Startups with a proven business model such as franchises will find this to be a great option due to their $5 million maximum loan amount available via a 7a loan.

SBA Express Loans

An SBA Express Loan is a form of an SBA 7a loan also is a fantastic option for many startups that only need up to $350k to get started. Many startups will prefer the Express loan option because creditors are more likely to approve Express loans than other SBA loans since the risk of lending a smaller sum isn’t too significant. In reality, at 2017 SBA Express loans accounted for 46% of all SBA working capital lending, but only 8 percent of the total dollars funded.

If you’re interested in learning more, check out our article on SBA express loans.

SBA Microloans

The SBA microloan application helps nonprofit intermediary lenders lend money to small companies. These loans are best for small companies only needing up to $50k to start your business or to get non-profit childcare centers. This really is the only SBA program where the SBA does not guarantee that the loans.

SBA 504 Loans

Should you need money for owner occupied real estate to get your company off the ground, then an SBA 504 loan is a good match for you. You can get access to up to $5 million in financing for the real estate you might have to use as a warehouse, office, or production facility. To learn more, you may read our article on SBA 504 loans.

While those startup loans tend to be somewhat less common than conventional SBA loans, they’re getting more popular with creditors every single year. In 2013, startups only received 31 percent of the entire SBA 7a loans given out and 26% of the total money. In 2017, however, startups received 38% of overall 7a loans and 35 percent of the overall dollars financed. As of writing this guide, these numbers have increased in 2018 to 44% each.

Irrespective of the rise in popularity, many lenders will still ask that you come up with a 25-30percent down payment. A ROBS is a great way to receive those money tax and penalty free from your retirement accounts. A ROBS specialist can assist you get through the process if you’ve got $50k+ in a tax deferred account. You can contact our recommended supplier, Guidant, to establish a free 1-on-1 appointment today.

Visit Guidant

2. Ascertain How Much Money You Will Need

Many business owners believe that they need to borrow as much cash as they qualify for, but that can cause financial constraints if you’re not careful. You should only borrow the cash you need and can afford to pay back. By way of example, you can’t need your debt service coverage ratio (DSCR) to transcend 1.25 for startups. To estimate your own DSCR, you can use our SBA loan calculator.

To really know how much cash you require for your startup, however, you’ll want to put together a comprehensive cash flow analysis of your new business. You can create your own cash flow analysis following these steps:

- Forecast revenue over the next 12 weeks

- Forecast all expenses over the next 12 weeks

- Factor in any desirable working funds or CapEx purchases

- Subtract the total expenses from the revenue

- The gap following all of these measures is the minimum required funding

The cash flow analysis can help you understand how much you’ll need each month within the beginning of your small business. You’ll want to make sure you’re asking for enough cash to cover any possible”red” or negative cash flow weeks over this time period.

A best practice to help you feel confident on your cash flow is to get a safety net saved for whatever that’s unexpected or that changes from your money flow analysis. One way to do so is to depositing money from the retirement accounts through a ROBS trade. Unlike borrowing extra cash, a ROBS does not require monthly payments or charge you interestrates. Read our ROBS manual to learn more.

3. Determine Your Eligibility

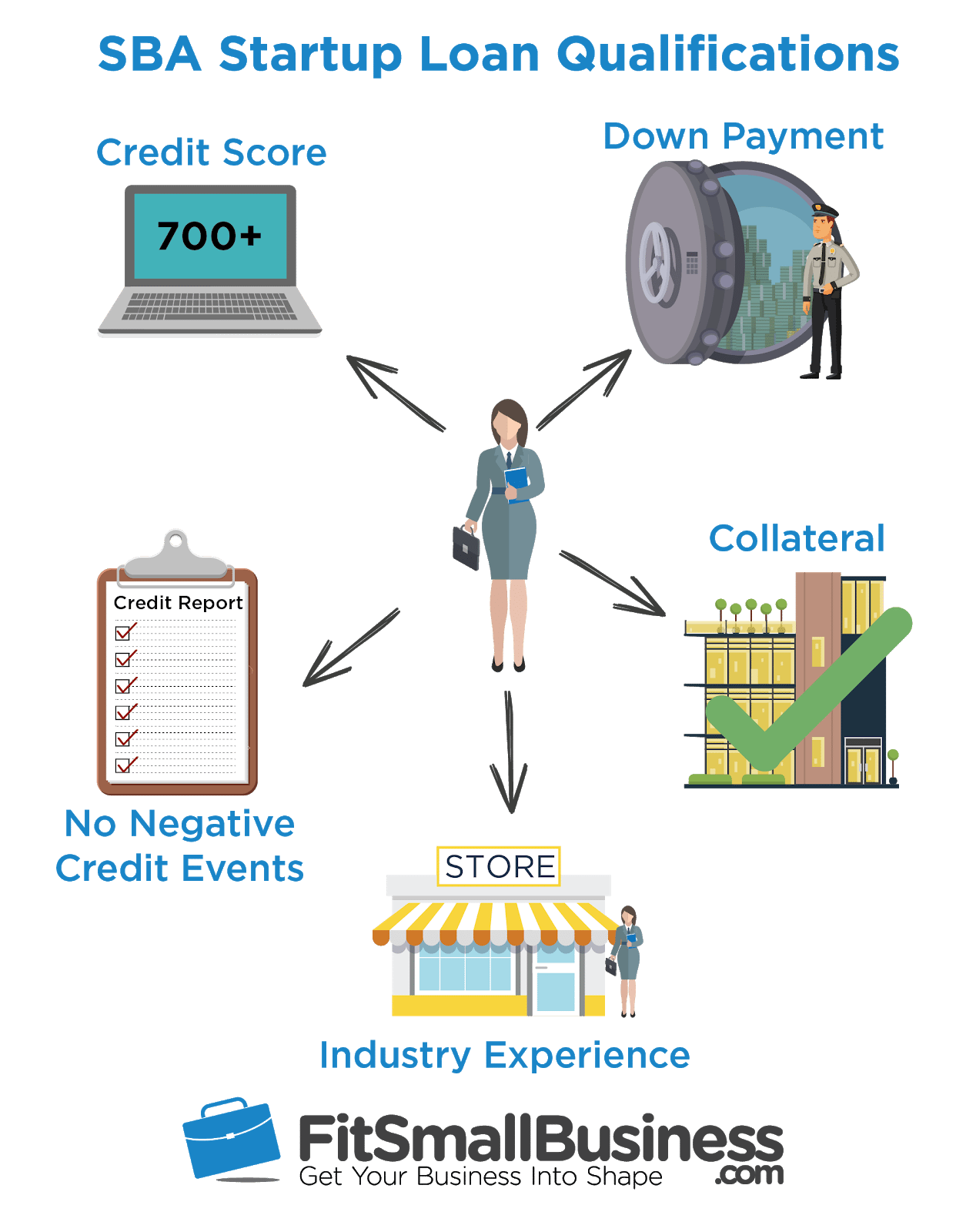

SBA loan conditions are the same for startups as they are for existing companies. The requirements are strict, requiring exceptional personal credit and a solid business plan.

General SBA startup loan eligibility requirements are:

Personal Credit Score

Startups will want a credit score over 700 to feel confident that they meet this requirement. You may examine your credit score for free to see if you could qualify.

Down Payment

While most SBA loans don’t technically require a downpayment (unless you’re purchasing property ), the SBA requires that approved lenders hold prospective borrowers for their typical qualification standards. This means that most creditors will want to see you invest at least 10% in a project or buy for SBA loans.

But, startups will typically put 25 — 30% down to demonstrate that they have more skin in the sport. To get a commercial real estate purchase, the deposit is simple and is a percentage of their purchase price. If you’re searching for working capital or to purchase a business, the down payment is the difference between the total cost and the amount the SBA lender is willing to provide you, which is typically 70 — 75 percent of the entire quantity.

This is sometimes challenging for brand new companies. You essentially have to put in enough money while still showing your SBA lender that you have sufficient liquid assets to cover debt payments. For this reason, using your entire savings as a down payment might not seem good to a lender, especially if your new business enterprise is not yet profitable.

One approach to come up with your deposit is to make money from the tax deferred retirement account through a ROBS transaction, penalty- and – tax-free. It is also not a loan so there’s nothing to refund and no interest to worry about. If you’ve got $50k+ at a qualified retirement account, you can talk with Guidant to learn more.

Visit Guidant

Collateral

Collateral is very important for startups seeking an SBA loan. The loan might not need to be 100% collateralized by your personal assets, however the further security you have the better your chances will be of getting funded. You may learn more by reading our post about the security coverage ratio.

Experience

You’ll need both industry and management expertise to find an SBA startup loan, or you’ll need to have hired an operating partner which has it and is willing to conduct the business. You are going to want at least 5-10 decades of experience to pass this particular test, but it will vary by lender.

Other Prerequisites

You can’t have some recent bankruptcies, tax delinquencies, or defaults of debt obligations into the U.S. government (including student loans) on your credit report. You must also have a solid business strategy (discussed below) that highlights the future success of your business.

If you meet these minimum qualifications you can see what your financing chances are by using an experienced SBA loan agent who understands what lenders will finance startup businesses. Guidant is a good example of a company that will perform this service for you, increasing your probability of getting funded.

4. Create a Detailed Business Plan

A thorough business plan is important for startups looking for SBA financing because the creditor wants to not only understand the company you’re creating but they will need to feel like you will be successful. Supplying your whole strategy to the creditor can go a very long way to helping the two these things occur. It is a necessary portion of the SBA loan application process and the greater your plan is, the better your odds are of getting financed.

Your startup business plan should include:

- Executive Summary: What your startup does (or plans to do), what it provides, and what your overall strategies for the company are.

- Product or Service Overview: Provide details of what your startup provides and how it’s different than the contest. Ensure anyone reading this knows how your service or product helps your target market.

- Target Market: Identify who you’re targeting as customers and why they create a fantastic fit for what you have to offer you.

- Competitor Evaluation: Be clear about who your competitors will be and how you’re able to distinguish from them.

- Business Model: Below you are going to provide an in-depth view of how you’re going to run the business and achieve everything that needs to be done.

- Business Projections: Produce projections based off of conservative estimates on the way the business will perform financially, such as your money flow evaluation.

- Financial Plan: Supply a detailed analysis of just how much cash you want to borrow, what your plans are for that cash, and the way you’re overcome unexpected expenses.

Remember that as a startup, your business plan will need to create lots of assumptions about the future of your company throughout your written plan and your financial projections. These assumptions should be backed up by industry and geographical data, and you need to be prepared to defend your assumptions to potential lenders.

The easiest way to make a startup business plan is by using the right small business plan program. For more information, you may read our article on the very best business planning software.

5. Get Your Down Payment Collectively

Among the greatest things that stop startups from accessing SBA loans is the down payment. While established companies can find an SBA loan with as little as 10% down, we’ve learned from talking with SBA loan specialists that startups will generally be asked to put 25 — 30 percent. The three ways to get the required deposit would be to utilize liquid savings, additional assets like retirement savings, or perhaps borrow the necessary funds.

David Nilssen, CEO of Guidant Financial who consults on SBA loans, says:

“Though often abbreviated lower, most startup SBA Loans demand 25-30percent as a proportion of their purchase price or project cost and a few extra operating capital. This can be hard for the average entrepreneur so ROBS opens up opportunity.”

Having an SBA 7a loan for working capital, your deposit is never really paid to the lender, but not all the cash that you request will be financed. SBA lenders will generally just approve startups for 70 — 75 percent of the entire cost of a project or initiative. This helps to show the lender that you’ve got sufficient skin in the game to give the company your best effort.

For example, if you would like to borrow $100k for a project the lender will request the details on how you are going to spend that cash. If they feel as if you want $100k and approve you for this, they’ll give you that amount minus whatever down payment they ask that you pay. So if your required down payment is 25 percent, then you’re going to be asked to produce $25k for your organization project and the lender will fund $75k.

With SBA 504 loans for commercial real estate, the process is a lot more straightforward. Instead of the lender requiring 10 percent as a proportion of the property’s purchase price, for startups they will instead require 25 percent or more down.

Many company founders end up either not being able to scrap the deposit together or do one of these things:

Conduct a Rollover for Business Startups (ROBS)

A ROBS is a good financing solution that makes it possible to access your retirement funds without paying any withdrawal penalties or taxes before you’ve turned 59 1/2 decades old. It’s also not a loan so there is nothing to pay back and there aren’t any issues with your business being on the hook with multiple lenders. It is one of the best options to the down payment problem for startups seeking an SBA loan, and it could work for you if you have $50k+ in a tax deferred retirement accounts.

A ROBS works by rolling over funds from your retirement account into a new retirement account for your new business entity. That retirement account then buys shares in your business and your business is free to utilize those funds to cover any essential business expense. It’s a great way to find the capital required to qualify for more funding, like an SBA loan.

ROBS transactions are observed over by the IRS and the Department of Labor. A tiny fraction of ROBS — less than 1% — are audited every year. However, if you fail an audit then you could be asked to pay the taxes and early withdrawal penalties mentioned above. That’s why it’s important to employ an experienced ROBS supplier to help you install and manage your ROBS throughout the moment you’ve spent those funds in your business.

Our recommended ROBS supplier is Guidant, who can help you get set up using a ROBS over 2-3 weeks if you’ve got $50k+ in your retirement accounts. Since these trades are so unique to your personal situation we invite you to sit down together in a completely free 1-on-1 consultation to get your questions answered.

Visit Guidant

Borrow From Your 401(k)

Borrowing from your 401(k) account could be costly, and requires one to pay it back in complete within 5 decades. If you do not pay it back afterward you will become cashed out and be charged a withdrawal penalty and be taxed for the full amount that was in your accounts. Plus you will pay interest on the money you borrow and have two loan payments you are paying back while trying to construct a business enterprise.

Cash Out Your 401(k)

This is a solution available for you but since the government needs one to be 59 1/2 decades old before accessing your retirement funds, you’ll be charged taxes and penalties that could complete 20 percent or more of your total account value. That’s a significant amount of money to cover just to get access to your funds.

To learn more on funding your company with your retirement savings, check out our post on 401(k) business financing.

Borrow From Friends and Family

This is a possibility but it requires you to have access to high network individuals who you do not mind due money. Businesses are insecure, no matter how solid your plan is, and if something happens and you are not able to repay these folks then it might damage your relationships.

Take Out a Personal Loan

Some borrowers think that they can take out a private loan by a 3rd party to get the necessary down payment. Regrettably, as a startup you’re going to need all of the collateral it is possible to get along with the more loans you have the less available security you are most likely to have.

Plus, your own SBA lender will not like that you personally owe someone else when you are looking to get financed for an SBA loan. They will wish the first right to all of your personal assets in the event that you can’t refund your SBA loan.

Utilize a Home Equity Loan

Many startup company owners have equity in their private home which can be leveraged to acquire a loan up to 90% of that equity. Such loans are usually low interest loans and may be a good alternative if taking a mortgage is the only option.

However, the trouble with this is that you’ll have two loan payments when you mix it with an SBA loan. While home equity loan rates are more favorable than SBA prices, the joint can be too expensive for your business to deal with. And of course, the 2 loans will further increase your debt to income ratio and reduce the amount of security you have available. For more information on using a home equity loan to finance your business, read our article on and a HEL or HELOCs.

Apply for a Personal Credit Cards

Some company owners charge up their own credit cards to get the money needed to put back on a loan. This isn’t only an expensive option since credit cards take an APR of 12 — 29%, but you’ll also probably not have access to the amount of funding you need for a downpayment. What is more, it can destroy your debt to income ratio, making it harder to qualify for financing.

6. Find the Ideal SBA Lender

Once you’ve your deposit in hand, you still may find it difficult to find an SBA loan since the amount of SBA lenders which can contribute to startups is limited. While we have a fantastic comprehensive list of SBA lenders which will give you access to the top 100 SBA lenders in the country, the problem is that most lenders do not advertise if they operate with startups or not.

To discover an SBA lender willing to fund your startup, you could go down this list and reach out to every SBA lender to find out that which you could possibly apply with. Reaching out to so many possible lending partners can be time intensive, and most startup entrepreneurs are brief time.

A much better way to obtain the right lender is to use a broker or consulting company that always operates with SBA lenders. They will know just which firms are prepared to work with you as a startup, and according to your business or personal credit profile, they’ll have the ability to match one to a person likely to fund your loan.

An SBA consultant like Guidant Financial works with a network of SBA lenders and has an understanding of each of the distinctive credit boxes. Based on David Nilssen, CEO at Guidant Financial:

“Most entrepreneurs walk into their bank and attempt to secure an SBA loan. Per the Biz2Credit Small Business Lending Index (from 2017) — just 24 percent will get funding. So most will undergo the full application procedure, which can take up to 90 days, only to hit a dead end. This is where one can benefit of working with an SBA Consulting Firm like Guidant Financial. We operate with a community of SBA lenders and has an understanding of all the financing tastes and unique credit boxes. Plus, it never hurts to have banks competing on rates and terms.”

7. Total SBA Loan Paperwork and Split

Once you find a lender willing to work with startups, then you’ll need to fill out the appropriate paperwork and go through the underwriting process. It is possible to expect the SBA underwriting procedure to take 45 — 120+ days, depending upon your lender and how quickly you are at responding to their record requests.

To cut this down time as far as possible you should be prepared together with the necessary paperwork and documentation before your lender asks. When you apply, you should be Ready to supply your lender with the following documents:

- Your business plan that contains an executive summary

- Breakdown your company’s ownership

- Personal profile highlighting your industry and management expertise

- Breakdown of how you’ll use the funds you are borrowing

- Record of how you’ll repay the loan

All this could be covered on your company strategy, but your lender may want individual submissions with each of those pieces of information. You will also be asked to complete a generic SBA loan program containing your personal and business information. Each creditor provides their particular application that may fluctuate marginally.

The SBA also has certain forms you’ll be required to fill out based on your personal circumstance. For instance, each borrower must complete Form 1919 that contains borrower information in addition to Form 413. As soon as you finish all the required paperwork, your loan will enter underwriting.

During the underwriting process, you will probably be asked to deliver many different paperwork and answer a bunch of questions. The lender just needs to get their arms around your business and your business plan to be certain that you’re worth the risk of committing money. The entire procedure can take 90 days more before you get the money you need.

A firm like Guidant can help walk you through this application paperwork and help you manage the process. Also, but they can even introduce you to the lenders most likely to fund an SBA startup loan such as the one you need. At length, the may also help you use your retirement savings should you require more capital to devote towards the deposit.

Visit Guidant

SBA Startup Loan Trends

SBA startup loans are becoming more popular with creditors each and every year. In 2013, startups just received 31 percent of their entire SBA 7a loans given out and 26% of the total money. In 2017, however, startups received 38 percent of total 7a loans and 35% of the overall dollars funded. As of this guide, those numbers have risen in 2018 to 44 percent each, demonstrating that startups currently have more SBA loan chances than they ever have before. Same goes with a commercial property purchase.

Bottom Line

SBA startup loans are pretty much exactly the same as regular SBA loans. The largest differences are locating a lender who will lend to startups and inventing a bigger down payment and much more security then you normally would have to if you’re borrowing for an existing company. With an SBA startup loan, then you’ll want to place 25-30% of your own money down.

A fantastic way to think of the necessary down payment is with a ROBS, that provides you access to a retirement funds without paying early withdrawal penalties or penalties. If you’ve got $50k+ in a tax deferred 401(k) or IRA then you may be eligible to work with a ROBS provider. We recommend speaking to our advocated ROBS provider, Guidant, to learn more. Schedule a free 1-on-1 appointment today.

Visit Guidant